Navigating the complexities of accident insurance payouts can be daunting. This guide dissects Mutual of Omaha’s accident insurance offerings, providing clarity on the factors influencing payout amounts, from policy type and accident severity to claim processing and potential denials.

We’ll delve into real-world scenarios, compare Mutual of Omaha to competitors, and address common consumer questions to empower you with the knowledge needed to make informed decisions.

Understanding your potential payout is crucial for financial preparedness. This analysis examines the intricacies of Mutual of Omaha’s policies, offering insights into policy features, coverage limits, and the claim process. By exploring various scenarios and comparing Mutual of Omaha’s offerings to those of its competitors, we aim to provide a comprehensive understanding of what you can expect should you need to file a claim.

Understanding Policy Types

Mutual of Omaha offers a range of accident insurance policies, each designed to cater to different needs and budgets. Understanding the nuances between these policies is crucial for consumers seeking appropriate coverage and maximizing potential payouts. The key differentiators lie in the coverage amounts, specific benefits included, and the overall policy structure.

Policy types vary significantly in their approach to benefit payouts. Some focus on a fixed sum for specific injuries, while others offer a more flexible approach based on the severity of the accident and associated medical expenses. This variability directly impacts the potential payout amounts received by policyholders.

Policy Coverage Amounts and Variations

The coverage amounts offered by Mutual of Omaha’s accident insurance policies vary widely depending on the chosen plan and the specific coverage options selected. For instance, a basic plan might offer a relatively modest payout for accidental death or dismemberment, whereas a comprehensive plan could provide substantially higher benefits, potentially covering medical expenses, lost income, and rehabilitation costs.

The premium paid directly correlates with the level of coverage offered. Higher premiums generally correspond to greater benefit payouts. Specific examples of coverage amounts are not publicly available without access to individual policy documents, but a comparison between policy brochures would illustrate this variability.

Policy Features Influencing Payout Amounts

Several policy features directly influence the final payout amount. These features are often presented as optional add-ons or integrated components within specific policy packages.

One significant factor is the inclusion of specific benefits. For example, some policies may include coverage for ambulance fees, emergency room visits, or rehabilitation therapies. These additional benefits increase the overall potential payout. The presence of a deductible, which represents the amount the policyholder must pay out-of-pocket before the insurance coverage begins, also significantly affects the net payout.

A higher deductible results in a lower net payout, even if the overall coverage amount is high.

Accidental Death and Dismemberment (AD&D) Benefit Variations

AD&D benefits form a core component of most accident insurance policies. However, the payout structure for AD&D benefits can differ substantially across Mutual of Omaha’s various policy options. Some policies might offer a fixed lump-sum payment for specific injuries (e.g., loss of a limb), while others might offer a percentage-based payout relative to the total policy coverage.

The specific schedule of benefits for different injuries or death is usually detailed within the policy document. A policy with a higher AD&D benefit maximum will naturally result in a larger payout in the event of a covered loss.

Factors Affecting Payout Amounts

The size of an accident insurance payout from Mutual of Omaha is determined by a complex interplay of factors, all rooted in the specifics of the individual policy and the circumstances of the accident. Understanding these factors is crucial for policyholders to accurately assess their potential coverage and plan accordingly.Policy Coverage Limits Play a Pivotal RoleThe most fundamental determinant of a payout is the policy’s coverage limits.

These limits, clearly defined in the policy documents, represent the maximum amount Mutual of Omaha will pay for covered losses resulting from an accident. For example, a policy with a $50,000 accident coverage limit will not pay out more than that amount, regardless of the severity of injuries or expenses incurred.

Policyholders should carefully review their policy documents to understand their specific coverage limits, which can vary significantly depending on the chosen plan and premium paid. Understanding these limits is crucial for realistic financial planning in the event of an accident.Accident Severity Directly Influences Payout AmountsThe severity of the accident directly impacts the payout amount, within the constraints of the policy’s coverage limits.

A minor accident resulting in minimal medical expenses will naturally lead to a smaller payout than a major accident involving significant medical bills, lost wages, and long-term rehabilitation. For instance, a simple sprain treated with a short course of physical therapy would result in a smaller claim than a severe fracture requiring surgery, hospitalization, and extensive physical therapy.

The insurer will assess the medical documentation, including bills and treatment records, to determine the appropriate compensation. The more extensive the injuries and related expenses, the higher the potential payout – up to the policy’s stated limits.

Claim Process and Documentation

Navigating the claim process for Mutual of Omaha accident insurance requires a clear understanding of the necessary steps and documentation. A prompt and accurate submission significantly impacts the speed and efficiency of your payout. This section details the procedures and required documents to facilitate a smooth claims experience.Filing a claim with Mutual of Omaha for an accident insurance payout involves a straightforward process, but meticulous attention to detail is crucial.

The insurer prioritizes a streamlined approach to ensure policyholders receive their benefits efficiently.

Claim Filing Steps

The claim process begins with promptly reporting the accident. This initial notification sets the process in motion, allowing Mutual of Omaha to begin the investigation and assessment. Subsequent steps involve providing detailed information and supporting documentation to substantiate the claim.

Failure to promptly report the incident could potentially delay or jeopardize the claim. The following steps Artikel the process:

- Report the accident to Mutual of Omaha within the timeframe specified in your policy. This is typically within 24-48 hours of the incident. Contact information is usually found on your policy documents or the company website.

- Obtain a claim form from Mutual of Omaha. This form requires detailed information about the accident, including date, time, location, and circumstances.

- Complete the claim form accurately and thoroughly. Inaccurate or incomplete information can lead to delays in processing.

- Submit the completed claim form along with all supporting documentation (detailed below).

- Mutual of Omaha will review your claim and request additional information if needed.

- Once the claim is approved, you will receive your payout according to the terms of your policy.

Required Documentation Checklist

Submitting the correct documentation is paramount to a timely claim settlement. Missing documents can significantly delay the process. The following checklist ensures all necessary materials are included with your claim.

- Completed Claim Form:This is the foundation of your claim and requires accurate and complete information.

- Accident Report:A copy of the official police report, if applicable. This provides an independent account of the incident.

- Medical Records:Detailed medical records from all treating physicians, including diagnoses, treatment plans, and bills. This documentation substantiates the injuries sustained.

- Photographs:Pictures of the accident scene, injuries, and any damaged property. Visual evidence can significantly strengthen your claim.

- Witness Statements:Written statements from any witnesses to the accident. These statements provide corroborating evidence.

- Proof of Identity:A copy of your driver’s license or other government-issued identification.

- Policy Information:Your policy number and other relevant policy details.

Document Submission Guidelines

Submitting all documentation in a clear, organized, and easily accessible manner is essential. Consider using a binder or folder to organize all materials. Ensure all documents are legible and readily identifiable. Electronic submissions may be accepted, but always check with Mutual of Omaha for their specific requirements and preferred methods.

Consider sending documents via certified mail with return receipt requested for proof of delivery. This method provides verification of submission.

Example Payout Scenarios

Understanding the potential payout amounts under different Mutual of Omaha accident insurance policies requires examining specific scenarios. The following examples illustrate potential payouts based on hypothetical accidents and policy types, highlighting the importance of carefully reviewing policy details. Remember, these are illustrative examples and actual payouts may vary based on individual policy terms and the specifics of each claim.

Scenario Examples and Payout Calculations

The following table presents three hypothetical accident scenarios and illustrates the potential payout amounts based on different policy types. Payout calculations are based on assumed policy limits and deductibles, as well as the specific circumstances of each accident.

| Policy Type | Accident Scenario | Relevant Policy Clauses | Payout Amount |

|---|---|---|---|

| Basic Accident Insurance | Broken leg requiring surgery and six weeks of physical therapy following a car accident. | Coverage for medical expenses related to accidental injury; $5,000 maximum benefit for broken bones; $100 daily benefit for hospitalization (up to 30 days). | $8,100 (Surgery, physical therapy, and partial hospitalization benefit) |

| Enhanced Accident Insurance with AD&D | Severe head injury resulting in permanent disability following a motorcycle accident. | Coverage for medical expenses, rehabilitation costs, and Accidental Death & Dismemberment (AD&D) benefit; $100,000 AD&D benefit for total disability; $50,000 maximum for medical expenses. | $150,000 (Medical expenses and AD&D benefit) |

| Comprehensive Accident Insurance | Multiple injuries (concussion, fractured ribs, and soft tissue damage) sustained during a workplace accident. | Coverage for medical expenses, lost wages, and rehabilitation; $250 daily benefit for lost wages (up to 1 year); $20,000 maximum for medical expenses; $50,000 maximum for lost wages. | $60,000 (Medical expenses, and partial lost wages benefit for 6 months) |

Payout Calculation Details

The payout amounts in the table above are based on several assumptions. For the basic accident insurance scenario, the $8,100 payout is a hypothetical estimate derived from assumed costs of surgery ($5,000), physical therapy ($2,100), and a portion of the daily hospitalization benefit ($1,000).

The enhanced policy scenario demonstrates a higher payout due to the inclusion of AD&D benefits, significantly increasing the potential compensation in cases of severe injury. The comprehensive policy scenario illustrates a combination of medical expenses and lost wages, showcasing the broader coverage offered by this type of plan.

It is crucial to note that these calculations are simplified examples and actual payouts will depend on detailed policy terms, medical bills, and supporting documentation provided during the claims process. Always refer to your specific policy documents for accurate details.

Common Claim Denials

Mutual of Omaha, like other accident insurance providers, has specific criteria for approving claims. Understanding the common reasons for denial can help policyholders avoid pitfalls and strengthen their claims. This section Artikels frequent causes for claim rejection and the appeals process.Claims denials often stem from a discrepancy between the policy’s terms and the circumstances of the accident.

Careful review of the policy wording is crucial before filing a claim, and accurate documentation is essential for a smooth process. Failure to meet these requirements frequently leads to claim rejection.

Policy Exclusions

Many denials arise from situations explicitly excluded in the policy’s fine print. These exclusions might cover pre-existing conditions, self-inflicted injuries, participation in high-risk activities (such as skydiving or extreme sports), or injuries resulting from intoxication. For instance, a policy might exclude coverage for injuries sustained while operating a vehicle under the influence of alcohol or drugs.

Similarly, a pre-existing back condition might lead to a denial if the accident only aggravated the existing problem rather than causing a new injury. Policyholders should carefully examine their specific policy document to understand these limitations.

Insufficient Documentation

Another significant reason for claim denial is inadequate or missing documentation. Mutual of Omaha requires comprehensive evidence supporting the claim, including a detailed accident report from law enforcement, medical records documenting injuries and treatment, and receipts for medical expenses.

The absence of any of these essential components can delay or even prevent claim approval. For example, a lack of medical records confirming the severity of an injury could lead to a denial, particularly if the claimed injury is subjective and lacks objective medical evidence.

Failure to Meet Reporting Requirements

Timely reporting of the accident is critical. Mutual of Omaha policies usually specify a time limit within which the insured must report the accident. Failing to adhere to this deadline often results in claim denial. For example, a policy might stipulate that accidents must be reported within 30 days.

If the insured reports the incident after this period, the claim might be denied due to non-compliance with the policy terms.

Appealing a Denied Claim

If a claim is denied, the policyholder has the right to appeal the decision. Mutual of Omaha provides a formal appeals process, usually Artikeld in the policy documents. This typically involves submitting additional documentation, providing further clarification on the circumstances of the accident, or requesting a review of the initial decision.

The appeals process provides an opportunity to address any concerns the insurer might have and present a more comprehensive case. The specific steps and timeframe for appealing a denied claim are clearly defined in the policy and should be followed carefully.

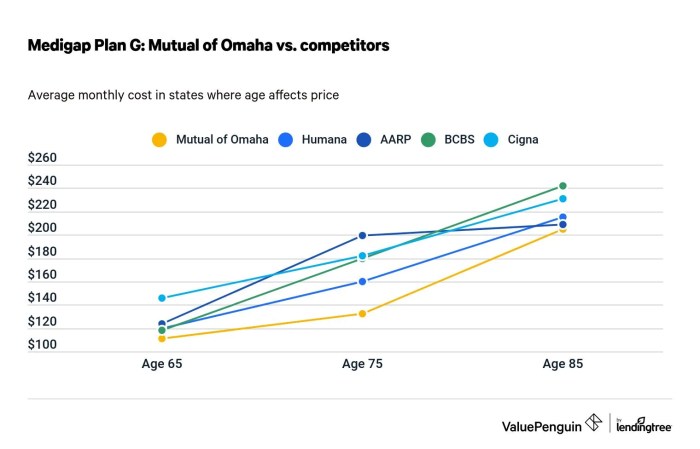

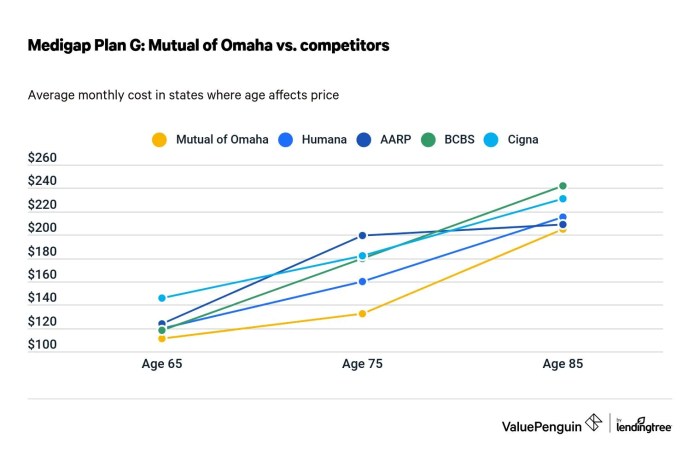

Comparison with Competitors

Mutual of Omaha’s accident insurance offerings compete in a crowded marketplace. Understanding how its payout amounts stack up against key competitors is crucial for potential policyholders. This section compares Mutual of Omaha’s accident insurance with two leading providers, highlighting key differences in policy features, coverage limits, and average payout amounts.

Note that average payout amounts can vary significantly based on the specific policy details and the nature of the accident.

Direct comparison of insurance products requires careful consideration of policy nuances. Factors such as specific coverage inclusions (e.g., accidental death benefits, disability coverage, medical expense reimbursement), deductible amounts, and policy limits significantly influence the ultimate payout. Furthermore, publicly available data on average payout amounts is often limited, and precise figures are usually proprietary to the insurance companies.

Policy Feature, Coverage Limit, and Average Payout Comparison

The following table provides a comparative analysis, using hypothetical examples to illustrate potential differences. The data presented is for illustrative purposes only and should not be considered definitive. Actual payout amounts depend on individual policy terms and claim circumstances.

Consult individual policy documents for accurate details.

| Feature | Mutual of Omaha (Hypothetical Example) | Competitor A (Hypothetical Example) | Competitor B (Hypothetical Example) |

|---|---|---|---|

| Accidental Death Benefit | $500,000 | $250,000 | $750,000 |

| Dismemberment Benefit (Loss of Limb) | $250,000 | $150,000 | $300,000 |

| Medical Expense Reimbursement | Up to $100,000 with $5,000 deductible | Up to $50,000 with $2,500 deductible | Up to $150,000 with $10,000 deductible |

| Average Payout (Illustrative Example based on similar claims) | $75,000 | $50,000 | $100,000 |

| Policy Premium (Illustrative Example) | $50/month | $35/month | $75/month |

Policy Exclusions and Limitations

Mutual of Omaha’s accident insurance policies, like most such policies, contain specific exclusions and limitations that define the circumstances under which benefits will not be paid. Understanding these limitations is crucial for accurately assessing the policy’s value and avoiding unexpected claim denials.

These exclusions are designed to prevent coverage for situations considered outside the scope of accidental injury, or where pre-existing conditions or other factors contribute significantly to the injury or loss.Policy exclusions typically fall into several categories, significantly impacting potential payout amounts.

A thorough review of the specific policy wording is always recommended.

Pre-Existing Conditions

Mutual of Omaha’s accident insurance policies generally exclude coverage for injuries or illnesses that existed before the policy’s effective date. This exclusion aims to prevent individuals from obtaining coverage specifically for pre-existing conditions. For example, if an individual has a history of back problems and suffers a back injury, the claim may be partially or fully denied if the insurer can demonstrate a link between the current injury and the pre-existing condition.

The extent of the denial depends on the insurer’s assessment of the causal relationship. If the new injury is deemed an independent event unrelated to the pre-existing condition, coverage may be granted.

Self-Inflicted Injuries

Claims resulting from self-inflicted injuries, including suicide attempts, are typically excluded. This is a standard exclusion across most accident insurance policies. The policy will explicitly state that intentional self-harm is not covered.

Participation in Illegal Activities

Injuries sustained while participating in illegal activities are generally not covered. This exclusion is intended to discourage risky behavior. For instance, injuries sustained during a robbery or while driving under the influence of alcohol or drugs would likely be denied.

The policy will specify what constitutes an illegal activity.

War or Military Service

Injuries incurred during wartime or active military service are usually excluded from coverage. This exclusion reflects the inherent risks associated with these activities, which are often outside the scope of typical accident insurance coverage. Specific wording within the policy will detail the conditions related to this exclusion.

Hazardous Activities

Many policies exclude or limit coverage for injuries sustained while participating in hazardous activities, such as extreme sports or professional stunt work. The definition of “hazardous activity” varies across policies, but generally includes activities with a high risk of injury.

For example, a claim resulting from an injury sustained during skydiving may be denied if the policy explicitly excludes such activities. The policy will typically list specific examples of excluded activities.

Customer Reviews and Experiences

Analyzing online reviews reveals a mixed bag of experiences with Mutual of Omaha accident insurance payouts. While some customers report positive experiences with prompt and fair settlements, others express frustration with lengthy processing times, unclear communication, and disputes over claim eligibility.

These reviews offer valuable insights into the practical realities of navigating the claims process and the variability in payout outcomes.Customer reviews illustrate the payout process’s complexity and the factors influencing final amounts. Positive reviews often highlight clear communication from adjusters, straightforward documentation requirements, and timely payments aligned with policy terms.

Conversely, negative reviews frequently cite difficulties in obtaining necessary documentation, inconsistent communication from the company, and protracted disputes over the interpretation of policy clauses and the definition of covered accidents.

Positive Payout Experiences

Positive reviews frequently describe straightforward claims processes. Customers report receiving prompt responses to inquiries, clear explanations of required documentation, and timely payouts that accurately reflect the policy’s coverage and the extent of their injuries or losses. These accounts often emphasize the professionalism and helpfulness of Mutual of Omaha’s claims adjusters, who provided clear guidance throughout the process.

For instance, one review detailed a quick settlement for a broken leg, with the payout accurately matching the policy’s specified benefit for such injuries. Another described a smooth process for reimbursement of medical expenses following a car accident, with the company readily providing supporting documentation and quickly processing the claim.

Negative Payout Experiences

Negative reviews often focus on lengthy processing times, confusing policy language, and difficulties in obtaining a satisfactory settlement. These accounts highlight instances where claims were delayed due to bureaucratic hurdles, missing documentation, or disputes over the interpretation of policy terms.

Some customers report feeling pressured to accept lower settlements than they believed were warranted, while others describe difficulties in contacting claims adjusters or obtaining clear explanations for decisions regarding their claims. For example, one review detailed a protracted dispute over the definition of “accident” in the policy, resulting in a significantly reduced payout.

Another review described numerous attempts to contact the company with unanswered phone calls and emails, leading to delays in claim processing and significant stress for the claimant.

Impact of Claim Documentation

The importance of complete and accurate documentation is a recurring theme in both positive and negative reviews. Customers who submitted comprehensive documentation, including medical records, police reports, and other relevant evidence, generally reported smoother and more efficient claims processes. In contrast, those who experienced delays or denials often cited missing or incomplete documentation as a contributing factor.

This underscores the need for meticulous record-keeping and the importance of understanding the specific documentation requirements Artikeld in the policy.

Legal and Regulatory Considerations

Accident insurance payouts in the United States are subject to a complex web of federal and state regulations designed to protect consumers and ensure fair practices by insurance companies. These regulations significantly influence the payout process, the amounts paid, and the overall experience of policyholders.

Non-compliance can result in substantial penalties for insurers.State insurance departments play a crucial role in overseeing accident insurance policies and claims. Each state has its own set of regulations regarding policy language, claim handling procedures, and the grounds for denying claims.

These variations across states contribute to the complexity of navigating the legal landscape of accident insurance. Federal regulations, while less directly involved in the specifics of individual payouts, provide overarching consumer protection frameworks and standards that states must adhere to in their own regulatory efforts.

State Insurance Department Oversight

State insurance departments are the primary regulators of accident insurance companies within their jurisdictions. Their responsibilities include licensing insurers, reviewing policy forms for compliance with state law, investigating consumer complaints, and enforcing regulations related to claims handling. These departments often publish consumer guides and frequently asked questions (FAQs) to educate policyholders about their rights and responsibilities.

For example, many states have regulations specifying timeframes within which insurers must acknowledge a claim and make a decision. Failure to meet these deadlines can lead to penalties.

Consumer Protection Laws

Federal and state laws provide significant consumer protection in the realm of insurance. These laws often address issues such as unfair claims practices, prohibited policy exclusions, and the requirement for insurers to act in good faith when handling claims.

For instance, the Unfair Claims Settlement Practices Act, adopted in many states, prohibits insurers from engaging in tactics like delaying claims unreasonably, denying claims without proper investigation, or failing to provide a reasonable explanation for a claim denial. Violations can result in fines and other penalties for the insurance company.

Policy Language and Interpretation

The language used in accident insurance policies is carefully scrutinized by regulators to ensure clarity and prevent ambiguity. Policies must be easily understandable by the average consumer, and any ambiguous terms are often interpreted in favor of the policyholder.

State regulations frequently require insurers to use plain language and avoid jargon that could confuse policyholders. Courts may interpret policy language differently depending on the specific circumstances of a case, leading to variability in payout outcomes.

Impact on Payout Amounts

Regulatory frameworks directly impact payout amounts through requirements related to policy language, claim handling procedures, and prohibited practices. Regulations limiting exclusions, requiring prompt claim processing, and mandating good faith practices all contribute to a higher likelihood of fair and timely payouts.

Conversely, loopholes or inadequate enforcement can lead to insurers minimizing payouts or delaying them. The impact of regulations varies across states and depends on the specific legal precedents and enforcement efforts within each jurisdiction.

Last Recap

Ultimately, securing adequate accident insurance hinges on understanding the fine print and the nuances of the claim process. While Mutual of Omaha offers various policy options, the ultimate payout amount is contingent upon a confluence of factors, from the specific policy details and the severity of the accident to the thoroughness of claim documentation.

This guide serves as a roadmap, equipping consumers with the knowledge to navigate this complex landscape and secure the financial protection they need.