Moda Health Insurance, a prominent player in the Pacific Northwest’s healthcare market, has carved a niche for itself by offering a diverse range of health insurance plans tailored to the needs of individuals and families. Founded in 1997, Moda has grown into a respected provider, offering a comprehensive approach to health insurance, encompassing coverage options, network access, and customer support.

This in-depth exploration delves into the core aspects of Moda Health Insurance, examining its history, target market, key services, pricing considerations, customer experience, and competitive landscape. We’ll also analyze industry trends and future prospects for Moda, providing a comprehensive overview of its position within the evolving healthcare market.

Moda Health Insurance Overview

Moda Health is a health insurance company based in Portland, Oregon. Established in 1993, Moda has grown to become a leading provider of health insurance plans in the Pacific Northwest, serving individuals, families, and businesses in Oregon, Washington, and Alaska.

Types of Health Insurance Plans

Moda offers a wide range of health insurance plans to meet the diverse needs of its customers. These plans are categorized into different types, each with its own unique features and benefits.

- Individual and Family Plans: Moda provides a variety of individual and family plans, including plans available through the Health Insurance Marketplace. These plans offer coverage for a range of healthcare needs, from preventive care to hospitalization.

- Small Business Plans: Moda caters to small businesses by offering group health insurance plans that can be tailored to the specific needs of the company and its employees. These plans often include options for employee wellness programs and cost-saving features.

- Large Group Plans: Moda also provides health insurance plans for large employers, offering comprehensive coverage and administrative support to meet the needs of large workforces.

Key Features and Benefits

Moda health insurance plans are known for their comprehensive coverage and value-added features.

- Wide Network of Providers: Moda has a vast network of healthcare providers, including doctors, hospitals, and specialists, ensuring access to quality care across its service areas.

- Preventive Care Coverage: Moda plans emphasize preventive care, covering services such as annual checkups, screenings, and vaccinations, promoting early detection and healthy lifestyles.

- Prescription Drug Coverage: Most Moda plans include prescription drug coverage, allowing members to access needed medications at affordable prices.

- Mental Health and Substance Use Disorder Coverage: Moda recognizes the importance of mental health and substance use disorder treatment, providing coverage for these services, ensuring comprehensive care for members’ well-being.

- Telehealth Services: Moda plans often include telehealth services, allowing members to consult with healthcare providers remotely, increasing convenience and accessibility.

Target Market and Demographics

Moda Health Insurance, based in Portland, Oregon, targets a diverse market segment, primarily focusing on individuals and families seeking comprehensive health coverage. The company’s customer base is characterized by a blend of demographics, with specific needs and preferences that influence their choices in health insurance plans.

Demographics of Moda’s Customer Base

The demographics of Moda’s customer base reflect a diverse population with varying needs and preferences. The company caters to a wide range of individuals and families, encompassing various age groups, income levels, and geographic locations.

- Age Distribution: Moda’s customer base includes individuals across all age groups, from young adults to seniors. The company offers plans tailored to different life stages, such as young adults seeking affordable coverage, families with children requiring comprehensive care, and seniors needing Medicare supplemental plans.

- Income Levels: Moda caters to a broad range of income levels, providing plans that align with varying budgets. The company offers affordable options for individuals and families with limited incomes, as well as more comprehensive plans for those with higher earning potential.

- Geographic Distribution: Moda operates primarily in the Pacific Northwest, with a significant presence in Oregon, Washington, and Idaho. The company’s customer base reflects the diverse demographics of these regions, including urban and rural populations, as well as communities with varying ethnic and cultural backgrounds.

Needs and Preferences of Moda’s Target Audience

Moda’s target audience exhibits distinct needs and preferences that shape their choices in health insurance plans. These preferences are influenced by factors such as age, income, health status, and lifestyle.

- Value for Money: Many individuals and families seek affordable health insurance plans that provide comprehensive coverage without excessive premiums. Moda’s focus on affordability and value is a key driver of customer satisfaction.

- Access to Quality Care: Individuals and families prioritize access to quality healthcare providers and facilities. Moda partners with a network of reputable hospitals, clinics, and healthcare professionals to ensure its customers receive quality care.

- Personalized Coverage: Customers value personalized plans that meet their unique health needs and preferences. Moda offers a variety of plans with different coverage options, allowing individuals to choose the plan that best suits their specific requirements.

- Digital Convenience: In today’s digital age, individuals expect convenient access to their health insurance information and services. Moda provides online portals and mobile apps for managing accounts, accessing benefits, and contacting customer support.

Key Services and Products

Moda Health Insurance offers a comprehensive range of health insurance plans designed to meet the diverse needs of individuals, families, and businesses across Oregon and Washington. The company’s products are characterized by their flexibility, affordability, and focus on providing access to quality healthcare.

Health Insurance Plans

Moda offers a variety of health insurance plans, categorized by their coverage levels and intended beneficiaries. These plans are designed to cater to different needs and budgets.

- Individual and Family Plans: These plans are designed for individuals and families seeking comprehensive health insurance coverage. They offer various options for deductibles, copayments, and out-of-pocket maximums, allowing individuals to choose a plan that aligns with their financial situation and healthcare needs.

- Small Business Plans: Moda provides health insurance plans specifically tailored for small businesses. These plans offer a range of benefits, including flexible coverage options, competitive pricing, and access to a network of healthcare providers.

- Large Group Plans: Moda offers health insurance plans for large employers, providing comprehensive coverage and administrative support. These plans are designed to meet the specific needs of larger organizations and offer various benefits, including employee wellness programs and health management tools.

Types of Coverage

Moda’s health insurance plans offer various types of coverage to address different healthcare needs. These coverage options ensure that individuals have access to the necessary medical care.

- Hospital and Surgical Coverage: This coverage includes hospitalization, surgery, and related medical expenses, providing financial protection against high medical costs associated with serious illnesses or injuries.

- Physician and Outpatient Coverage: This coverage includes doctor visits, preventive care, and outpatient services, ensuring access to routine medical care and early detection of health issues.

- Prescription Drug Coverage: This coverage helps manage the cost of prescription medications, providing access to essential drugs and therapies.

- Mental Health and Substance Use Disorder Coverage: Moda’s plans include coverage for mental health and substance use disorder services, promoting comprehensive well-being and access to necessary treatment.

Healthcare Services

Beyond providing health insurance, Moda offers a range of healthcare services designed to enhance the health and well-being of its members.

- Provider Network: Moda has a vast network of healthcare providers, including doctors, hospitals, and specialists, offering access to quality medical care across its service areas.

- Wellness Programs: Moda promotes healthy lifestyles through wellness programs that offer resources, tools, and incentives for preventive care, fitness activities, and healthy eating habits.

- Health Management Tools: Moda provides online tools and resources to help members manage their health, track their medical expenses, and access health information.

- Customer Support: Moda offers dedicated customer support services to assist members with their health insurance needs, answer questions, and resolve issues.

Network and Provider Access

Moda Health Insurance offers a wide network of healthcare providers, including hospitals, clinics, and physicians. The network’s size and breadth are crucial for ensuring access to quality healthcare services for policyholders.

Provider Network Size and Scope

Moda’s provider network encompasses a diverse range of healthcare professionals and facilities across various states. The network’s extensive reach ensures that policyholders have access to a wide selection of healthcare options, including specialists, primary care physicians, and hospitals.

Availability of Healthcare Providers

Moda’s network is designed to provide convenient access to healthcare services. Policyholders can find in-network providers through Moda’s website or mobile app, which allow them to search for providers by specialty, location, and other criteria.

Accessibility of Healthcare Services

Moda prioritizes the accessibility of healthcare services within its network. The company offers tools and resources to help policyholders navigate the healthcare system and find the care they need. For instance, Moda’s website and mobile app provide information on provider availability, appointment scheduling, and telehealth options.

Pricing and Cost Considerations

The cost of Moda health insurance plans varies depending on several factors, including the individual’s age, location, health status, and the chosen plan. Moda offers a variety of plans to cater to diverse needs and budgets, with a transparent pricing structure.

Factors Influencing Plan Costs

Several factors contribute to the cost of Moda health insurance plans. These include:

- Age: Generally, older individuals tend to have higher healthcare costs due to increased health risks. Therefore, their premiums are usually higher.

- Location: The cost of living and healthcare expenses vary significantly across different regions. Plans in areas with higher healthcare costs tend to be more expensive.

- Health Status: Individuals with pre-existing conditions or higher health risks may face higher premiums as they are more likely to require healthcare services.

- Plan Type: Different plan types offer varying levels of coverage and benefits, impacting their cost. For example, plans with lower deductibles and copayments are generally more expensive.

Moda’s Pricing Structure and Cost Estimations

Moda’s pricing structure is based on a combination of factors, including the individual’s age, location, health status, and the chosen plan.

- Premium Calculator: Moda provides an online premium calculator that allows individuals to estimate their monthly premiums based on their personal details and plan preferences. This tool can be helpful in comparing different plans and finding the most affordable option.

- Open Enrollment Period: During the annual open enrollment period, individuals can enroll in or change their health insurance plans. Moda offers various plans with different premiums, allowing individuals to choose the plan that best suits their needs and budget.

Comparison with Other Providers

Moda’s pricing is competitive within the health insurance market. To compare Moda’s plans with other providers, individuals can use online comparison tools or consult with an insurance broker.

- Online Comparison Tools: Websites like eHealth and HealthMarkets allow individuals to compare health insurance plans from various providers, including Moda, side-by-side. This allows for a comprehensive comparison of premiums, benefits, and network coverage.

- Insurance Brokers: Independent insurance brokers can provide personalized advice and help individuals compare different health insurance plans from multiple providers, including Moda.

Customer Experience and Satisfaction

Moda Health Insurance has garnered a reputation for its customer-centric approach, striving to provide a seamless and positive experience for its policyholders. This commitment is reflected in various aspects, from the ease of navigating their website and mobile app to the responsiveness of their customer support team.

Customer Testimonials and Reviews

Customer testimonials and reviews provide valuable insights into the actual experiences of Moda Health Insurance policyholders. These firsthand accounts highlight both the strengths and weaknesses of the company’s services, offering a comprehensive view of customer satisfaction.

- Positive Feedback: Many customers praise Moda for its user-friendly website and mobile app, making it convenient to manage their health insurance plans. They also appreciate the company’s responsive customer support team, which is readily available to address inquiries and resolve issues promptly.

- Areas for Improvement: Some customers have expressed concerns about the complexity of certain aspects of their plans, particularly when navigating specific coverage details or seeking pre-authorization for certain medical procedures.

Overall Customer Experience with Moda

Moda Health Insurance prioritizes a positive customer experience by focusing on several key areas:

- User-Friendly Platform: Moda’s website and mobile app are designed with user-friendliness in mind, providing a seamless and intuitive platform for managing health insurance plans. This includes features like online account management, claims filing, and accessing policy information.

- Responsive Customer Support: Moda’s customer support team is available through multiple channels, including phone, email, and online chat. They are known for their responsiveness and commitment to resolving customer issues promptly and efficiently.

- Personalized Service: Moda aims to provide a personalized experience by offering tailored solutions based on individual needs and preferences. This includes providing guidance on choosing the right plan, explaining coverage details, and offering support throughout the healthcare journey.

Customer Satisfaction Levels with Moda’s Services

Customer satisfaction is a key metric for assessing the quality of Moda Health Insurance’s services. While specific satisfaction data is not publicly available, independent customer review platforms like Trustpilot and Yelp offer valuable insights into customer sentiment.

- Trustpilot: On Trustpilot, Moda Health Insurance has an average rating of 3.5 out of 5 stars, indicating a generally positive customer experience. Many reviews highlight the company’s responsive customer support, user-friendly platform, and competitive pricing.

- Yelp: Yelp provides a similar picture, with Moda Health Insurance receiving an average rating of 3.0 out of 5 stars. Reviews on Yelp often focus on the company’s coverage options, network of providers, and ease of use.

Claims Process and Procedures

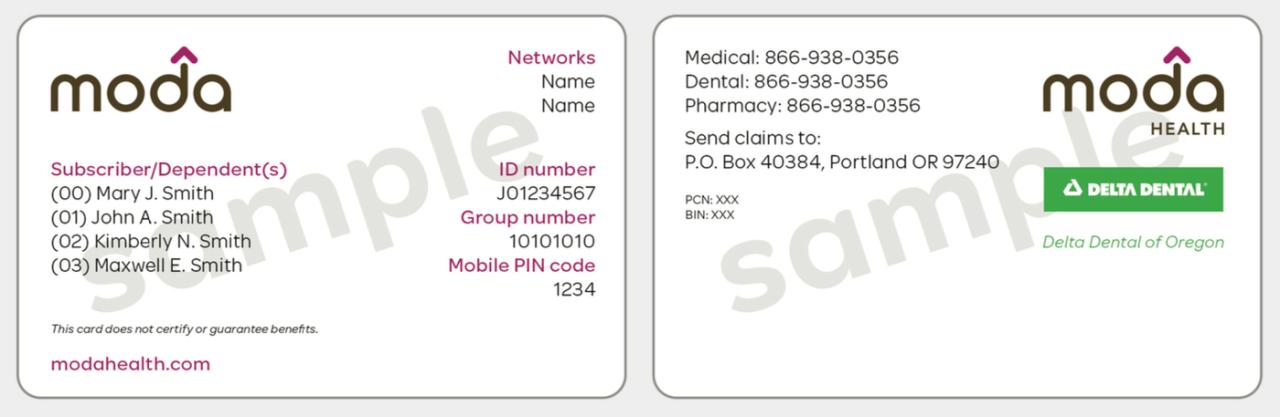

Moda Health Insurance offers a streamlined claims process designed to ensure members receive timely and efficient reimbursements for eligible medical expenses. The claims process is straightforward and can be initiated through various methods, including online, mail, or phone.

Submitting a Claim

Submitting a claim with Moda Health Insurance is relatively simple. Members can choose to submit their claims through one of the following methods:

- Online: Moda provides a secure online portal where members can submit claims electronically, track their status, and access other account information. This method is convenient and allows for faster processing times.

- Mail: Members can also submit their claims by mail. They can download claim forms from the Moda website or request them by phone. Completed forms should be mailed to the address provided on the form.

- Phone: Members can also submit their claims by phone by calling Moda’s customer service line. A representative will guide them through the process and gather the necessary information.

Claim Processing Timeframes

The time it takes for Moda to process a claim varies depending on the complexity of the claim and the information provided. Generally, claims are processed within 30 days of receipt. However, complex claims, such as those involving multiple providers or requiring additional documentation, may take longer.

Claim Status Tracking

Members can track the status of their claims online through Moda’s secure portal. They can view the progress of their claim, check the status of payments, and access any relevant documentation.

Claim Denials and Appeals

If a claim is denied, Moda will send a written explanation outlining the reason for denial. Members have the right to appeal a claim denial. The appeal process involves submitting additional information or documentation to support the claim. Moda will review the appeal and provide a decision within a specified timeframe.

Customer Support and Resources

Moda Health Insurance offers a comprehensive range of customer support options to address member inquiries and concerns effectively. The company prioritizes providing easy access to information and assistance through multiple channels, ensuring a smooth and positive experience for its policyholders.

Website and Online Resources

Moda’s website serves as a central hub for information and resources for its members. The website is user-friendly and well-organized, making it easy for members to find the information they need.

- The website provides access to policy documents, claim forms, and other important materials.

- It also features a comprehensive FAQ section that addresses common questions and concerns.

- Members can access their account information online, including their policy details, claims history, and payment information.

- Moda’s website also offers a variety of health and wellness resources, including articles, videos, and tools to help members manage their health.

Customer Service Representatives

Moda provides multiple channels for members to connect with customer service representatives.

- Members can contact customer service by phone, email, or live chat.

- Customer service representatives are available during extended hours, including weekends and holidays, to provide assistance when needed.

- Moda also offers a dedicated team of customer service representatives who specialize in specific areas, such as claims processing, billing, or provider relations.

Competition and Market Landscape

Moda Health Insurance operates in a highly competitive health insurance market, facing challenges from established national players and regional insurers. Understanding the competitive landscape is crucial to assess Moda’s market position, identify opportunities, and develop effective strategies.

Competitive Landscape and Market Share

The health insurance market in the United States is dominated by a few large national players, including Anthem, UnitedHealth Group, and Cigna. These companies boast extensive networks, strong brand recognition, and significant resources. Regional insurers, such as Moda, often compete with these national players by focusing on specific geographic areas and tailoring their products and services to local needs.

Moda’s market share varies depending on the specific geographic region and product line. In the Pacific Northwest, where Moda has a strong presence, the company holds a significant share of the individual and small group markets. However, in the broader national market, Moda’s market share is relatively smaller compared to its larger competitors.

Strengths and Weaknesses Compared to Competitors

Moda Health Insurance has several strengths that differentiate it from its competitors, including:

- Strong regional presence and focus: Moda’s focus on the Pacific Northwest allows it to develop deep relationships with local providers and understand the specific healthcare needs of the region.

- Customer-centric approach: Moda is known for its commitment to providing excellent customer service and personalized solutions. This focus on customer experience can be a significant advantage in attracting and retaining customers.

- Innovative product offerings: Moda offers a range of innovative products, such as its telehealth services and health management programs, that cater to the evolving needs of consumers.

However, Moda also faces some challenges compared to its competitors:

- Limited national reach: Moda’s focus on the Pacific Northwest limits its ability to compete with national players in other regions.

- Smaller size and resources: Compared to its larger competitors, Moda has fewer resources to invest in marketing, technology, and research and development.

- Competition from emerging players: The health insurance market is increasingly competitive, with the emergence of new players, such as direct-to-consumer insurers, offering innovative products and services.

Industry Trends and Future Outlook

The health insurance industry is undergoing a period of significant transformation, driven by factors such as technological advancements, changing demographics, and evolving consumer preferences. These trends present both opportunities and challenges for Moda Health Insurance, requiring the company to adapt its strategies and offerings to remain competitive in the evolving market landscape.

Impact of Technological Advancements

Technological advancements are playing a crucial role in shaping the health insurance industry. The rise of digital health platforms, telehealth services, and wearable technology is transforming how consumers access and manage their healthcare.

- Digital Health Platforms: These platforms offer a wide range of services, including appointment scheduling, medication refills, and access to medical records, providing convenience and increased transparency for consumers.

- Telehealth: Virtual consultations and remote monitoring technologies are expanding access to healthcare services, particularly in rural areas and for individuals with mobility limitations.

- Wearable Technology: Fitness trackers and other wearable devices collect health data that can be used to personalize health insurance plans and incentivize healthy behaviors.

Moda Health Insurance must embrace these technological advancements to enhance its offerings and remain competitive. This involves investing in digital infrastructure, partnering with technology providers, and developing innovative solutions that leverage data analytics and artificial intelligence to improve customer experience and health outcomes.

Legal and Regulatory Considerations

Navigating the complex legal and regulatory landscape is crucial for any health insurance provider, including Moda Health Insurance. Understanding the intricate web of federal and state laws governing health insurance is paramount for ensuring compliance and maintaining a strong reputation.

Impact of Regulations on Moda’s Operations

Regulations significantly influence Moda’s operations, dictating various aspects of its business, from product design and pricing to marketing and customer service.

- The Affordable Care Act (ACA): The ACA has had a profound impact on the health insurance industry, leading to significant changes in coverage requirements, market structure, and consumer protections. Moda, like other insurers, has had to adapt its products and operations to comply with the ACA’s provisions, including essential health benefits, premium subsidies, and the individual mandate.

- State Regulations: Each state has its own set of regulations governing health insurance, which can vary significantly. Moda must comply with these state-specific regulations, including requirements for coverage, rates, and consumer protections. This can involve navigating different licensing requirements, rate filing processes, and consumer complaint handling procedures.

- Privacy and Security: Moda, like all health insurance providers, is subject to strict privacy and security regulations, such as the Health Insurance Portability and Accountability Act (HIPAA). These regulations dictate how Moda handles and protects sensitive patient information, including medical records, financial data, and personal details. Moda must implement robust security measures to safeguard this information from unauthorized access, use, or disclosure.

Moda’s Compliance with Industry Standards

Moda prioritizes compliance with industry standards and regulations. This commitment involves:

- Maintaining a strong internal compliance program: Moda has established a comprehensive compliance program that includes policies, procedures, and training to ensure adherence to applicable laws and regulations. This program involves regular reviews and updates to keep pace with evolving regulatory requirements.

- Engaging with regulatory bodies: Moda actively engages with federal and state regulatory agencies, including the Centers for Medicare and Medicaid Services (CMS) and state insurance departments. This engagement involves regular reporting, participation in industry forums, and seeking clarification on regulatory requirements.

- Investing in technology and resources: Moda invests in technology and resources to support compliance efforts. This includes implementing systems to track regulatory changes, conduct audits, and manage compliance risks. Moda also leverages technology to streamline its processes and enhance efficiency, reducing the risk of non-compliance.

Conclusion

Moda Health Insurance has emerged as a significant force in the Northwest’s healthcare market, demonstrating a commitment to providing accessible and affordable health insurance solutions. With its focus on customer satisfaction, extensive provider network, and innovative plans, Moda is well-positioned to navigate the dynamic landscape of the health insurance industry, continuing to meet the evolving needs of its diverse customer base.