The roar of a motorcycle engine is a symphony of freedom, but the cost of insuring your ride can be a jarring note. Understanding how much motorcycle insurance costs is crucial for any rider, whether you’re a seasoned veteran or a new enthusiast. From factors like your age and riding history to the type of motorcycle you own, a multitude of variables can influence your premiums.

This comprehensive guide will delve into the intricate world of motorcycle insurance, breaking down the key factors that determine costs, exploring different coverage options, and providing tips to save money. We’ll also address common misconceptions and equip you with the knowledge to make informed decisions about your insurance.

Factors Influencing Motorcycle Insurance Costs

Motorcycle insurance premiums are determined by a variety of factors, reflecting the inherent risks associated with riding and the potential for financial losses. These factors are carefully considered by insurance companies to assess the likelihood of claims and establish fair pricing for coverage.

Rider Age, Experience, and Driving Record

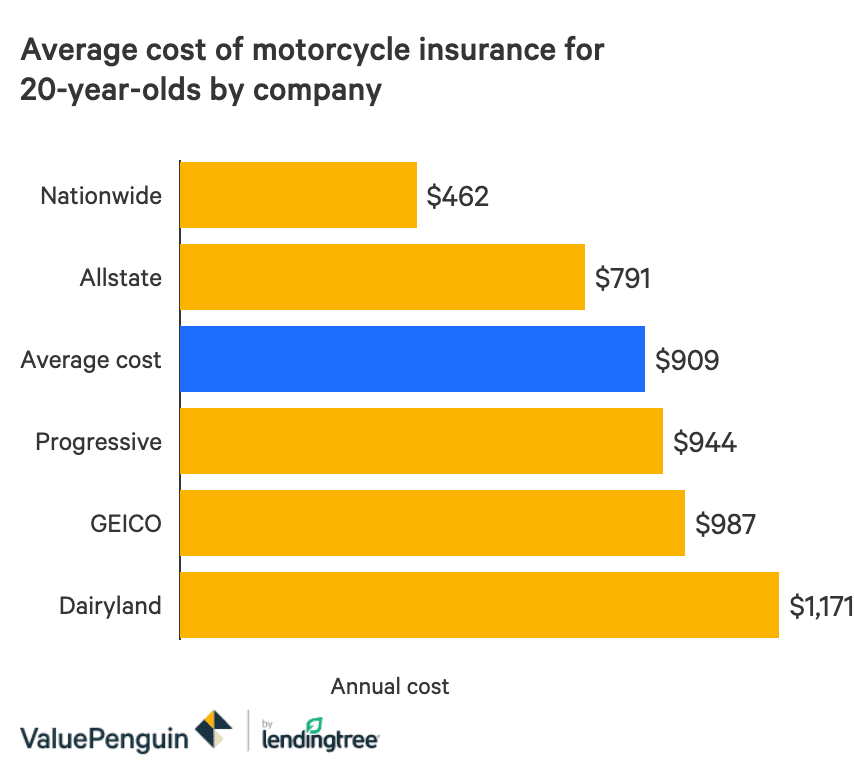

An individual’s age, riding experience, and driving record are crucial factors in determining motorcycle insurance premiums. Younger riders, particularly those with limited experience, are statistically more likely to be involved in accidents. Insurance companies typically charge higher premiums for inexperienced riders, recognizing their higher risk profile. Conversely, seasoned riders with a clean driving record and extensive experience often qualify for lower premiums, reflecting their reduced risk of accidents.

Motorcycle Type, Value, and Usage

The type, value, and intended usage of a motorcycle significantly impact insurance costs. High-performance motorcycles, such as sportbikes, often command higher premiums due to their potential for higher speeds and increased risk of accidents. Similarly, motorcycles with a high market value will generally attract higher insurance premiums, reflecting the greater financial loss in case of damage or theft. The frequency and purpose of motorcycle usage also influence premiums. Riders who use their motorcycles primarily for commuting or short trips may qualify for lower premiums compared to those who engage in long-distance touring or participate in competitive racing.

Location, Coverage Options, and Deductibles

The location where a motorcycle is garaged and operated plays a significant role in determining insurance premiums. Urban areas with heavy traffic and higher accident rates tend to have higher insurance costs compared to rural areas with lower traffic density.

The coverage options selected by the rider also influence premiums. Comprehensive coverage, which protects against theft and damage from non-accident events, is generally more expensive than liability coverage, which covers damages to others in case of an accident. Deductibles, the amount a rider pays out of pocket before insurance coverage kicks in, also impact premiums. Higher deductibles typically result in lower premiums, as the rider assumes a greater portion of the financial burden in case of an accident.

Types of Motorcycle Insurance Coverage

Motorcycle insurance is designed to protect you financially in case of an accident or other incident involving your motorcycle. Understanding the different types of coverage available is crucial for ensuring you have the right protection. This section provides a comprehensive overview of common motorcycle insurance coverages and their key features.

Liability Coverage

Liability coverage is a fundamental aspect of motorcycle insurance. It safeguards you financially if you cause an accident that results in injuries or property damage to others. This coverage typically includes two main components:

- Bodily injury liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party due to injuries caused by you.

- Property damage liability: This coverage covers the cost of repairs or replacement of the other party’s vehicle or property damaged in an accident that you caused.

The amount of liability coverage you need depends on your individual circumstances and the laws in your state. It is generally advisable to have sufficient coverage to protect yourself from significant financial losses.

Collision Coverage

Collision coverage is designed to cover damage to your motorcycle in an accident, regardless of who is at fault. It reimburses you for repairs or replacement of your motorcycle, minus your deductible.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

- Actual cash value (ACV): This is the market value of your motorcycle at the time of the accident, taking into account depreciation.

Collision coverage is optional, but it can be beneficial if you want to ensure your motorcycle is repaired or replaced in case of an accident.

Comprehensive Coverage

Comprehensive coverage protects your motorcycle against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Deductible: Similar to collision coverage, you will have to pay a deductible before your insurance coverage kicks in.

- Actual cash value (ACV): The amount you receive for a covered loss is typically based on the actual cash value of your motorcycle.

Comprehensive coverage is optional, but it can be valuable for protecting your motorcycle against unexpected events.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured. It can cover your medical expenses, lost wages, and property damage.

Medical Payments Coverage

Medical payments coverage (MedPay) provides coverage for your medical expenses, regardless of who is at fault in an accident. This coverage applies to you and your passengers.

Roadside Assistance

Roadside assistance provides coverage for unexpected situations, such as flat tires, dead batteries, and towing. This coverage can be helpful if you experience a breakdown while riding.

Coverage Options Comparison

| Coverage Type | Benefits | Limitations | Typical Cost |

|---|---|---|---|

| Liability | Protects you financially if you cause an accident that results in injuries or property damage to others. | Does not cover damage to your own motorcycle. | Varies based on factors such as your driving record, location, and coverage limits. |

| Collision | Covers damage to your motorcycle in an accident, regardless of who is at fault. | Requires you to pay a deductible. Coverage is based on the actual cash value of your motorcycle. | Varies based on factors such as your driving record, location, and deductible amount. |

| Comprehensive | Protects your motorcycle against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. | Requires you to pay a deductible. Coverage is based on the actual cash value of your motorcycle. | Varies based on factors such as your driving record, location, and deductible amount. |

| Uninsured/Underinsured Motorist | Protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured. | May not cover all damages. | Varies based on factors such as your driving record, location, and coverage limits. |

| Medical Payments | Provides coverage for your medical expenses, regardless of who is at fault in an accident. | Limited coverage amount. | Varies based on factors such as your driving record, location, and coverage limits. |

| Roadside Assistance | Provides coverage for unexpected situations, such as flat tires, dead batteries, and towing. | Limited coverage for certain services. | Varies based on factors such as your driving record, location, and coverage limits. |

Getting Motorcycle Insurance Quotes

Obtaining motorcycle insurance quotes is a crucial step in finding the right coverage for your needs and budget. By comparing quotes from different insurance providers, you can ensure you’re getting the best possible value.

Comparing Motorcycle Insurance Quotes

It’s essential to compare quotes from multiple insurance companies to find the best deal. Each company uses different factors to determine premiums, so you may find significant price variations.

- Get quotes from multiple insurance providers. Don’t limit yourself to just a few companies; shop around and get quotes from at least five or more. You can use online comparison tools or contact insurance agents directly.

- Use online comparison tools. Several websites allow you to compare quotes from multiple insurance companies simultaneously. This can save you time and effort. These tools often offer a user-friendly interface and allow you to customize your search based on your specific needs.

- Consider factors influencing premium rates. Remember that factors like your age, driving history, credit score, and motorcycle type significantly impact your insurance premium. Be sure to provide accurate information when requesting quotes to get the most accurate pricing.

- Ask about discounts. Many insurance companies offer discounts for various factors, such as safety courses, anti-theft devices, and multiple policy discounts. Be sure to inquire about these discounts when getting quotes.

Understanding Coverage Options and Deductibles

When comparing quotes, it’s important to consider the coverage options and deductibles offered by each insurance provider.

- Coverage options. Motorcycle insurance policies typically include various coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each option has its benefits and costs, so it’s crucial to understand what each covers and choose the coverage that best suits your needs.

- Deductibles. Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums, while a lower deductible leads to higher premiums. Consider your financial situation and risk tolerance when choosing a deductible.

Getting Accurate and Competitive Quotes

To get accurate and competitive quotes, follow these steps:

- Gather your information. Before requesting quotes, gather all the necessary information, such as your motorcycle’s make, model, year, and VIN (Vehicle Identification Number), your driving history, and your contact information.

- Be honest and accurate. Provide truthful and accurate information when requesting quotes. This will ensure you get the most accurate pricing and avoid any potential issues later on.

- Compare quotes carefully. Once you receive quotes from different insurance providers, compare them carefully, considering the coverage options, deductibles, and overall cost. Don’t just focus on the lowest price; ensure the coverage meets your needs.

- Ask questions. Don’t hesitate to ask questions if you don’t understand something or need clarification. Insurance policies can be complex, so ensure you fully understand the terms and conditions before making a decision.

Motorcycle Insurance Discounts

Motorcycle insurance companies often offer discounts to lower premiums. These discounts can significantly reduce your overall cost of insurance. By taking advantage of these savings opportunities, you can keep your motorcycle insurance affordable.

Discounts Based on Safety and Security

Discounts based on safety and security measures are designed to encourage responsible motorcycle ownership and reduce the risk of accidents and theft. These discounts recognize that taking precautions can lead to lower insurance premiums.

- Motorcycle Safety Course Discount: Completing a motorcycle safety course demonstrates your commitment to safe riding practices. This discount is usually offered to riders who have completed a recognized motorcycle safety course, such as those approved by the Motorcycle Safety Foundation (MSF).

- Anti-theft Device Discount: Installing anti-theft devices on your motorcycle, such as an alarm system or GPS tracking device, can deter theft and lower your insurance premiums. These devices can help reduce the likelihood of your motorcycle being stolen, which in turn lowers the risk for insurance companies.

Discounts for Good Driving Records and Memberships

Motorcycle insurance companies often reward riders with clean driving records and active involvement in motorcycle organizations. These discounts recognize responsible riding habits and community engagement.

- Good Driver Discount: Maintaining a clean driving record, free from accidents or violations, is a significant factor in determining your insurance premium. Insurance companies view riders with good driving records as less risky, leading to lower premiums.

- Motorcycle Organization Membership Discount: Joining a motorcycle organization, such as the American Motorcyclist Association (AMA), can demonstrate your commitment to responsible riding and safety. Some insurance companies offer discounts to members of these organizations, recognizing their dedication to motorcycle safety and advocacy.

Multi-Policy Discounts

Bundling your motorcycle insurance with other types of insurance, such as auto or home insurance, can lead to significant savings. This is often referred to as a multi-policy discount.

- Bundling Discount: Insurance companies often offer discounts when you insure multiple vehicles or properties with them. This is because they view you as a more valuable customer and are more likely to retain your business.

Tips for Saving on Motorcycle Insurance

Motorcycle insurance premiums can vary significantly, and there are several strategies you can use to reduce your costs. By understanding these tactics and implementing them effectively, you can potentially save a substantial amount of money on your motorcycle insurance.

Negotiating Premiums

Negotiating your motorcycle insurance premiums can be an effective way to lower your costs.

- Shop around and compare quotes: Obtain quotes from multiple insurance providers to identify the most competitive rates. This allows you to compare different coverage options and premiums.

- Bundle your policies: If you have other insurance policies, such as auto or homeowners insurance, bundling them with your motorcycle insurance can often result in discounts.

- Ask about discounts: Many insurance companies offer discounts for various factors, such as safety courses, good driving records, and anti-theft devices. Inquire about these discounts and see if you qualify.

- Negotiate your deductible: A higher deductible typically translates to lower premiums. Consider increasing your deductible if you’re comfortable with a higher out-of-pocket expense in case of an accident.

Optimizing Coverage Options

Choosing the right coverage options can also help you save money on your motorcycle insurance.

- Review your coverage needs: Assess your specific needs and determine the minimum coverage required by law in your state.

- Consider dropping optional coverage: If you’re comfortable with a higher out-of-pocket expense, consider dropping optional coverage, such as comprehensive or collision coverage, which can significantly reduce your premiums.

- Choose the right coverage limits: Select coverage limits that are adequate for your needs but not excessive.

Maintaining a Good Driving Record

A clean driving record is essential for keeping your motorcycle insurance premiums low.

- Avoid traffic violations: Traffic violations, such as speeding tickets or reckless driving, can lead to increased insurance premiums.

- Drive safely and defensively: Practice safe driving habits and be aware of your surroundings to minimize the risk of accidents.

- Take a motorcycle safety course: Completing a motorcycle safety course can demonstrate your commitment to safe riding and potentially earn you a discount.

Understanding Motorcycle Insurance Policies

Motorcycle insurance policies are legally binding contracts between you and your insurance company. They Artikel the terms and conditions of your coverage, specifying what is covered, what is excluded, and the limits of your coverage.

Key Provisions and Terms

The following are some key provisions and terms commonly found in motorcycle insurance policies:

- Declarations Page: This page summarizes your policy information, including your name, address, policy number, coverage details, and premium amount. It also includes details about your motorcycle, such as the year, make, model, and VIN (Vehicle Identification Number).

- Coverage: This section describes the specific types of coverage you have purchased, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It also Artikels the limits of each coverage, indicating the maximum amount the insurer will pay for covered losses.

- Exclusions: This section lists situations and circumstances that are not covered by your policy. Examples include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs.

- Conditions: This section Artikels the responsibilities and obligations of both the insured and the insurer. For example, it may require you to notify the insurer in case of an accident or provide proof of loss.

- Endorsements: These are addendums or modifications to the original policy that add or change coverage. For instance, an endorsement might be added to cover specific modifications made to your motorcycle, like custom parts or accessories.

Importance of Reviewing Policy Documents

Thoroughly reviewing your policy documents is crucial for several reasons:

- Understanding Your Coverage: A careful review helps you understand what is covered, what is excluded, and the limits of your coverage. This ensures you have adequate protection for your motorcycle and potential liabilities.

- Identifying Gaps in Coverage: By reviewing the policy, you can identify potential gaps in your coverage and make necessary adjustments to ensure you have the right level of protection. For example, you might discover that your policy does not cover certain modifications to your motorcycle or that your liability limits are too low.

- Avoiding Disputes: Understanding the terms and conditions of your policy can help you avoid disputes with your insurer in case of a claim. A clear understanding of your coverage can prevent misunderstandings and ensure that you receive the benefits you are entitled to.

Common Exclusions and Limitations

It is important to be aware of common exclusions and limitations in motorcycle insurance policies. Some examples include:

- Damage Caused by Wear and Tear: Most policies exclude coverage for damage resulting from normal wear and tear, such as a worn-out tire or a cracked windshield.

- Intentional Acts: Damage caused by intentional acts, such as vandalism or theft, may not be covered. However, comprehensive coverage can often provide protection for theft.

- Driving Under the Influence: Insurance companies generally do not cover accidents caused by driving under the influence of alcohol or drugs.

- Racing or Stunt Driving: Policies typically exclude coverage for accidents that occur while racing or performing stunts.

- Modifications: Some modifications to your motorcycle, such as aftermarket parts or custom paint jobs, may not be covered unless they are specifically endorsed.

- Age and Experience: Insurers may impose limitations on coverage based on your age and experience. For example, a new rider with limited experience may face higher premiums or more restrictive coverage.

Understanding Policy Language

Insurance policies are often written in complex legal language. Here are some tips for understanding policy language:

- Read Carefully: Take your time and read the policy carefully, paying attention to every detail.

- Ask Questions: If you have any questions about the policy language, don’t hesitate to contact your insurance agent or broker.

- Use a Dictionary: If you encounter unfamiliar terms, use a dictionary or online resources to understand their meaning.

- Seek Professional Advice: If you are still unsure about the policy terms, consider seeking advice from a legal professional or an insurance expert.

Motorcycle Insurance Claims Process

Filing a motorcycle insurance claim can be a stressful experience, but understanding the process can help make it smoother. Knowing what to expect and how to navigate the system can help you maximize your payout and ensure a positive outcome.

Reporting an Accident to the Insurance Company

After an accident, it’s crucial to report it to your insurance company as soon as possible. This is typically done by phone or online through your insurance provider’s website. The insurance company will likely ask you for details about the accident, including:

- Date, time, and location of the accident

- Details of the other vehicles involved, including their make, model, and license plate numbers

- Names and contact information of any witnesses

- A description of the damage to your motorcycle

- Any injuries sustained

It’s also important to document the accident by taking photographs of the damage, gathering witness statements, and keeping a detailed record of the events.

The Role of Insurance Adjusters in Evaluating Claims

Once you’ve reported the accident, an insurance adjuster will be assigned to your case. Their role is to investigate the claim and determine the extent of the damage and the amount of coverage you’re entitled to. The adjuster will typically:

- Review the accident report and any other documentation you’ve provided

- Inspect the damage to your motorcycle

- May interview you, witnesses, and other parties involved in the accident

- Evaluate the claim and determine the amount of compensation you’re eligible for

Maximizing Claim Payouts and Ensuring a Smooth Claims Process

Here are some tips for maximizing your claim payout and ensuring a smooth claims process:

- Be honest and accurate when providing information to your insurance company.

- Keep detailed records of all communication with your insurance company, including dates, times, and the names of any individuals you speak with.

- Gather all relevant documentation, including repair estimates, medical bills, and police reports.

- Don’t hesitate to ask questions about the claims process and your coverage.

- Be patient, as the claims process can take some time.

“It’s important to remember that your insurance company is a business, and their goal is to minimize their payouts. By being prepared and proactive, you can increase your chances of receiving a fair settlement.”

Common Motorcycle Insurance Myths

Motorcycle insurance can be a complex topic, and many misconceptions surround it. Understanding the truth behind these myths is crucial for making informed decisions about your coverage.

Motorcycle Insurance is More Expensive Than Car Insurance

It’s a common belief that motorcycle insurance is pricier than car insurance. However, this isn’t always the case. While motorcycles can be more expensive to repair or replace than cars, they also have a lower risk of causing serious accidents. The cost of motorcycle insurance varies depending on several factors, including the type of motorcycle, rider’s age and driving history, and the coverage chosen. In some cases, motorcycle insurance can be cheaper than car insurance. For example, a 25-year-old with a clean driving record may find that their motorcycle insurance premium is lower than their car insurance premium, especially if they own a smaller, less powerful motorcycle.

You Don’t Need Insurance If You Only Ride a Short Distance

Many believe that insurance is unnecessary for short rides. However, accidents can happen anytime, anywhere, regardless of the distance traveled. Even a short ride can result in a costly accident, leaving you responsible for damages and injuries. Motorcycle insurance protects you from financial ruin in such situations, making it essential for every rider, regardless of how often or far they ride.

You Don’t Need Comprehensive Coverage

Comprehensive coverage protects your motorcycle against damage from non-accident events like theft, vandalism, and natural disasters. While it may seem optional, it’s crucial for safeguarding your investment. Without comprehensive coverage, you’ll have to pay for repairs or replacement out of pocket, which can be financially devastating.

Motorcycle Insurance is Only for Expensive Bikes

This myth suggests that only high-value motorcycles need insurance. However, even a less expensive motorcycle can lead to significant repair costs or legal expenses in case of an accident. Insurance protects you regardless of the motorcycle’s value, providing financial security and peace of mind.

Motorcycle Insurance Doesn’t Cover Passengers

Many believe that motorcycle insurance only covers the rider. However, most insurance policies include liability coverage for passengers. This coverage protects you financially if a passenger is injured in an accident.

You Can’t Get Discounts on Motorcycle Insurance

Motorcycle insurance companies offer various discounts to help riders save money. These discounts can be based on factors such as safe driving records, multiple policy ownership, anti-theft devices, and rider training courses. Taking advantage of these discounts can significantly reduce your premium.

Motorcycle Insurance Doesn’t Cover Medical Expenses

Motorcycle insurance typically includes medical payments coverage, which pays for medical expenses for you and your passengers, regardless of who’s at fault. This coverage helps you pay for medical bills after an accident, ensuring you receive necessary treatment without financial burden.

You Can’t Cancel Your Policy If You Sell Your Motorcycle

You can cancel your motorcycle insurance policy if you sell your motorcycle. However, it’s essential to notify your insurance company promptly. Failing to do so could result in continued premium payments even after selling the motorcycle.

Impact of Motorcycle Modifications on Insurance

Modifying your motorcycle can be a fun way to personalize your ride, but it can also have a significant impact on your insurance premiums. Insurance companies consider modified motorcycles to be higher risk, which can lead to increased costs.

Factors Affecting Premiums

Insurance companies consider several factors when assessing the risk associated with a modified motorcycle. These factors include:

- Performance Enhancements: Modifications that increase the motorcycle’s power or speed, such as engine upgrades, exhaust systems, or turbochargers, can significantly increase the risk of accidents. These modifications can make the motorcycle more difficult to control and increase the severity of accidents.

- Custom Parts: Replacing stock parts with custom or aftermarket parts can increase the cost of repairs and replacement. Insurance companies may charge higher premiums if the value of the motorcycle is increased due to expensive custom parts.

- Aftermarket Accessories: While some accessories, like windshields or luggage racks, may not significantly affect premiums, others, such as aftermarket lighting or audio systems, can increase the risk of theft or vandalism. Insurance companies may consider these factors when setting premiums.

Assessing Risk

Insurance companies use a variety of methods to assess the risk associated with modified motorcycles. These methods may include:

- Reviewing Modification Records: Insurance companies may review modification records, such as receipts or invoices, to determine the extent of modifications and their potential impact on risk.

- Inspection: Some insurance companies may require a physical inspection of the motorcycle to assess the modifications and their impact on safety and value.

- Using Risk-Assessment Models: Insurance companies often use sophisticated risk-assessment models to evaluate the risk associated with modified motorcycles based on various factors, including the type of modifications, the rider’s driving history, and the motorcycle’s value.

Disclosing Modifications

It is crucial to be transparent with your insurance provider about any modifications you make to your motorcycle. Failing to disclose modifications can lead to your insurance policy being invalidated in the event of an accident or claim.

- Inform Your Insurance Provider: Contact your insurance provider immediately after making any modifications to your motorcycle and inform them about the changes. Provide detailed information about the modifications, including the type, manufacturer, and any supporting documentation.

- Obtain Updated Quotes: Request updated insurance quotes from your provider after disclosing the modifications. This will ensure you understand the potential impact on your premiums and have the opportunity to make informed decisions about your coverage.

Motorcycle Insurance for Different Riders

Motorcycle insurance is not a one-size-fits-all solution. The specific needs of each rider vary based on their experience, riding style, and the type of motorcycle they own. Understanding these factors is crucial for selecting the right insurance plan and ensuring adequate coverage.

Insurance Needs for Different Rider Profiles

Insurance companies tailor their policies to cater to different rider profiles, recognizing that various factors influence the risk associated with each individual. This section will explore how insurance policies are designed to meet the unique needs of new riders, experienced riders, and riders with specific requirements.

- New Riders: New riders, often inexperienced and with less riding history, typically face higher insurance premiums. Insurance companies perceive them as higher risk due to their lack of experience and potential for accidents. Policies for new riders often include additional safety features and training programs, aimed at reducing risk and lowering premiums over time.

- Experienced Riders: Experienced riders with a clean driving record and a history of safe riding benefit from lower premiums. Insurance companies recognize their experience and responsible riding habits, leading to a reduced risk profile. Experienced riders may also qualify for discounts on their insurance policies, further lowering their costs.

- Riders with Specific Requirements: Riders with specific needs, such as those who frequently commute on their motorcycles or participate in racing events, require specialized insurance plans. Insurance companies offer policies tailored to these specific riding styles and purposes, providing appropriate coverage for the unique risks involved.

Insurance Plans for Different Riding Styles and Purposes

Motorcycle insurance policies are designed to accommodate different riding styles and purposes. This ensures riders receive the appropriate coverage for their specific needs, whether they use their motorcycle for daily commuting, weekend adventures, or competitive racing.

- Commuting Riders: Riders who use their motorcycles for daily commuting may need higher liability coverage, as they are more likely to be involved in accidents on busy roads. They may also consider adding comprehensive and collision coverage to protect their motorcycle against damage from theft or accidents.

- Recreational Riders: Riders who use their motorcycles for weekend adventures or recreational riding may need less liability coverage but may benefit from higher comprehensive and collision coverage, protecting their motorcycle against damage during off-road adventures or long-distance trips.

- Racing Riders: Riders who participate in racing events require specialized insurance plans that cover the unique risks associated with competitive riding. These plans often include higher liability coverage, as well as coverage for racing-related damage and injuries.

Examples of Insurance Plans for Specific Rider Groups

Insurance companies offer a wide range of motorcycle insurance plans designed to meet the specific needs of different rider groups. Here are a few examples:

- New Rider Packages: These packages often include basic liability coverage, comprehensive and collision coverage, and access to safety training programs. They are designed to provide new riders with the necessary protection while they gain experience and build a safe riding history.

- Experienced Rider Discounts: Insurance companies offer discounts to experienced riders with a clean driving record and a history of safe riding. These discounts can significantly reduce insurance premiums, rewarding responsible riding behavior.

- Racing Insurance Plans: These plans provide specialized coverage for riders who participate in racing events. They include higher liability coverage, as well as coverage for racing-related damage and injuries, ensuring riders have the appropriate protection during competitive events.

Resources for Motorcycle Insurance Information

Navigating the world of motorcycle insurance can be overwhelming, especially for first-time riders. Fortunately, numerous resources are available to help you understand your coverage options, compare prices, and make informed decisions.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumer rights. They provide valuable information on insurance requirements, consumer protection laws, and complaint resolution processes.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance regulators in the United States. Its website offers information on state insurance laws, consumer resources, and insurance company financial data. [link: https://www.naic.org/]

- State Insurance Departments: Each state has its own insurance department responsible for regulating insurance companies and enforcing consumer protection laws. You can find contact information for your state’s insurance department on the NAIC website. [link: https://www.naic.org/documents/state_web_sites.htm]

Consumer Advocacy Groups

Consumer advocacy groups are dedicated to protecting consumer rights and promoting fair insurance practices. They offer independent information, advice, and support to consumers dealing with insurance issues.

- Consumer Reports: This organization provides unbiased reviews and ratings of insurance companies, helping consumers make informed choices. [link: https://www.consumerreports.org/]

- National Consumer Law Center (NCLC): The NCLC advocates for consumer rights in various areas, including insurance. Its website offers resources and information on insurance issues and consumer protection laws. [link: https://www.nclc.org/]

Industry Associations

Industry associations represent insurance companies and provide information on industry trends, best practices, and consumer resources.

- Insurance Information Institute (III): The III is a non-profit organization that provides information and resources on various insurance topics, including motorcycle insurance. [link: https://www.iii.org/]

- American Insurance Association (AIA): The AIA represents property and casualty insurance companies and provides information on insurance issues and policyholder rights. [link: https://www.aiadc.org/]

Online Resources and Publications

Numerous online resources and publications offer information on motorcycle insurance, including comparisons, reviews, and tips.

- Motorcycle Consumer News: This magazine provides comprehensive coverage of motorcycle-related topics, including insurance. [link: https://www.motorcycleconsumernews.com/]

- Cycle World: This magazine offers news, reviews, and advice for motorcycle enthusiasts, including information on insurance. [link: https://www.cycleworld.com/]

- Insurance Websites: Many insurance companies have dedicated websites with information on their motorcycle insurance policies, including coverage options, discounts, and online quotes. [link: https://www.geico.com/, https://www.progressive.com/, https://www.statefarm.com/]

Finding Trusted Insurance Brokers and Agents

Insurance brokers and agents can provide personalized advice and help you find the right motorcycle insurance policy.

- Independent Insurance Brokers: These brokers work with multiple insurance companies and can compare quotes from different carriers. [link: https://www.trustedchoice.com/]

- Insurance Agent Directories: Online directories can help you find insurance agents in your area. [link: https://www.iii.org/find-an-agent/]

- Recommendations: Ask friends, family, and fellow motorcycle enthusiasts for recommendations on trusted insurance brokers or agents.

Final Summary

Navigating the world of motorcycle insurance can be a daunting task, but with the right information, you can find a policy that provides adequate coverage at a price that fits your budget. By understanding the factors that influence costs, exploring different coverage options, and taking advantage of available discounts, you can ride with peace of mind knowing that you’re protected on the road.