Life insurance is a cornerstone of financial planning, providing peace of mind and financial security for loved ones in the event of an untimely death. However, the tax implications of life insurance payouts can be complex and often raise questions. This guide delves into the intricacies of taxation on life insurance proceeds, exploring the circumstances under which these payouts are subject to taxes and when they are tax-free.

Understanding the tax treatment of life insurance payouts is crucial for beneficiaries, policyholders, and estate planners alike. This knowledge empowers individuals to make informed decisions about their insurance policies and minimize potential tax liabilities.

Life Insurance Basics

Life insurance is a contract between an individual and an insurance company that provides financial protection to beneficiaries upon the insured’s death. This financial protection comes in the form of a death benefit, which is a lump sum payment that helps replace lost income and cover expenses.

Types of Life Insurance Policies

Life insurance policies are designed to meet diverse needs and financial goals. Understanding the different types of policies is essential for choosing the right coverage.

- Term Life Insurance: This is the most common and affordable type of life insurance. It provides coverage for a specific period, typically 10, 20, or 30 years. If the insured dies within the term, the death benefit is paid to the beneficiary. If the insured survives the term, the policy expires, and no benefit is paid. Term life insurance is ideal for temporary coverage needs, such as protecting a young family while a mortgage is being paid off or covering outstanding debts.

- Whole Life Insurance: This type of policy provides lifetime coverage, meaning the death benefit is paid out whenever the insured dies. Whole life insurance also accumulates cash value, which grows tax-deferred and can be borrowed against. This cash value component can be used for various financial needs, such as retirement planning, education expenses, or unexpected emergencies. Whole life insurance is more expensive than term life insurance but offers permanent coverage and a savings component.

- Universal Life Insurance: This flexible policy allows policyholders to adjust their premium payments and death benefit amount over time. Universal life insurance also builds cash value, which grows at a variable interest rate. Policyholders have more control over their coverage and can tailor it to their changing needs.

- Variable Life Insurance: This type of policy offers a death benefit and a cash value component that is invested in sub-accounts. The cash value growth is dependent on the performance of the underlying investments. Variable life insurance offers the potential for higher returns but also carries more risk.

Life Insurance Payout Structures

The way a life insurance policy pays out the death benefit can vary depending on the policy type and the insured’s wishes. Here are some common payout structures:

- Lump Sum Payment: This is the most common payout structure, where the beneficiary receives the entire death benefit in a single lump sum payment. This provides flexibility for the beneficiary to use the funds as needed.

- Structured Settlement: This payout structure involves periodic payments over a set period of time. This can provide a steady stream of income for the beneficiary, ensuring financial stability.

- Income Stream: Some life insurance policies allow for the death benefit to be used to create an income stream for the beneficiary, providing ongoing financial support.

Life Insurance Scenarios

Here are some common scenarios where life insurance plays a crucial role:

- Replacing Lost Income: If the insured is the primary breadwinner, life insurance can provide financial support to the family, ensuring they can maintain their standard of living after the insured’s death.

- Paying Off Debts: Life insurance can be used to pay off outstanding debts, such as a mortgage, car loan, or credit card debt, relieving the beneficiary of this financial burden.

- Funding Education Expenses: Life insurance can provide the funds needed for a child’s education, ensuring they have the opportunity to pursue their goals.

- Estate Planning: Life insurance can be used to minimize estate taxes and ensure the smooth transfer of assets to heirs.

Key Features and Benefits of Life Insurance

Life insurance offers numerous benefits that can provide peace of mind and financial security:

- Financial Protection: Life insurance provides a financial safety net for beneficiaries, helping them cope with the financial hardship of losing a loved one.

- Peace of Mind: Knowing that your loved ones will be financially protected in the event of your death can provide a sense of peace and security.

- Flexibility: Life insurance policies offer various options for payout structures, allowing you to tailor the coverage to your specific needs.

- Tax Advantages: Death benefits are generally tax-free, providing beneficiaries with a significant financial advantage.

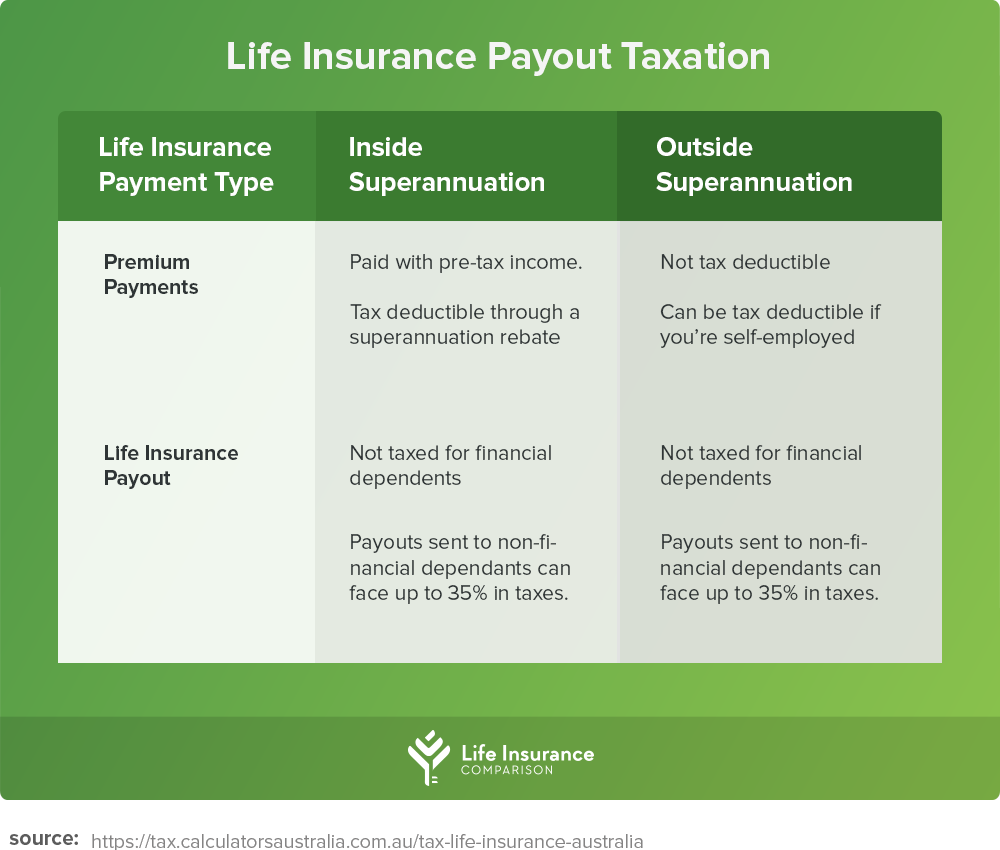

Taxation of Life Insurance Payouts

In the United States, life insurance payouts are generally tax-free to beneficiaries. This means that the recipient of the death benefit does not have to pay federal income tax on the money they receive. This is a significant advantage of life insurance, as it allows families to receive a large sum of money without having to worry about paying taxes on it. However, there are some exceptions to this general rule, and certain types of life insurance policies may be subject to taxation.

Tax Implications of Different Types of Life Insurance Policies

The tax treatment of life insurance payouts can vary depending on the type of policy.

- Term Life Insurance: Term life insurance is a type of policy that provides coverage for a specific period of time, typically 10, 20, or 30 years. Premiums for term life insurance are generally lower than premiums for other types of life insurance, but the policy does not build cash value. Death benefits from term life insurance policies are generally tax-free to beneficiaries.

- Whole Life Insurance: Whole life insurance is a type of policy that provides coverage for your entire life. Premiums for whole life insurance are generally higher than premiums for term life insurance, but the policy builds cash value. This cash value can be borrowed against or withdrawn, and it is generally taxed as ordinary income. Death benefits from whole life insurance policies are generally tax-free to beneficiaries.

- Universal Life Insurance: Universal life insurance is a type of policy that combines features of both term life and whole life insurance. Premiums for universal life insurance are generally flexible, and the policy builds cash value. Death benefits from universal life insurance policies are generally tax-free to beneficiaries.

- Variable Life Insurance: Variable life insurance is a type of policy that allows policyholders to invest the cash value of their policy in sub-accounts. The value of these sub-accounts can fluctuate based on the performance of the underlying investments. Death benefits from variable life insurance policies are generally tax-free to beneficiaries. However, any gains from the sub-accounts may be subject to capital gains tax.

Death Benefit

The death benefit is the amount of money that is paid to the beneficiary of a life insurance policy upon the death of the insured. In most cases, the death benefit is tax-free to the beneficiary. This is because the death benefit is considered to be a payment for the loss of the insured’s life, and not income.

“The death benefit is generally not considered taxable income to the beneficiary. This is because the death benefit is a payment for the loss of the insured’s life, and not income.”

Exceptions to the Tax-Free Rule

There are some exceptions to the general rule that life insurance payouts are tax-free. For example, if the beneficiary of a life insurance policy is a business, the death benefit may be subject to corporate income tax. Additionally, if the life insurance policy was purchased with borrowed money, the interest on the loan may be subject to tax.

Other Tax Considerations

In addition to the tax treatment of life insurance payouts, there are other tax considerations that may be relevant. For example, if a life insurance policy is transferred to a trust, the trust may be subject to income tax on any earnings from the policy. Additionally, if a life insurance policy is used to pay for funeral expenses, the expenses may be deductible on the beneficiary’s income tax return.

Tax-Free Life Insurance Payouts

Life insurance payouts are generally considered tax-free, meaning that the beneficiary who receives the death benefit does not have to pay federal income taxes on it. This is a significant advantage of life insurance, as it allows the proceeds to be used for their intended purpose without being reduced by taxes.

Requirements for Tax-Free Death Benefits

To receive a tax-free life insurance payout, certain requirements must be met, including beneficiary designation and policy ownership.

- Beneficiary Designation: The policyholder must designate a beneficiary to receive the death benefit. The beneficiary can be an individual, a trust, or a charity. The policyholder can change the beneficiary at any time. If no beneficiary is designated, the death benefit will be paid to the policyholder’s estate.

- Policy Ownership: The policyholder must own the life insurance policy. This means that the policyholder has the right to make decisions about the policy, such as changing the beneficiary, surrendering the policy, or borrowing against the policy’s cash value. The policyholder can also transfer ownership of the policy to another person.

Situations Where Life Insurance Payouts May Be Taxable

While life insurance payouts are generally tax-free, there are some situations where they may be subject to taxation.

- Business-Owned Life Insurance Policies: If a life insurance policy is owned by a business and the beneficiary is the business, the death benefit may be taxable to the business. This is because the death benefit is considered income to the business.

- Life Insurance Proceeds Used for Business Purposes: If a life insurance policy is used for business purposes, such as to fund a buy-sell agreement or to cover the costs of a business loan, the death benefit may be taxable to the business. This is because the death benefit is considered income to the business.

- Transfer for Value: If a life insurance policy is transferred for value, the death benefit may be taxable to the recipient. This is because the recipient is considered to have received income from the transfer.

Taxable Life Insurance Payouts

While life insurance payouts are generally tax-free, certain situations can trigger income tax liability. Understanding these scenarios is crucial for beneficiaries to avoid unexpected tax burdens.

Taxable Life Insurance Payouts

Life insurance payouts may be subject to income tax in several situations, including:

- Transfer for Value: If a policy is sold or transferred for a value greater than the premiums paid, the difference between the proceeds and the premiums paid is considered taxable income. For example, if you sell a life insurance policy for $100,000, but you only paid $50,000 in premiums, the $50,000 difference is taxable.

- Life Insurance Proceeds Used for Business Purposes: If a business owns a life insurance policy on an employee and receives the proceeds upon the employee’s death, the payout may be considered taxable income. This is because the business received a financial benefit from the employee’s death, which is considered a taxable event.

- Life Insurance Proceeds Used as Collateral: If a life insurance policy is used as collateral for a loan, the proceeds received upon the policyholder’s death may be considered taxable income. This is because the lender receives a financial benefit from the policyholder’s death, which is considered a taxable event.

- Life Insurance Proceeds Received by a Trust: If a life insurance policy is owned by a trust, the proceeds may be subject to income tax depending on the trust’s structure and the terms of the policy. This is because the trust is considered a separate legal entity and may be taxed differently than an individual.

- Life Insurance Proceeds Received by a Corporation: When a corporation receives life insurance proceeds on a policy it owns, the payout is generally considered taxable income. This is because the corporation received a financial benefit from the death of the insured individual, which is considered a taxable event.

Types of Taxes on Life Insurance Payouts

Life insurance payouts may be subject to federal income tax and state income tax.

- Federal Income Tax: The federal income tax rate on life insurance payouts depends on the beneficiary’s income bracket.

- State Income Tax: State income tax laws vary, and some states may tax life insurance payouts while others may not.

Tax Implications of Life Insurance Payouts for Businesses

When a business receives life insurance proceeds on a policy it owns, the payout is generally considered taxable income. The tax implications for businesses are as follows:

- Corporate Tax Rate: The business will be taxed on the life insurance proceeds at the applicable corporate tax rate.

- Deductibility of Premiums: The business may be able to deduct the premiums paid on the life insurance policy as a business expense.

- Capital Gains Tax: If the business sold the life insurance policy for a profit, the gain may be subject to capital gains tax.

Example: A corporation owns a life insurance policy on its CEO. Upon the CEO’s death, the corporation receives a $1 million payout. The corporation will be taxed on the $1 million payout at the applicable corporate tax rate. If the corporation paid $500,000 in premiums over the life of the policy, it may be able to deduct the $500,000 as a business expense.

Tax Reporting and Documentation

Reporting life insurance payouts on your tax return is essential to ensure you comply with IRS regulations and avoid potential penalties. Whether you receive a tax-free or taxable payout, you must accurately report the transaction on your tax forms.

Reporting Life Insurance Payouts

When reporting life insurance payouts, it’s crucial to accurately document the information. You’ll need to provide details about the policy, the beneficiary, and the payout amount. The specific forms and documentation required vary depending on the nature of the payout and your tax situation.

Form 1040

The primary form for reporting income and expenses is Form 1040, U.S. Individual Income Tax Return. Depending on the type of life insurance payout, you may need to report it on different sections of this form.

Schedule A

If you received a tax-free life insurance payout, you may need to report it on Schedule A, Itemized Deductions. This schedule allows you to itemize your deductions, which can potentially reduce your taxable income.

Schedule D

If you received a taxable life insurance payout, you’ll report it on Schedule D, Capital Gains and Losses. This schedule is used to report gains and losses from the sale or exchange of capital assets, which can include certain life insurance policies.

Form 1099-R

Form 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is a standard form used to report distributions from life insurance policies. The IRS requires the payer of the life insurance payout to issue this form to the beneficiary.

Form 56

Form 56, Notice Concerning Fiduciary Relationship, is used to report information about trusts or estates that receive life insurance payouts. This form is typically filed by the trustee or executor of the trust or estate.

Maintaining Accurate Records

Maintaining accurate records related to your life insurance policies is crucial for tax reporting purposes. You should keep copies of all policy documents, including the policy contract, beneficiary designations, and any correspondence with the insurance company. It’s also essential to keep records of all premiums paid, policy changes, and any payouts received.

Maintaining thorough and accurate records related to your life insurance policies can save you time and potential headaches during tax season. It ensures that you can accurately report the information on your tax return and avoid any penalties for non-compliance.

Life Insurance and Estate Planning

Life insurance plays a crucial role in estate planning, helping individuals to ensure their loved ones are financially secure after their passing. It can also be a valuable tool for minimizing estate taxes, which can significantly reduce the inheritance received by beneficiaries.

Estate Tax Implications

Estate tax is a federal tax levied on the value of a deceased person’s assets, known as their estate. The current federal estate tax exemption is a significant amount, meaning that many estates will not be subject to this tax. However, for larger estates exceeding the exemption, the tax rate can be substantial.

Life insurance proceeds can be included in the taxable estate, increasing the estate tax liability. However, there are strategies to minimize this tax burden.

Strategies for Minimizing Estate Tax Liability

There are various strategies that can be employed to minimize the estate tax liability associated with life insurance proceeds.

- Irrevocable Life Insurance Trusts (ILITs): An ILIT is a trust that holds the life insurance policy and is designed to remove the policy from the insured’s estate. The policy owner, typically the insured, transfers ownership of the policy to the trust, making the proceeds payable to the beneficiaries outside of the estate. This structure ensures the proceeds are not subject to estate tax.

- Naming Beneficiaries Directly: By naming beneficiaries directly on the life insurance policy, the proceeds bypass the probate process and are paid directly to the beneficiaries. This ensures the proceeds are not subject to estate tax, as they are not part of the deceased’s estate.

- Using Life Insurance as a Charitable Gift: Donating life insurance proceeds to a charity can be a tax-efficient way to reduce estate taxes. The proceeds are not subject to estate tax, and the charitable donation can generate a tax deduction for the estate.

Life Insurance and Inheritance Taxes

Inheriting life insurance payouts can have tax implications, depending on the circumstances. Understanding how inheritance taxes are calculated and applied to life insurance benefits is crucial for beneficiaries. This section explores the potential tax consequences for beneficiaries who receive life insurance payouts as part of an inheritance.

Inheritance Tax Implications

Inheritance taxes are levied on the value of assets transferred from a deceased person’s estate to their beneficiaries. Life insurance payouts are generally considered part of the estate, meaning they are subject to inheritance taxes. However, there are exceptions to this rule, such as when the policy is owned by an irrevocable trust.

The tax implications of inheriting life insurance payouts depend on several factors, including:

- The beneficiary’s relationship to the deceased

- The value of the life insurance payout

- The state of residence of the deceased

- The federal estate tax laws in effect at the time of death

Calculating Inheritance Taxes

Inheritance taxes are typically calculated as a percentage of the value of the inherited assets. The tax rate varies depending on the state and the value of the inheritance. For example, in the United States, the federal estate tax rate for 2023 is 40% on assets exceeding $12.92 million.

Inheritance Tax = Tax Rate x Value of Inheritance

Tax Consequences for Beneficiaries

Beneficiaries who inherit life insurance payouts may be required to pay inheritance taxes on the proceeds. The tax liability is determined by the factors mentioned earlier.

For example, if a beneficiary inherits a $1 million life insurance payout and the federal estate tax rate is 40%, the beneficiary may owe $400,000 in inheritance taxes. However, if the beneficiary is a spouse, they may be exempt from inheritance taxes under the marital deduction.

It’s important to note that the tax consequences of inheriting life insurance payouts can vary significantly depending on individual circumstances. Consulting with a tax professional is crucial to understand the specific tax implications for your situation.

Tax Planning Strategies for Life Insurance

Minimizing taxes on life insurance payouts is a key aspect of estate planning. There are several strategies that can be employed to reduce your tax liability and ensure your beneficiaries receive the maximum benefit from your life insurance policy.

Using Trusts to Minimize Taxes

Employing trusts can be an effective way to reduce the tax burden on life insurance payouts. Trusts can help shield the proceeds from estate taxes, income taxes, and other potential liabilities.

A trust is a legal entity that holds assets for the benefit of others, known as beneficiaries.

- Irrevocable Life Insurance Trusts (ILITs): An ILIT is a trust established during your lifetime where you transfer ownership of your life insurance policy to the trust. The proceeds of the policy are then distributed to your beneficiaries according to the terms of the trust, typically avoiding inclusion in your taxable estate.

- Revocable Living Trusts: These trusts allow you to maintain control over your assets during your lifetime and can help simplify the probate process. While they don’t offer the same estate tax advantages as ILITs, they can still provide some tax benefits by transferring ownership of assets, including life insurance policies, to the trust, potentially reducing the size of your taxable estate.

Other Estate Planning Strategies

Besides trusts, several other estate planning tools can help minimize taxes on life insurance payouts.

- Gift Tax Exclusions: The annual gift tax exclusion allows you to gift a certain amount of money to individuals each year without incurring gift tax. You can utilize this exclusion to transfer ownership of your life insurance policy to beneficiaries, potentially reducing your taxable estate.

- Charitable Donations: If you wish to make a charitable contribution, you can designate a charity as the beneficiary of your life insurance policy. This allows you to make a tax-deductible donation while ensuring your loved ones still benefit from the proceeds.

- Proper Beneficiary Designation: It is crucial to ensure that your beneficiaries are correctly designated on your life insurance policy. If the beneficiary is your estate, the proceeds will be subject to estate taxes. Naming individuals or trusts as beneficiaries can help avoid this.

Importance of Professional Advice

Navigating the complexities of life insurance and estate planning can be challenging. Consulting with a tax professional or financial advisor is essential for personalized guidance. They can help you:

- Determine the most suitable strategies for your specific situation.

- Optimize your life insurance policy to minimize tax liabilities.

- Develop a comprehensive estate plan that aligns with your financial goals and family needs.

Life Insurance and Business Owners

Life insurance can be a valuable tool for business owners, providing financial protection and helping to ensure the continuity of their operations in the event of an unexpected death. Understanding the tax implications of life insurance for business owners is crucial for maximizing its benefits and minimizing potential tax liabilities.

Key Person Coverage

Key person coverage is a type of life insurance policy that businesses purchase to protect themselves against the financial loss that could occur if a key employee or executive were to die. The death benefit from a key person policy is typically used to cover expenses such as:

- Replacing the deceased employee’s salary and benefits.

- Training a new employee to take over the deceased employee’s role.

- Covering the cost of lost productivity.

The death benefit from a key person policy is generally considered taxable income to the business. However, there are some exceptions, such as when the policy is owned by a trust or when the business is a partnership or S corporation.

Business Succession Planning

Life insurance can also play a crucial role in business succession planning. When a business owner dies, their shares of the business may be transferred to their heirs. This can create a number of challenges for the business, such as:

- The heirs may not have the experience or expertise to run the business.

- The heirs may not be interested in running the business.

- The heirs may not be able to afford to buy out the other owners.

Life insurance can be used to provide the funds necessary to buy out the deceased owner’s shares of the business, ensuring a smooth transition of ownership.

A life insurance policy can be used to provide liquidity for the business, allowing the surviving owners to buy out the deceased owner’s interest.

This can help to prevent the business from being sold to outsiders or being dissolved, ensuring its continued operation.

Tax Minimization Strategies

Business owners can use a variety of strategies to minimize the tax liability associated with life insurance payouts. Some common strategies include:

- Using a trust: If the life insurance policy is owned by a trust, the death benefit may be paid directly to the trust, avoiding taxation at the business level.

- Using a business entity: If the life insurance policy is owned by a business entity, such as a corporation or LLC, the death benefit may be tax-free to the business.

- Using a buy-sell agreement: A buy-sell agreement is a legal contract that Artikels how the ownership of a business will be transferred in the event of the death or disability of an owner. Life insurance can be used to fund a buy-sell agreement, ensuring that the business can continue to operate smoothly.

It’s important to consult with a qualified tax advisor to determine the best strategy for minimizing taxes on life insurance payouts.

Life Insurance and Charitable Giving

Life insurance can be a powerful tool for supporting charitable causes and maximizing tax benefits. By strategically incorporating charitable giving into your life insurance planning, you can make a lasting impact while potentially reducing your tax burden.

Tax Deductions for Charitable Contributions

Charitable contributions made through life insurance policies can offer significant tax advantages. The Internal Revenue Code (IRC) provides specific deductions for these contributions, allowing you to potentially reduce your taxable income and tax liability.

- Deduction for Charitable Gifts: When you donate a life insurance policy to a qualified charity, you may be eligible to deduct the fair market value of the policy as a charitable contribution. This deduction can be substantial, especially for policies with a high cash value.

- Deduction for Premiums Paid: If you make a charitable contribution by naming a charity as the beneficiary of your life insurance policy, you may be able to deduct the premiums you pay on the policy. This deduction is typically limited to the amount of the premiums paid after the date you designated the charity as the beneficiary.

Examples of Charitable Giving with Life Insurance

Here are some examples of how life insurance can be used to support charitable causes:

- Naming a Charity as Beneficiary: You can designate a charity as the beneficiary of your life insurance policy, ensuring that a substantial donation will be made to the organization upon your death. This allows you to leave a lasting legacy and support a cause you care about.

- Charitable Remainder Trust (CRT): A CRT is a trust that allows you to donate a portion of your life insurance policy to a charity while retaining an income stream for yourself or your beneficiaries. This arrangement can provide both tax benefits and charitable support.

- Charitable Lead Trust (CLT): A CLT is a trust that pays a fixed income to a charity for a specified period, after which the remaining assets are distributed to your chosen beneficiaries. This approach allows you to provide immediate support to a charity while ensuring that your loved ones ultimately benefit from the trust’s assets.

Closing Summary

Navigating the tax landscape surrounding life insurance payouts requires careful consideration and planning. Understanding the different tax implications of life insurance policies, beneficiary designations, and estate planning strategies is essential for maximizing the benefits of this vital financial tool. By consulting with a tax professional or financial advisor, individuals can ensure they are making informed decisions that align with their financial goals and minimize potential tax burdens.