North Carolina’s auto insurance landscape is a complex web of factors, from state-mandated minimum coverage requirements to individual driving habits. While the cost of car insurance can seem like a constant drain on your budget, understanding the factors that influence rates can empower you to find affordable options. Whether you’re a new driver or a seasoned veteran of the roads, this guide will equip you with the knowledge to navigate the market and secure the best possible rates.

From understanding the minimum coverage requirements and comparing insurance providers to exploring discounts and savings opportunities, this comprehensive guide will provide actionable insights to help you lower your auto insurance costs in North Carolina. By understanding the key factors that affect premiums and utilizing the tips and resources provided, you can unlock significant savings without compromising on essential coverage.

Understanding North Carolina’s Auto Insurance Landscape

Navigating the complex world of auto insurance in North Carolina can be daunting, especially when trying to find the most affordable option. Factors like the state’s unique laws, driving conditions, and the availability of different insurance types all play a role in determining your premium. Understanding these nuances can help you make informed decisions and secure the best coverage for your needs.

Minimum Coverage Requirements in North Carolina

North Carolina mandates specific minimum auto insurance coverage levels, commonly referred to as “liability” coverage. These requirements aim to ensure financial protection for drivers involved in accidents. The state’s minimum coverage requirements include:

- Bodily Injury Liability: $30,000 per person, $60,000 per accident. This coverage protects you financially if you injure someone else in an accident. It covers their medical expenses, lost wages, and other related costs.

- Property Damage Liability: $25,000 per accident. This coverage protects you if you damage someone else’s property, such as their vehicle or a fence, in an accident.

While these minimum requirements are legally mandated, they may not be sufficient to cover all potential costs in the event of a serious accident. For example, if you cause an accident resulting in significant injuries or property damage exceeding the minimum coverage limits, you could be personally liable for the remaining costs.

Types of Auto Insurance Available in North Carolina

Beyond the minimum liability coverage, North Carolina offers a range of additional insurance options to provide more comprehensive protection. These optional coverages can enhance your financial security in various scenarios, although they come at an additional cost.

Liability Coverage

Liability coverage, as discussed earlier, protects you financially if you cause an accident that results in injuries or property damage to others. This coverage is crucial for protecting yourself from potential financial ruin in the event of a serious accident.

Collision Coverage

Collision coverage protects you if your vehicle is damaged in an accident, regardless of who is at fault. This coverage helps pay for repairs or replacement costs, even if you are responsible for the accident.

Comprehensive Coverage

Comprehensive coverage protects you against damages to your vehicle from non-accident related events, such as theft, vandalism, fire, or natural disasters. This coverage helps you recover from unexpected events that could otherwise leave you with substantial repair or replacement costs.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. This coverage helps pay for your medical expenses, lost wages, and other related costs, even if the other driver cannot afford to cover the damages.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as “no-fault” insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident. This coverage is optional in North Carolina, but it can provide valuable protection in the event of an accident, especially if you are unable to work due to injuries.

Factors Affecting Cheap Auto Insurance Rates

In North Carolina, the cost of auto insurance can vary significantly depending on a multitude of factors. Understanding these factors empowers drivers to make informed decisions and potentially secure more affordable premiums.

Driving History

A clean driving record is paramount in obtaining cheap auto insurance. Insurance companies assess your driving history to gauge your risk level. Drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and, therefore, face higher premiums.

Maintaining a good driving record is crucial for securing affordable auto insurance.

- Avoid Accidents: Defensive driving techniques, such as maintaining a safe following distance and being aware of your surroundings, can help minimize the risk of accidents.

- Obey Traffic Laws: Adhering to speed limits, using turn signals, and avoiding distractions while driving can prevent traffic violations.

- Maintain a Safe Driving Environment: Regularly servicing your vehicle and ensuring it is in good working condition can contribute to safe driving.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your insurance premium. Insurance companies consider factors such as:

- Vehicle Make and Model: Certain vehicle models are known for their safety features, while others are more prone to accidents or theft. This can impact the cost of insurance.

- Vehicle Age: Older vehicles are generally less expensive to insure than newer models.

- Vehicle Value: The market value of your vehicle influences the cost of collision and comprehensive coverage.

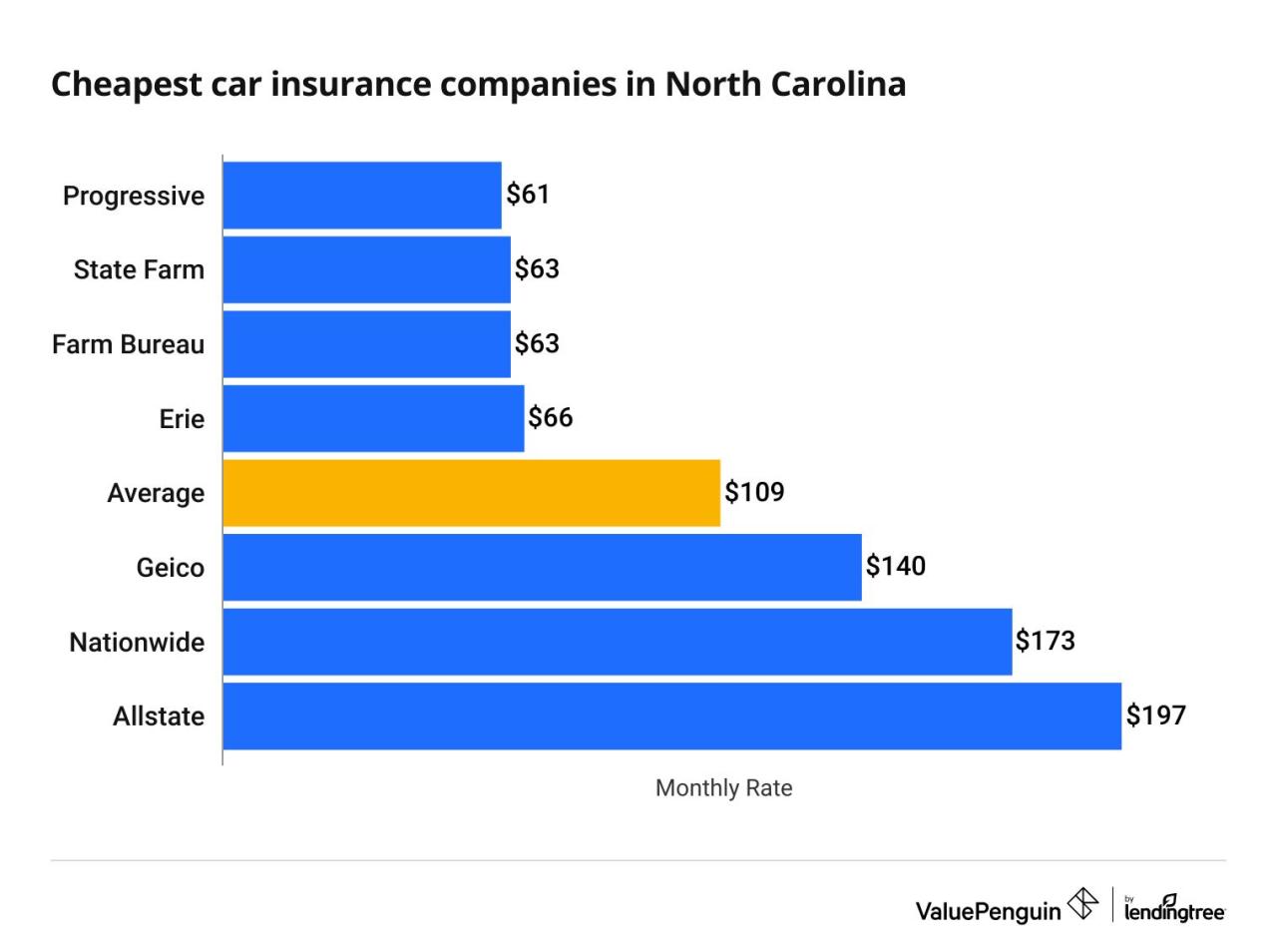

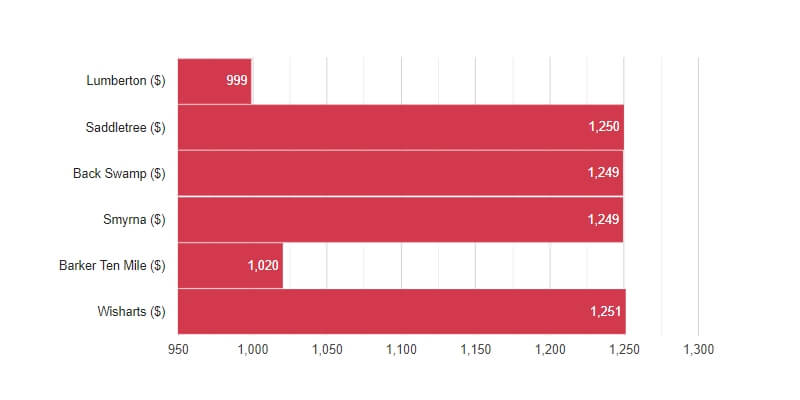

Location

The location where you live can also affect your auto insurance rates. Insurance companies consider factors such as:

- Population Density: Urban areas with higher population density tend to have more traffic and accidents, leading to higher insurance premiums.

- Crime Rates: Areas with higher crime rates, including theft and vandalism, may result in higher premiums.

- Weather Conditions: Regions prone to severe weather events, such as hurricanes or tornadoes, can have higher insurance costs due to the increased risk of damage.

Finding Affordable Insurance Providers

Navigating the world of auto insurance in North Carolina can feel overwhelming, especially when you’re on a budget. However, with a little research and understanding of the market, you can find an insurance provider that offers competitive rates and comprehensive coverage.

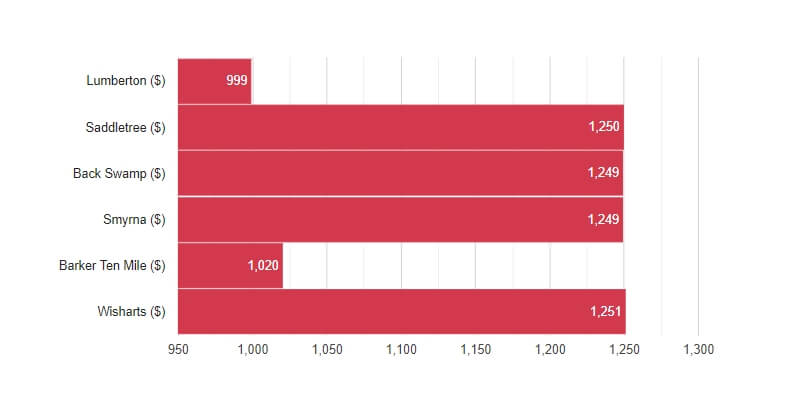

Reputable Insurance Companies in North Carolina

Several insurance companies are known for offering competitive rates in North Carolina. These companies often have different strengths, so it’s crucial to compare their coverage options, discounts, and customer service to find the best fit for your needs.

- GEICO: GEICO is a large national insurer with a reputation for competitive rates and a user-friendly online platform. They offer various discounts, including good driver, multi-car, and military discounts. However, their customer service has been criticized by some, and their claims process can be complex.

- State Farm: State Farm is another large national insurer with a strong presence in North Carolina. They offer a wide range of coverage options and discounts, including good driver, safe driver, and multi-policy discounts. State Farm is known for its excellent customer service and reliable claims processing.

- Progressive: Progressive is known for its innovative approach to insurance, offering personalized rates based on your driving habits. They also offer a variety of discounts, including good driver, safe driver, and multi-policy discounts. Progressive’s online platform is easy to use, and they have a strong reputation for customer service.

- Nationwide: Nationwide is a national insurer with a strong presence in North Carolina. They offer a wide range of coverage options and discounts, including good driver, multi-car, and safe driver discounts. Nationwide is known for its financial stability and reliable claims processing.

- USAA: USAA is a highly-rated insurance company that primarily serves military members and their families. They offer competitive rates, excellent customer service, and a streamlined claims process. However, their services are only available to eligible individuals.

Comparing Coverage Options and Discounts

When comparing insurance companies, it’s crucial to consider the coverage options and discounts they offer. Coverage options typically include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Discounts can include good driver, safe driver, multi-car, multi-policy, and defensive driving discounts.

Using Online Insurance Brokers

Online insurance brokers can be a valuable resource when searching for cheap auto insurance. They can compare quotes from multiple insurance companies, allowing you to find the best rates for your needs. However, it’s important to be aware of the potential drawbacks of using online brokers.

- Limited Coverage Options: Online brokers may not offer access to all insurance companies, potentially limiting your coverage options.

- Lack of Personalization: Online brokers may not be able to provide personalized advice or recommendations based on your specific needs.

- Potential for Hidden Fees: Some online brokers may charge hidden fees or commissions, which can affect your overall cost.

Discounts and Savings Opportunities

In North Carolina, numerous discounts can significantly reduce your auto insurance premiums. Understanding these discounts and their eligibility criteria can help you save considerably on your insurance costs.

Common Auto Insurance Discounts in North Carolina

Discounts are a crucial component of lowering your auto insurance costs in North Carolina. These discounts are offered by various insurance providers and can vary in terms of eligibility and savings potential.

- Good Driver Discount: This discount is offered to drivers with a clean driving record, typically with no accidents or traffic violations within a specified period. The savings can be substantial, potentially reaching 20% or more.

- Safe Driver Discount: Similar to the good driver discount, this discount rewards drivers who demonstrate safe driving habits. Insurance companies may consider factors like driving history, driving experience, and defensive driving course completion.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you can qualify for this discount. The discount usually increases with the number of vehicles insured.

- Multi-Policy Discount: This discount applies when you bundle your auto insurance with other insurance policies, such as homeowners or renters insurance, with the same insurer. Bundling policies can result in significant savings.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarm systems or GPS tracking systems, can reduce your insurance premium. This discount acknowledges the reduced risk of theft with these devices.

- Good Student Discount: This discount is available to students who maintain a certain GPA or academic standing. It encourages good academic performance and responsible behavior.

- Defensive Driving Course Discount: Completing a defensive driving course demonstrates your commitment to safe driving practices and can earn you a discount on your insurance.

- Loyalty Discount: Some insurers offer discounts to long-term customers who have maintained their insurance policy for a significant period.

- Early Payment Discount: Paying your insurance premium in full or in advance can often qualify you for a discount.

- Paperless Billing Discount: Many insurers offer discounts to policyholders who opt for electronic billing and communication.

Bundling Insurance Policies

Bundling your auto insurance with other insurance policies, such as homeowners, renters, or life insurance, can lead to significant cost reductions. Insurance companies often offer discounts for bundling policies, as they view it as a sign of customer loyalty and reduced administrative costs. For example, if you bundle your auto insurance with homeowners insurance, you could potentially save 10% or more on your overall premium.

“Bundling your insurance policies can be a smart way to save money, especially if you have multiple insurance needs.”

Tips for Lowering Auto Insurance Costs

In North Carolina, where auto insurance rates can vary significantly, understanding how to lower your premiums is crucial. Here are some effective strategies to help you achieve substantial savings.

Negotiating Insurance Premiums

Negotiating your insurance premiums can be a powerful tool for reducing your overall costs. It’s essential to be prepared and understand your options.

- Shop Around and Compare Quotes: Obtaining quotes from multiple insurance providers allows you to compare rates and identify the most competitive offers. Consider using online comparison tools or contacting insurers directly.

- Bundle Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts. Many insurers offer bundled packages that provide substantial savings.

- Consider Higher Deductibles: Opting for a higher deductible can reduce your monthly premiums, as you agree to pay more out of pocket in the event of a claim. This strategy is particularly beneficial for drivers with a clean driving record and a good financial cushion.

- Negotiate with Your Current Provider: If you’ve been a loyal customer with your current insurer, consider reaching out to discuss your policy and explore potential discounts or rate adjustments. Highlighting your positive driving history and loyalty can be persuasive.

Improving Your Credit Score

While not directly related to driving, your credit score can play a role in determining your auto insurance rates. Insurers often use credit scores as a proxy for risk assessment, believing that individuals with good credit are less likely to file claims.

- Pay Bills on Time: Consistent on-time payments are crucial for building a strong credit history. Set reminders or automate payments to ensure timely bill settlement.

- Reduce Credit Utilization: Aim to keep your credit utilization ratio (the amount of credit you use compared to your available credit) below 30%. This indicates responsible credit management.

- Check for Errors: Regularly review your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) for any errors or inaccuracies. Dispute any discrepancies to ensure an accurate credit score.

Defensive Driving Courses

Participating in a defensive driving course can not only enhance your driving skills but also potentially lower your auto insurance premiums.

- Improved Driving Habits: These courses provide valuable insights into safe driving practices, risk management, and accident prevention, ultimately contributing to a safer driving record.

- Discounts and Rate Reductions: Many insurance providers offer discounts for completing approved defensive driving courses. Contact your insurer to inquire about specific program requirements and potential savings.

- Enhanced Safety Awareness: By learning defensive driving techniques, you can become a more cautious and aware driver, reducing the risk of accidents and potential claims.

Understanding Coverage Options

Choosing the right auto insurance coverage is crucial for protecting yourself financially in case of an accident or other unforeseen event. Understanding the different types of coverage available and their benefits is essential for making informed decisions about your policy.

Importance of Adequate Coverage

Adequate auto insurance coverage is essential for protecting your finances and ensuring you can cover potential costs associated with accidents. The amount of coverage you need depends on your individual circumstances, including the value of your vehicle, your driving history, and your financial situation. For example, a driver with a new, expensive car may need higher liability limits than someone with an older, less valuable vehicle.

Benefits and Drawbacks of Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured altogether. This coverage helps pay for your medical expenses, lost wages, and property damage. While UM/UIM coverage is optional in most states, it is highly recommended as it can provide vital financial protection in the event of an accident with an uninsured or underinsured driver.

- Benefits: Provides financial protection in the event of an accident with an uninsured or underinsured driver, helping to cover medical expenses, lost wages, and property damage.

- Drawbacks: May increase your insurance premium, but the potential financial benefits outweigh the cost for most drivers.

Comprehensive and Collision Coverage

Comprehensive and collision coverage protect your vehicle from damage caused by various events.

- Comprehensive Coverage: Protects against damage to your vehicle from events such as theft, vandalism, fire, hail, and natural disasters.

- Collision Coverage: Covers damage to your vehicle resulting from an accident, regardless of who is at fault.

Avoiding Common Insurance Mistakes

Navigating the world of auto insurance can be complex, and even well-intentioned individuals can make mistakes that lead to higher premiums or inadequate coverage. Understanding common pitfalls and adopting proactive strategies can help you secure the best possible insurance protection for your vehicle and your finances.

Choosing the Wrong Coverage

It’s crucial to choose the right coverage to ensure adequate protection in case of an accident. Many people make the mistake of selecting minimal coverage to save money, but this can lead to significant financial burdens if a major accident occurs. It’s essential to understand the different types of coverage available and select a policy that meets your specific needs.

- Liability Coverage: This covers damages to other people and their property if you are at fault in an accident. North Carolina requires a minimum liability coverage of $30,000 per person, $60,000 per accident, and $25,000 for property damage.

- Collision Coverage: This covers repairs or replacement of your vehicle if you are involved in an accident, regardless of fault. It’s usually recommended for newer or financed vehicles.

- Comprehensive Coverage: This covers damages to your vehicle from non-accident events like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It’s highly recommended in North Carolina, where a significant number of drivers are uninsured.

Resources for Further Information

Seeking additional resources to navigate North Carolina’s auto insurance landscape can empower you to make informed decisions and find the most suitable coverage. This section will provide you with a comprehensive list of valuable resources to aid your search.

Free Auto Insurance Quotes and Comparisons

Access to free online tools can significantly simplify the process of finding competitive auto insurance rates. Reputable websites offer comprehensive quote comparisons, allowing you to evaluate various insurance providers and their offerings side-by-side.

- Insurify: A leading platform that aggregates quotes from numerous insurance companies, providing a convenient way to compare prices and coverage options.

- QuoteWizard: A popular online tool that allows you to enter your details once and receive multiple quotes from different insurance providers.

- The Zebra: A website that focuses on providing personalized insurance recommendations based on your specific needs and preferences.

North Carolina Department of Insurance

The North Carolina Department of Insurance serves as a valuable resource for consumers seeking information about auto insurance regulations, consumer protection, and resolving disputes.

- Website: https://www.ncdoi.gov/

- Phone: (919) 807-6400

- Address: 430 N. Salisbury Street, Raleigh, NC 27603

Consumer Advocacy Organizations

Consumer advocacy organizations play a crucial role in protecting drivers’ rights and ensuring fair insurance practices. These organizations provide valuable resources, guidance, and support to consumers seeking affordable auto insurance.

- Consumer Reports: A non-profit organization that conducts independent research and testing on a wide range of products and services, including auto insurance.

- National Association of Insurance Commissioners (NAIC): A non-profit organization that promotes consumer protection and uniformity in insurance regulation across the United States.

- North Carolina Consumers Council: A non-profit organization dedicated to protecting consumer rights and advocating for fair and equitable business practices.

Conclusion

In conclusion, finding cheap auto insurance in North Carolina requires a proactive approach. By carefully considering your individual needs, comparing quotes from multiple providers, and utilizing available discounts, you can secure affordable coverage without compromising on protection. Remember, a little research and effort can go a long way in ensuring that your car insurance remains a manageable expense while providing peace of mind on the road.