The cost of auto insurance is on the rise across the United States, with state-specific trends adding another layer of complexity for consumers. This year, factors like inflation, increased claims, and evolving driving habits have pushed premiums higher, leaving many drivers grappling with rising costs. Understanding the factors driving these increases and the state-specific trends is crucial for navigating the ever-changing insurance landscape.

This in-depth analysis explores the key drivers behind auto insurance rate increases, examines state-specific trends for 2023, and provides practical strategies for consumers to manage their costs. We delve into the impact on consumers, industry perspectives, and the regulatory landscape, offering insights into both the challenges and opportunities facing the insurance industry.

Auto Insurance Rate Increases in the United States

Auto insurance rates in the United States have been on the rise in recent years, driven by a confluence of factors including inflation, supply chain disruptions, and increased claims costs. Understanding the specific trends in auto insurance rates across different states is crucial for consumers, businesses, and policymakers. This information can help individuals make informed decisions about their insurance coverage, while also providing insights into the broader economic and social factors that influence the cost of auto insurance.

State-Specific Trends in Auto Insurance Rates

State-specific trends in auto insurance rates are influenced by a variety of factors, including:

- The number and severity of accidents

- The cost of car repairs and medical care

- The density of population

- The prevalence of uninsured drivers

- State regulations and laws governing auto insurance

These factors can vary significantly from state to state, resulting in substantial differences in average auto insurance premiums.

For example, the average annual premium for car insurance in California is significantly higher than in Mississippi, due in part to higher accident rates, traffic congestion, and the cost of living in the state.

Factors Influencing Auto Insurance Rate Increases

The rising cost of auto insurance is a nationwide concern, affecting millions of drivers across the United States. Several factors contribute to these increases, impacting both the frequency and severity of claims, driving up insurance premiums.

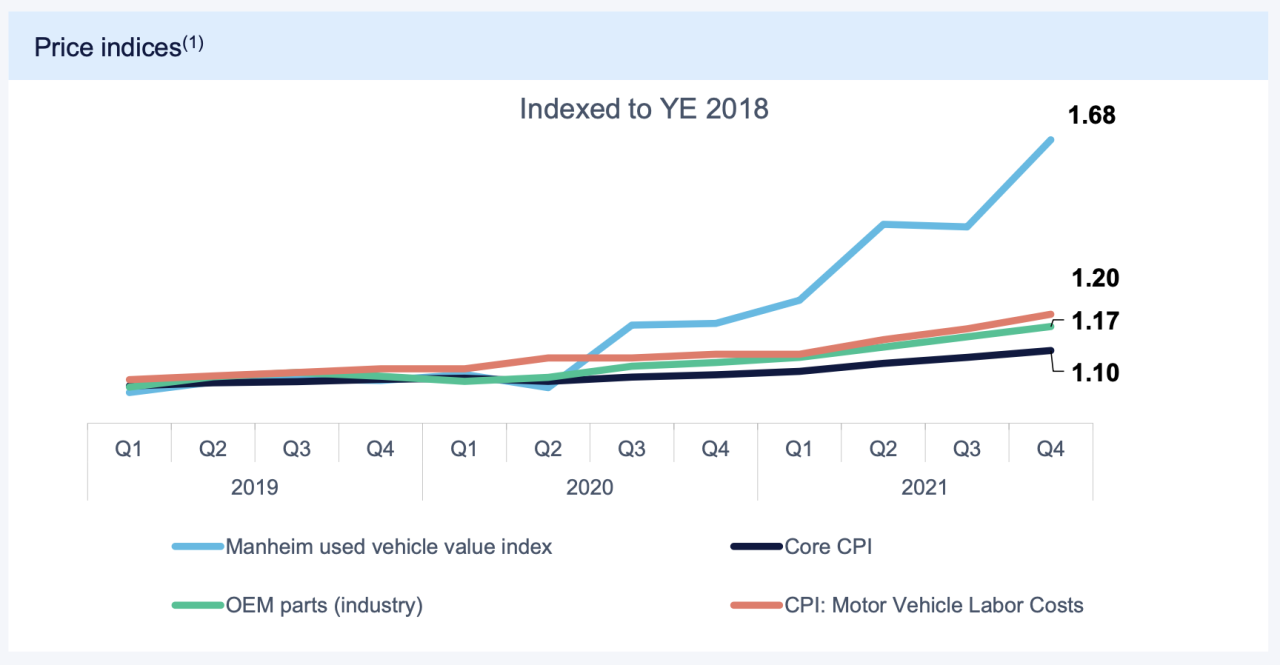

Inflation and Rising Costs of Repairs

Inflation has a significant impact on auto insurance rates. The cost of vehicle parts, labor, and materials has risen considerably, making repairs more expensive.

“The average cost of an auto repair has increased by over 20% in the past two years,” says a recent study by the National Highway Traffic Safety Administration.

Higher repair costs translate to higher insurance payouts, ultimately leading to increased premiums for policyholders.

Increased Claims Frequency and Severity

Increased claims frequency and severity are major contributors to rising auto insurance rates. Several factors contribute to this trend, including:

- Increased traffic volume: As more vehicles are on the road, the likelihood of accidents increases.

- Distracted driving: The widespread use of smartphones and other devices while driving has led to a rise in accidents caused by distracted drivers.

- Aggressive driving: Speeding, tailgating, and other aggressive driving behaviors contribute to accidents.

- Older vehicles: Older vehicles are more prone to mechanical failures, leading to accidents.

Changes in Driving Habits and Technology

Changes in driving habits and technology also play a role in auto insurance rate increases. The rise of ride-sharing services, autonomous vehicles, and connected cars has created new risks and challenges for insurers.

- Ride-sharing services: The increase in ride-sharing services has led to a surge in accidents involving ride-sharing drivers.

- Autonomous vehicles: While autonomous vehicles promise increased safety, their widespread adoption raises questions about liability and insurance coverage.

- Connected cars: Connected cars generate vast amounts of data, which insurers can use to assess risk and adjust premiums.

Regulatory Changes and Legislative Updates

Regulatory changes and legislative updates can also impact auto insurance rates.

- No-fault insurance laws: States with no-fault insurance laws often have higher auto insurance rates due to the increased cost of medical benefits.

- Changes in coverage requirements: Changes in minimum coverage requirements can lead to higher premiums for policyholders.

- New safety regulations: New safety regulations, such as mandatory safety features in vehicles, can impact insurance rates.

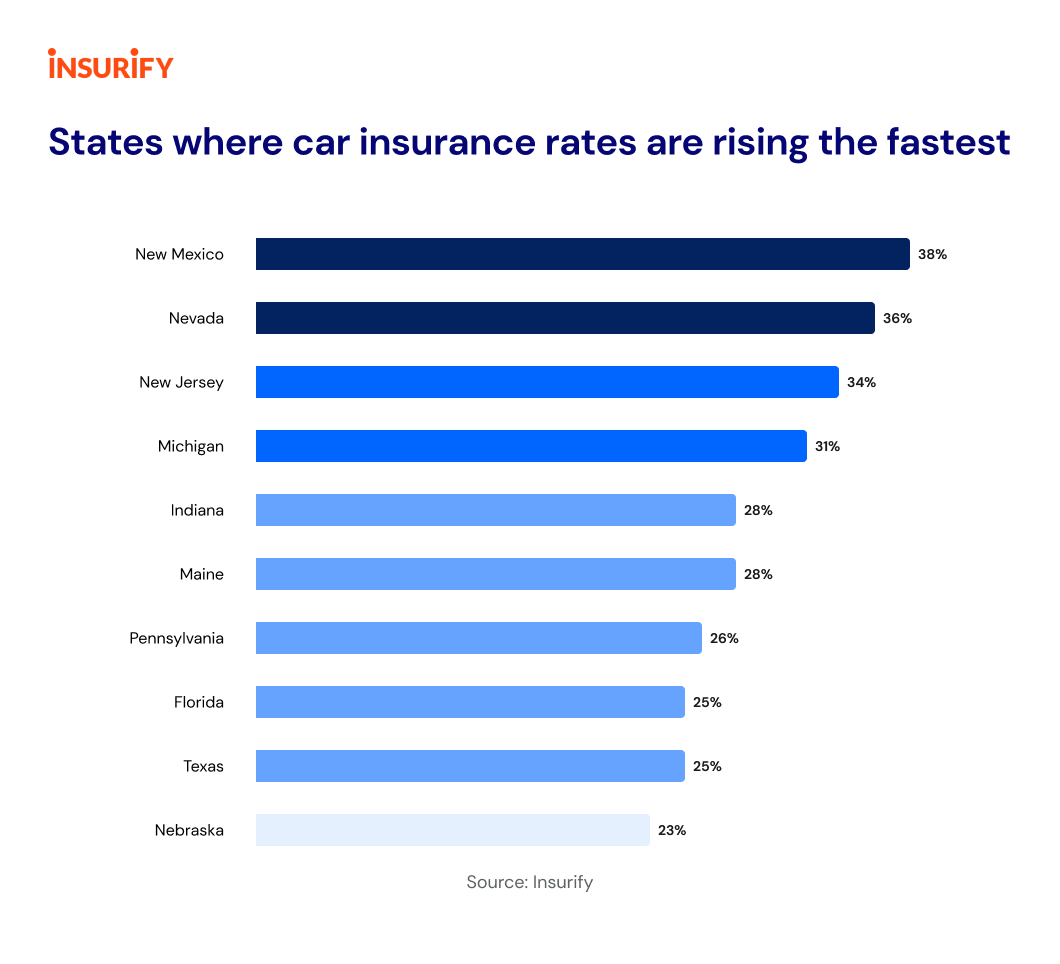

State-Specific Trends

Auto insurance rates vary significantly across the United States, influenced by a complex interplay of factors. While national trends provide a broad overview, understanding state-specific trends is crucial for consumers seeking the best rates.

State-Specific Auto Insurance Rate Increases in 2023

The following table summarizes average auto insurance rate increases by state for 2023, highlighting key contributing factors and notable trends.

| State | Average Rate Increase | Key Contributing Factors | Notable Trends |

|---|---|---|---|

| California | 5.2% | Rising repair costs, increased claims frequency, and a growing population | California has seen a surge in electric vehicle adoption, leading to higher repair costs for specialized parts and technologies. |

| Florida | 7.8% | High frequency of accidents, severe weather events, and a large uninsured driver population | Florida continues to grapple with a high number of uninsured drivers, leading to increased costs for insurers. |

| Texas | 6.1% | Increased traffic congestion, higher vehicle values, and a growing population | Texas has experienced rapid economic growth, resulting in increased traffic and a higher number of vehicles on the road. |

| New York | 4.5% | Rising medical costs, a higher density of drivers, and a growing urban population | New York City has seen a significant increase in ride-hailing services, leading to higher traffic congestion and accident rates. |

| Pennsylvania | 5.9% | Increased claims severity, higher vehicle repair costs, and a growing population | Pennsylvania has experienced a rise in distracted driving accidents, leading to more severe injuries and higher claim costs. |

Impact on Consumers

The surge in auto insurance rates across the United States has a direct and significant impact on consumers, leading to increased financial burdens and affordability challenges. These rate increases affect individuals and families differently, depending on their financial situation, driving habits, and location.

Increased Financial Burden and Affordability Challenges

Rising auto insurance premiums contribute to a growing financial burden for consumers, particularly those already struggling with rising costs of living. These increases can strain household budgets, forcing individuals to make difficult choices between essential expenses and insurance coverage. In some cases, individuals may be forced to reduce their coverage or even go without insurance altogether, exposing themselves to significant financial risks in the event of an accident.

Potential for Higher Premiums and Out-of-Pocket Expenses

The rising cost of auto insurance is directly reflected in higher premiums, which translate into increased out-of-pocket expenses for consumers. As rates increase, individuals may face higher deductibles, co-pays, and other fees associated with their insurance policies. This can lead to a significant increase in the overall cost of owning and operating a vehicle.

Impact on Budgeting and Financial Planning

The unpredictability of auto insurance rate increases makes it challenging for consumers to accurately budget and plan for their financial future. Individuals may find it difficult to allocate funds for insurance premiums, especially when faced with unexpected rate hikes. This can lead to financial instability and a sense of uncertainty about future expenses.

Strategies for Managing Auto Insurance Costs

Auto insurance is a necessity for most drivers, but rising premiums can put a strain on household budgets. Fortunately, there are several strategies consumers can employ to manage their auto insurance costs and potentially save money.

Shopping Around for Competitive Rates

Comparing quotes from multiple insurance providers is a crucial step in finding the best rates. Consumers should not simply renew their existing policy without exploring other options.

- Online comparison websites: Sites like Policygenius, NerdWallet, and Insurance.com allow users to compare quotes from various insurers quickly and easily. These sites gather basic information about your vehicle, driving history, and location to provide personalized rate estimates.

- Direct insurers: Companies like Geico, Progressive, and USAA offer competitive rates and convenient online tools for managing policies. They often have lower overhead costs than traditional insurance agencies, which can translate into lower premiums.

- Local insurance agents: While online comparison tools are convenient, working with a local insurance agent can provide personalized advice and help navigate complex insurance options.

Improving Driving Habits and Safety Measures

Safe driving habits are not only important for personal safety but also can reduce insurance premiums.

- Defensive driving courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts. These courses often teach techniques for avoiding accidents and managing risky situations.

- Maintaining a clean driving record: Avoid traffic violations, such as speeding tickets and reckless driving citations, as they can significantly increase your insurance premiums. A clean driving record is a key factor in determining your insurance rate.

- Installing safety features: Modern vehicles often come equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and lane departure warnings. These features can reduce your risk of accidents and may qualify you for discounts.

Maintaining a Good Driving Record

A clean driving record is a significant factor in determining your auto insurance premiums.

- Avoid traffic violations: Traffic violations, such as speeding tickets, reckless driving, and DUI charges, can significantly increase your insurance rates. Even minor violations can have a lasting impact on your premiums.

- Report accidents promptly: It is essential to report any accidents to your insurance company as soon as possible. Failing to do so could result in higher premiums or even denial of coverage.

- Consider driver training: If you have a history of accidents or traffic violations, consider taking a driver training course. This can demonstrate your commitment to improving your driving skills and may lead to lower premiums.

Exploring Discounts and Coverage Options

Insurance companies offer various discounts and coverage options that can help lower your premiums.

- Good student discounts: If you are a student with good grades, you may qualify for a discount. This discount recognizes the lower risk associated with young drivers who excel academically.

- Safe driver discounts: Maintaining a clean driving record for a certain period may qualify you for a safe driver discount. This discount reflects your commitment to safe driving and lower risk profile.

- Multi-policy discounts: If you bundle your auto insurance with other policies, such as homeowners or renters insurance, you may qualify for a multi-policy discount. This discount rewards customers for consolidating their insurance needs with one provider.

- Consider coverage options: Evaluate your coverage needs and consider options like higher deductibles or dropping unnecessary coverage. Higher deductibles can lower your premiums, but you will be responsible for paying more out-of-pocket in the event of an accident. Reviewing your coverage options can help identify areas where you can save money without compromising essential protection.

Industry Perspectives

Auto insurance rates are a complex issue, influenced by a multitude of factors. To understand the current state of the industry and anticipate future trends, it is essential to consider insights from industry experts.

Perspectives on Rate Increases

Industry experts acknowledge the significant impact of inflation on auto insurance rates. Rising costs for repairs, parts, and labor have directly contributed to increased premiums. However, they also highlight other factors driving rate increases, such as:

- Increased claims frequency and severity: More accidents and higher repair costs, particularly for newer vehicles with advanced safety features, are leading to higher payouts for insurers.

- Supply chain disruptions: The global supply chain crisis has impacted the availability of parts and materials, leading to longer repair times and higher costs.

- Changes in driving behavior: Post-pandemic, some drivers have exhibited riskier driving habits, leading to more accidents and higher claims.

- Increased litigation: The rise in lawsuits related to auto accidents is adding to insurance costs.

Challenges and Opportunities

Industry experts anticipate ongoing challenges, including:

- Persisting inflation: Continued high inflation is expected to continue putting upward pressure on insurance costs.

- Regulatory scrutiny: Insurance companies are facing increasing scrutiny from regulators, particularly regarding pricing practices and transparency.

- Competition from non-traditional insurers: The emergence of new players, such as technology-driven insurers, is challenging traditional business models.

However, experts also see opportunities for innovation and growth, including:

- Adoption of telematics: Telematics devices can provide valuable data on driving behavior, enabling insurers to offer personalized rates and reward safe drivers.

- Artificial intelligence (AI) and machine learning: AI and machine learning can be used to improve risk assessment, automate processes, and enhance customer service.

- Focus on customer experience: Insurers are increasingly prioritizing customer satisfaction by offering convenient online platforms, personalized services, and transparent communication.

Regulatory Landscape

State regulators play a crucial role in overseeing auto insurance rates and ensuring consumer protection. They aim to balance the need for insurers to remain financially sound with the need for consumers to have access to affordable coverage.

State Regulatory Oversight of Auto Insurance Rates

State insurance departments have broad authority to regulate auto insurance rates. They typically review rate filings from insurers, ensuring they are actuarially sound and justified by factors such as claims costs, expenses, and risk assessments. Some states have more stringent rate regulation, such as requiring insurers to demonstrate the necessity of rate increases or imposing caps on the magnitude of rate changes.

Recent Regulatory Changes and Initiatives

In recent years, there have been several notable regulatory changes and initiatives impacting the auto insurance industry. For instance, several states have adopted or are considering adopting “usage-based insurance” (UBI) programs, which use telematics devices or smartphone apps to track driving behavior and offer discounts to safe drivers. This has raised concerns about privacy and data security, leading to ongoing debates about the appropriate balance between innovation and consumer protection.

Consumer Protection Measures

State regulators also play a crucial role in protecting consumers from unfair or deceptive practices in the auto insurance market. This includes ensuring that insurers provide clear and accurate information about their policies, resolving consumer complaints, and enforcing penalties for violations of insurance laws.

Examples of Regulatory Changes

- California: In 2023, California implemented a new law requiring insurers to offer discounts for safe drivers who use UBI programs. This law also established data privacy protections for UBI data.

- Texas: Texas recently passed legislation that allows insurers to use credit scores as a factor in determining auto insurance rates. This change has sparked debate about the fairness and accuracy of using credit scores for insurance pricing.

- New York: New York has implemented a “no fault” system for auto insurance, which requires insurers to cover medical expenses regardless of fault in an accident. This has led to higher premiums but has also resulted in more equitable access to healthcare for accident victims.

Impact of Regulatory Changes on Auto Insurance Rates

Regulatory changes can have a significant impact on auto insurance rates. For example, the adoption of UBI programs has the potential to lower premiums for safe drivers while raising them for high-risk drivers. Similarly, the use of credit scores as a rating factor can lead to higher premiums for individuals with lower credit scores.

Future Trends in Auto Insurance Regulation

The auto insurance regulatory landscape is constantly evolving, driven by technological advancements, changing consumer expectations, and evolving risk profiles. Future trends include:

- Increased Focus on Data Security and Privacy: As insurers increasingly rely on data to price policies and personalize coverage, there will be a growing emphasis on data security and privacy regulations.

- Expansion of UBI Programs: More states are expected to adopt or expand UBI programs, leading to increased adoption of telematics technologies and changes in driving behavior.

- Regulation of Autonomous Vehicles: The rise of autonomous vehicles will require new regulations to address issues such as liability, insurance coverage, and data privacy.

Consumer Advocacy

As auto insurance rates rise, consumer advocacy groups play a crucial role in protecting policyholders’ rights and ensuring fair treatment. These organizations provide resources and guidance to help consumers understand their options, navigate complex insurance policies, and address unfair practices.

Resources and Organizations

Consumer advocacy groups offer a wide range of resources to help consumers understand their auto insurance rights and navigate the complexities of the industry. These resources include:

- Consumer Reports: This non-profit organization provides independent ratings and reviews of auto insurance companies, helping consumers make informed decisions about their coverage.

- National Association of Insurance Commissioners (NAIC): This organization represents insurance regulators from all 50 states, the District of Columbia, and five U.S. territories. The NAIC provides resources for consumers, including information about insurance laws and regulations, as well as tips for resolving insurance disputes.

- Insurance Information Institute (III): This industry-supported organization provides educational resources about insurance, including information about auto insurance rates, coverage options, and consumer rights.

- State-Specific Consumer Protection Offices: Most states have dedicated consumer protection offices that handle complaints and provide guidance on insurance matters. These offices can be valuable resources for consumers who are facing problems with their auto insurance.

Staying Informed and Participating in Policy Discussions

Consumers can stay informed about auto insurance issues and participate in policy discussions through various channels:

- Follow Consumer Advocacy Groups on Social Media: Many consumer advocacy groups maintain active social media presences, providing updates on insurance regulations, industry trends, and consumer rights.

- Attend Public Hearings: Insurance regulators often hold public hearings to gather input on proposed changes to insurance laws. Consumers can attend these hearings to express their concerns and advocate for policies that protect their interests.

- Contact Your Elected Officials: Consumers can contact their state and federal legislators to express their concerns about auto insurance rates and advocate for policies that promote fair and affordable insurance.

- Join Consumer Advocacy Groups: Joining consumer advocacy groups allows individuals to stay informed about insurance issues, participate in advocacy efforts, and receive support in resolving insurance disputes.

Future Outlook

Predicting future auto insurance rate trends is a complex endeavor, influenced by a confluence of economic, technological, and societal factors. Current trends, coupled with emerging technologies and shifting demographics, point to a dynamic insurance landscape in the years to come.

Impact of Emerging Technologies

The rise of connected vehicles, autonomous driving, and advanced driver-assistance systems (ADAS) will significantly impact the insurance industry. These technologies offer the potential to improve road safety, reduce accidents, and provide real-time data for risk assessment.

- Telematics: Connected vehicles generate vast amounts of data on driving behavior, enabling insurers to offer personalized rates based on individual driving habits. This data-driven approach can reward safe drivers with lower premiums while incentivizing risky drivers to improve their behavior. For example, a driver who consistently maintains a safe speed and avoids sudden braking might receive a discount, while a driver with a history of speeding or aggressive driving could face higher premiums.

- Autonomous Vehicles: The widespread adoption of autonomous vehicles could lead to a significant reduction in accidents, potentially lowering insurance costs. However, the liability and insurance implications of autonomous vehicles remain unclear, requiring new frameworks and regulations. The potential for lower claims could lead to lower premiums, but the emergence of new risks, such as cyberattacks, could also drive up costs.

- Advanced Driver-Assistance Systems (ADAS): Features like lane departure warning, adaptive cruise control, and automatic emergency braking are becoming increasingly common. These systems can help prevent accidents and potentially lower insurance premiums for vehicles equipped with ADAS. However, the effectiveness of these systems in preventing accidents and the associated liability issues need further research and analysis.

Societal Changes and Their Influence

Shifting demographics, urbanization, and evolving consumer preferences will also influence auto insurance rates.

- Urbanization: The increasing concentration of people in urban areas can lead to higher traffic congestion and increased accident rates. This could result in higher insurance premiums for drivers in urban areas.

- Ride-Sharing and Mobility Services: The popularity of ride-sharing services like Uber and Lyft, as well as other mobility solutions, could potentially reduce the number of privately owned vehicles. This could lead to lower insurance premiums for those who rely on these services instead of owning their own vehicles. However, the insurance needs of ride-sharing companies and their drivers remain a complex issue, requiring specific insurance policies and regulations.

- Climate Change: Extreme weather events, such as floods and wildfires, are becoming more frequent and severe, increasing the risk of damage to vehicles. This could lead to higher insurance premiums, particularly in regions prone to these events.

Conclusion

The rising cost of auto insurance across the United States is a complex issue driven by a confluence of factors. Understanding the unique dynamics at play in each state is crucial for consumers seeking to navigate this evolving landscape. While several factors contribute to rate increases, including inflation, increased claims costs, and changes in driving habits, it’s essential to remember that these trends are not uniform across the country.

State-Specific Trends and Managing Costs

State-specific trends play a significant role in determining auto insurance rates. This means that consumers need to be proactive in understanding the factors that influence rates in their specific location. This includes:

- Understanding the specific laws and regulations in their state that impact insurance costs.

- Staying informed about local driving conditions, accident rates, and other factors that can influence premiums.

- Comparing rates from different insurers to find the best deal.

- Taking advantage of discounts offered by insurers for safe driving, good credit scores, and other factors.

By taking these steps, consumers can effectively manage their auto insurance costs and ensure they are paying a fair price for the coverage they need.

Summary

As auto insurance rates continue to fluctuate, staying informed and proactive is essential. Consumers can take steps to mitigate the impact of rising premiums by shopping for competitive rates, improving their driving habits, and exploring discounts and coverage options. The insurance industry is evolving rapidly, and understanding the forces shaping auto insurance rates is crucial for navigating the future of this critical financial protection.