Actual cash value (ACV) insurance is a common type of coverage that pays for the depreciated value of damaged or lost property. Unlike replacement cost coverage, which pays for the full cost of replacing the item with a new one, ACV insurance considers the age and condition of the property when determining the payout amount. While it may seem less appealing at first glance, ACV insurance can offer significant cost savings for certain types of property, particularly older items.

This article delves into the intricacies of ACV insurance, exploring its mechanics, benefits, drawbacks, and applications. We will analyze how ACV is calculated, examine the factors that influence premium rates, and compare it to replacement cost coverage to help you determine the best option for your needs.

Definition of Actual Cash Value (ACV)

Actual cash value (ACV) is a method of valuation used in insurance to determine the amount of compensation paid for damaged or lost property. It reflects the fair market value of the property at the time of the loss, considering depreciation. This means the insured receives the current value of the property, taking into account its age, condition, and wear and tear.

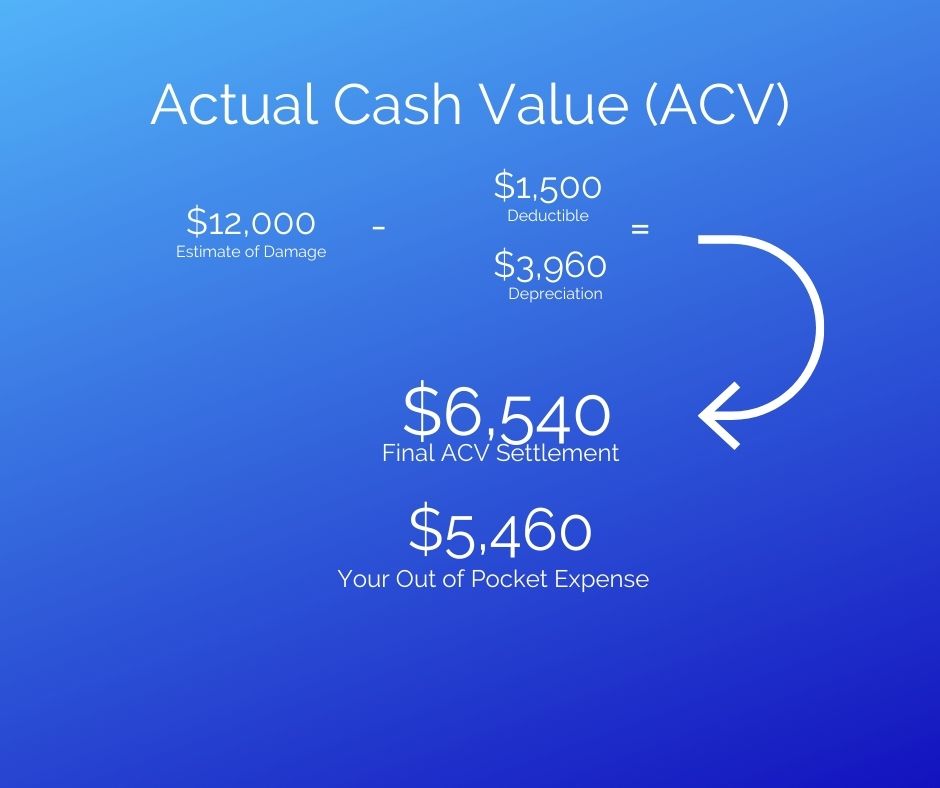

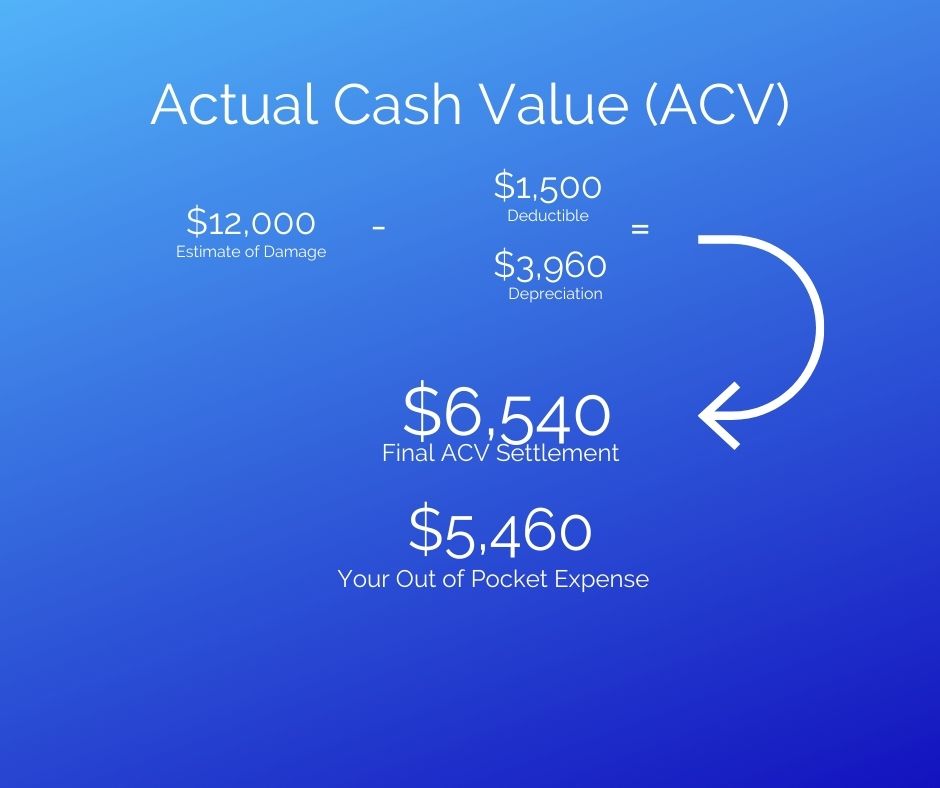

Calculating Actual Cash Value

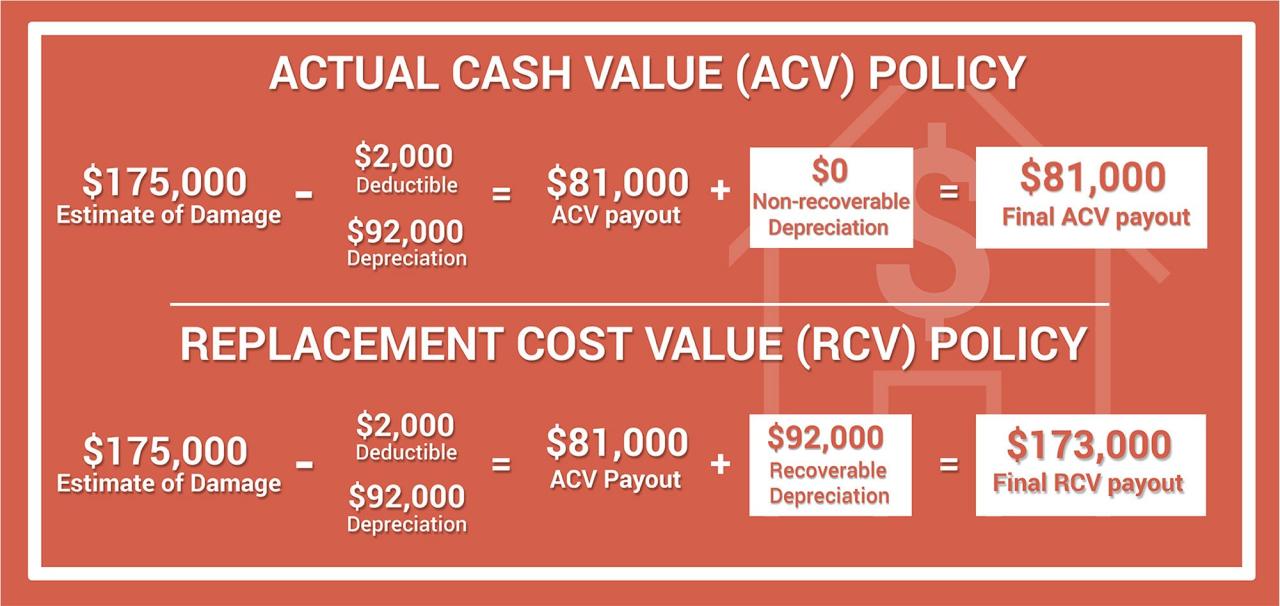

ACV is calculated by subtracting depreciation from the replacement cost value (RCV) of the property. RCV represents the cost to replace the damaged or lost property with a new, similar item.

ACV = RCV – Depreciation

- Depreciation: This represents the decrease in value of the property over time due to factors like age, use, and obsolescence. It is calculated using various methods, including straight-line depreciation, declining balance depreciation, and sum-of-the-years’ digits depreciation.

- Replacement Cost Value (RCV): This refers to the cost of replacing the damaged or lost property with a new, identical item. It does not consider depreciation.

Difference Between ACV and Replacement Cost Value

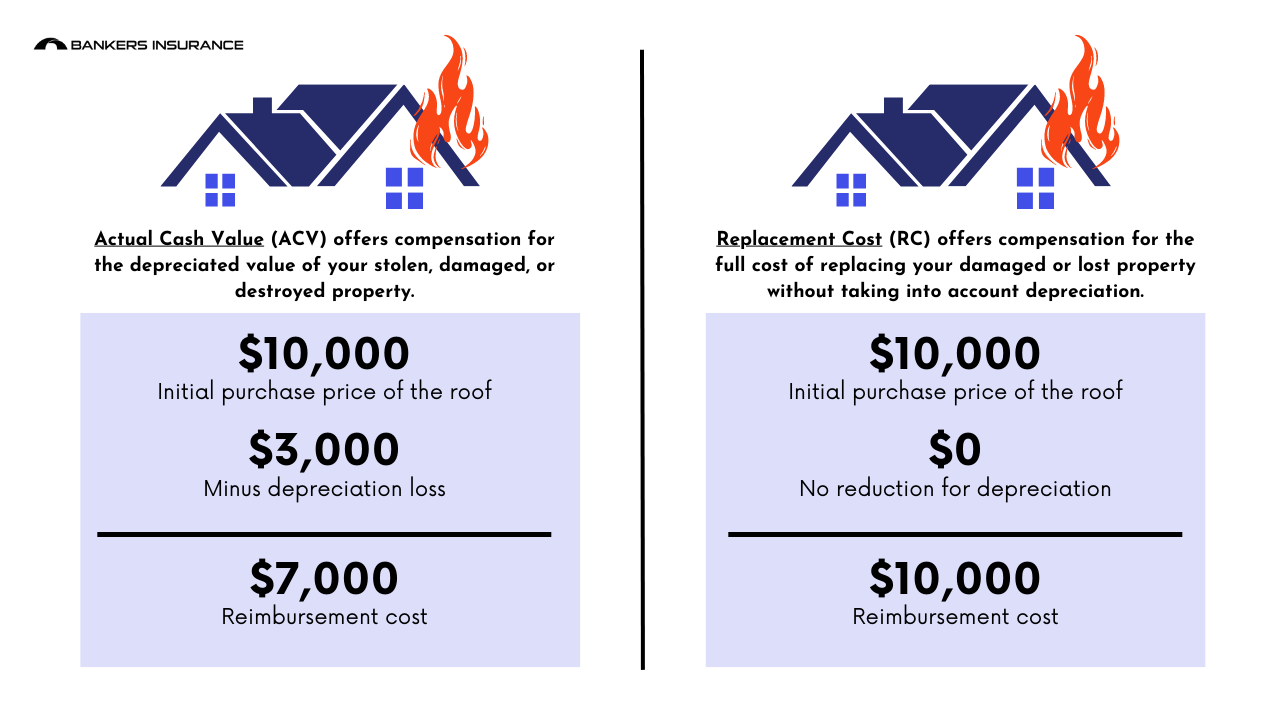

ACV and RCV are two different methods of valuing insured property. The key difference lies in the consideration of depreciation. ACV takes depreciation into account, while RCV does not. This means that ACV will generally result in a lower payout than RCV for the same property.

- ACV: Pays the current market value of the property, considering its age and condition. This is typically used for older items where depreciation is significant.

- RCV: Pays the cost of replacing the property with a new, similar item, without considering depreciation. This is often used for newer items where depreciation is minimal.

For example, consider a 10-year-old refrigerator that is damaged in a fire. The RCV of the refrigerator might be $1,000, representing the cost of a new, similar refrigerator. However, the ACV might be $500, reflecting the depreciation of the refrigerator over the past 10 years.

How ACV Insurance Works

Actual cash value (ACV) insurance is a type of coverage that reimburses the insured for the depreciated value of damaged or lost property. This means that the payout will be based on the current market value of the item, minus depreciation, rather than the original purchase price.

Determining ACV

The process of determining ACV for insured property involves assessing the current market value of the item and subtracting accumulated depreciation. This calculation takes into account factors such as age, condition, and wear and tear.

Factors Influencing ACV Assessment

Several factors influence the assessment of ACV, including:

- Age of the property: Older property generally depreciates more than newer property. For example, a five-year-old car will have a lower ACV than a brand-new car of the same model.

- Condition of the property: The condition of the property, including any damage or wear and tear, affects its current market value. For example, a used refrigerator in good condition will have a higher ACV than one that is damaged or in poor working order.

- Market value: The market value of the property is determined by comparing similar items that are currently available for sale. This can be done through online databases, appraisals, or consultations with experts.

- Depreciation methods: There are several depreciation methods used to calculate the accumulated depreciation of an asset. The most common methods include straight-line depreciation and declining balance depreciation.

Key Elements of an ACV Insurance Policy

An ACV insurance policy typically includes the following key elements:

- Covered perils: The policy will specify the events that are covered, such as fire, theft, or natural disasters.

- Deductible: The deductible is the amount of money that the insured is responsible for paying out-of-pocket before the insurance company will cover any losses.

- Policy limits: The policy limits specify the maximum amount that the insurance company will pay for any covered loss.

- Depreciation schedule: The policy may specify the depreciation schedule that will be used to calculate the ACV of the insured property.

Benefits of ACV Insurance

Actual cash value (ACV) insurance is a type of property insurance that reimburses policyholders for the depreciated value of their damaged or lost property. This means that the payout will be based on the current market value of the property, minus depreciation. While this may seem like a less attractive option compared to replacement cost coverage, ACV insurance offers several advantages that can make it a suitable choice for certain situations.

Cost-Effectiveness of ACV Insurance

ACV insurance is generally less expensive than replacement cost coverage because it considers the depreciation of the property. This means that policyholders will pay lower premiums for ACV insurance. The cost-effectiveness of ACV insurance is particularly attractive for older property, as depreciation will be more significant.

The lower premium of ACV insurance is a result of the lower payout that policyholders receive in the event of a claim.

ACV Insurance for Specific Types of Property

ACV insurance can be a beneficial option for certain types of property where depreciation is a significant factor. For example, ACV insurance is often a good choice for:

- Older vehicles: As cars age, their value depreciates rapidly. ACV insurance can be a cost-effective way to insure older vehicles, as the payout will reflect the vehicle’s current market value.

- Antique furniture: Antique furniture often appreciates in value over time, but it also depreciates in the event of damage or loss. ACV insurance can provide coverage for antique furniture, taking into account its current market value.

- Business equipment: Business equipment, such as computers and office furniture, depreciates over time. ACV insurance can be a cost-effective way to insure business equipment, as the payout will reflect the equipment’s current market value.

Situations Where ACV Insurance is Suitable

ACV insurance can be a suitable option in several situations, including:

- When the policyholder has a limited budget for insurance: ACV insurance can be a more affordable option for policyholders who are looking to save money on their premiums.

- When the policyholder is insuring property that is not essential: For example, if a policyholder is insuring a secondary residence or a piece of recreational equipment, ACV insurance may be a suitable option.

- When the policyholder is insuring property that is not expected to increase in value: ACV insurance is a good choice for property that is not expected to appreciate in value, such as older vehicles or furniture.

Drawbacks of ACV Insurance

Actual cash value (ACV) insurance offers cost-effective coverage, but it comes with drawbacks that may make it unsuitable for certain situations. The primary drawback is the depreciation factor, which can significantly reduce the payout amount, especially for older assets.

Depreciation and Payout Amounts

Depreciation, the decline in an asset’s value over time due to wear and tear or obsolescence, is a core component of ACV insurance. The insurer determines the asset’s current market value, considering its age, condition, and any potential damage. The payout amount is based on this depreciated value, not the original purchase price. This means you receive less than the full replacement cost, especially for older assets.

For example, if you bought a refrigerator for $1,000 five years ago and it was damaged beyond repair, ACV insurance would consider its current market value, which might be $500 due to depreciation. You would receive a payout of $500, not the original $1,000.

Inadequacy for Certain Property Types

ACV insurance can be inadequate for certain types of property, especially high-value items or those that are difficult to replace. For example, antiques, collectibles, or custom-built structures may have sentimental or unique value that is not reflected in their depreciated market value.

- High-Value Items: For valuable items like jewelry, artwork, or rare collectibles, ACV insurance may not provide sufficient coverage to replace them with similar items. This is because depreciation can significantly reduce the payout, leaving you with a substantial financial burden.

- Custom-Built Structures: Unique or custom-built structures, such as a home with a specialized design or a commercial building with specialized equipment, may be difficult to replace at their original cost. ACV insurance may not cover the full cost of rebuilding or replacing these structures.

Types of Property Covered by ACV Insurance

Actual cash value (ACV) insurance policies cover a wide range of personal and commercial property. While the specific coverage details can vary based on the insurance provider and the policy, ACV insurance typically protects against damage or loss caused by events like fire, theft, vandalism, and natural disasters.

The primary goal of ACV insurance is to compensate policyholders for the depreciated value of their property. This means the payout will reflect the current market value, taking into account factors like age, wear and tear, and obsolescence.

Property Types Covered by ACV Insurance

ACV insurance typically covers various types of property, including:

- Personal Property: This category encompasses belongings within a residence, such as furniture, appliances, electronics, clothing, and jewelry. The coverage for these items typically includes a limit based on the overall value of the insured’s belongings.

- Real Estate: ACV insurance can cover buildings, including houses, apartments, commercial structures, and other real estate properties. However, the coverage might exclude land value, focusing solely on the structure’s depreciated value.

- Vehicles: While ACV insurance is common for older vehicles, it’s less prevalent for newer cars. The coverage usually focuses on the vehicle’s depreciated value, considering factors like age, mileage, and condition.

- Business Equipment: Businesses rely on various equipment, such as computers, machinery, and tools, for operations. ACV insurance can cover these assets, but the payout will reflect their current market value, taking into account depreciation.

- Inventory: Businesses often maintain a stock of goods for sale. ACV insurance can cover inventory losses, but the payout will be based on the current market value, factoring in depreciation and obsolescence.

Specific Considerations for ACV Coverage

The following table summarizes the specific considerations for ACV coverage on various property types:

| Property Type | Specific Considerations |

|---|---|

| Personal Property | – Depreciation based on age, wear and tear, and obsolescence – Coverage limits may apply to specific categories or the overall value of belongings – Proof of purchase or valuation may be required for claims |

| Real Estate | – Depreciation based on age, condition, and market value – Coverage may exclude land value, focusing solely on the structure – Building codes and safety standards may influence the payout |

| Vehicles | – Depreciation based on age, mileage, condition, and market value – Coverage may be limited to older vehicles or those with lower market value – Vehicle history reports and appraisals may be required for claims |

| Business Equipment | – Depreciation based on age, usage, and market value – Coverage may vary based on the type of equipment and its intended use – Maintenance records and proof of purchase may be required for claims |

| Inventory | – Depreciation based on age, obsolescence, and market value – Coverage may vary based on the type of inventory and its intended use – Sales records and inventory management systems may be required for claims |

Calculating ACV for Different Property Types

Calculating actual cash value (ACV) for different property types involves various methods and considerations, ensuring fairness in determining the value of a damaged or lost item. The method used for calculating ACV depends on the specific type of property and its current market value.

Methods for Calculating ACV

The following table Artikels different methods for calculating ACV for various property types:

| Property Type | Calculation Method | Factors Considered |

|---|---|---|

| Cars | Depreciated Value | Original Purchase Price, Age, Mileage, Condition, Market Value of Similar Vehicles |

| Houses | Replacement Cost Less Depreciation | Construction Costs, Age of the House, Material Quality, Market Value of Similar Homes |

| Electronics | Depreciated Value | Original Purchase Price, Age, Usage, Market Value of Similar Models |

| Personal Property | Fair Market Value | Condition, Age, Market Value of Similar Items, Appraisals |

Calculating ACV for Specific Property Types

Cars

The ACV of a car is calculated by determining its depreciated value. This involves considering the original purchase price, age, mileage, condition, and market value of similar vehicles. For example, if a car was purchased for $20,000 five years ago and its current market value is $15,000, then its ACV would be $15,000.

Houses

The ACV of a house is typically calculated by subtracting depreciation from its replacement cost. Replacement cost refers to the cost of rebuilding the house with similar materials and construction standards. Depreciation is calculated based on the age of the house, material quality, and market value of similar homes. For instance, if a house has a replacement cost of $300,000 and its depreciation is estimated at 20%, then its ACV would be $240,000.

Electronics

Electronics are typically valued based on their depreciated value, similar to cars. This involves considering the original purchase price, age, usage, and market value of similar models. For example, if a laptop was purchased for $1,000 two years ago and its current market value is $600, then its ACV would be $600.

ACV Insurance vs. Replacement Cost Coverage

Both Actual Cash Value (ACV) and Replacement Cost Coverage are types of insurance that cover property damage or loss. While they share the same goal of providing financial protection, they differ significantly in how they calculate and pay out claims. Understanding the nuances of each coverage is crucial for choosing the right insurance for your specific needs.

Key Differences in Payout Structure and Coverage Benefits

The primary difference between ACV and Replacement Cost Coverage lies in how they determine the amount paid for a claim. ACV insurance pays the depreciated value of the damaged or lost property, while Replacement Cost Coverage pays the cost to replace the damaged or lost property with a new, similar item.

- Actual Cash Value (ACV): ACV considers the age, condition, and depreciation of the property at the time of the loss. This means that the payout will be less than the original purchase price, reflecting the fact that the property has lost value over time. For example, if a five-year-old couch is damaged beyond repair, the ACV insurance will pay the current market value of a similar five-year-old couch, which will be less than the cost of a brand new couch.

- Replacement Cost Coverage: Replacement Cost Coverage, on the other hand, pays the full cost to replace the damaged or lost property with a new, similar item, regardless of its age or condition. This means you will receive enough money to buy a new couch, even if the damaged couch was five years old. However, this type of coverage usually comes with a deductible, which is the amount you pay out of pocket before the insurance company starts paying.

Scenarios Where Each Type of Coverage Would Be More Suitable

The most suitable type of coverage depends on your individual circumstances and the type of property being insured.

- ACV: ACV insurance is typically more affordable than Replacement Cost Coverage. It is often a good choice for older properties, where the cost of replacement would be significantly higher than the current market value. For example, if you have a vintage car that is no longer manufactured, ACV insurance might be a better option than Replacement Cost Coverage, as the cost of replacing the car with a new one would be very high. ACV is also often used for personal property, such as furniture, clothing, and electronics.

- Replacement Cost Coverage: Replacement Cost Coverage is a better choice for newer properties, where the cost of replacement would be closer to the original purchase price. This type of coverage is also a good option for properties that are difficult or impossible to replace, such as antique furniture or unique artwork. Replacement Cost Coverage is also often used for valuable personal property, such as jewelry, art, and collectibles.

Factors Affecting ACV Insurance Premiums

ACV insurance premiums are influenced by several factors that determine the risk associated with insuring a particular property. These factors are carefully considered by insurance companies to assess the likelihood of claims and the potential cost of repairs or replacements.

Property Type

The type of property being insured significantly impacts the premium. Different property types carry different risk profiles. For instance, a residential property may have a lower risk of damage compared to a commercial property, leading to lower premiums. Similarly, properties with higher-value items or those located in areas prone to natural disasters may have higher premiums.

Age of the Property

Older properties are generally considered more susceptible to damage and wear and tear. This increased risk is reflected in higher premiums. As properties age, they may require more frequent repairs and maintenance, increasing the likelihood of claims.

Location of the Property

The location of the property is a crucial factor in determining premiums. Properties in areas with higher crime rates, natural disaster risks, or higher population density may have higher premiums. For example, properties located in hurricane-prone areas may face higher premiums due to the potential for significant damage from storms.

Deductible Amount

The deductible amount is the amount you agree to pay out-of-pocket in the event of a claim. Choosing a higher deductible typically results in lower premiums. This is because you are taking on more financial responsibility, which reduces the insurer’s potential payout.

Coverage Limits

The coverage limits on your policy determine the maximum amount your insurer will pay for a claim. Higher coverage limits generally result in higher premiums.

Claims History

Your claims history plays a significant role in premium calculations. Individuals with a history of frequent claims may face higher premiums as they are considered higher risk.

Credit Score

In some cases, insurers may consider your credit score as a factor in determining premiums. This is because individuals with lower credit scores may be more likely to default on their insurance payments.

Other Factors

Other factors, such as the presence of safety features (e.g., fire alarms, security systems), the property’s condition, and the insurer’s specific risk assessment methods, can also influence ACV insurance premiums.

ACV Insurance and Depreciation

Actual cash value (ACV) insurance policies account for the depreciation of insured property. This means that the payout for a claim will be based on the current market value of the property, factoring in its age and wear and tear. This is a crucial aspect of understanding ACV insurance and how it differs from replacement cost coverage.

Depreciation Calculation and Application

Depreciation is the decline in value of an asset over time due to factors like usage, obsolescence, and wear and tear. In ACV insurance, depreciation is calculated using various methods, with the most common being the straight-line method. This method assumes a consistent rate of depreciation over the asset’s lifespan.

The formula for calculating depreciation using the straight-line method is:

Depreciation = (Original Cost – Salvage Value) / Useful Life

Where:

* Original Cost: The initial purchase price of the asset.

* Salvage Value: The estimated value of the asset at the end of its useful life.

* Useful Life: The expected lifespan of the asset.

For example, if a roof was purchased for $10,000 with a useful life of 20 years and a salvage value of $1,000, the annual depreciation would be:

Depreciation = ($10,000 – $1,000) / 20 = $450

If the roof is 10 years old, the accumulated depreciation would be $4,500 ($450 x 10). This means the ACV payout for the roof would be $5,500 ($10,000 – $4,500).

Impact of Depreciation on Older Property

Depreciation significantly impacts the payout for older property. As an asset ages, its value decreases, resulting in a lower ACV payout. This can be a disadvantage for policyholders, especially if they need to replace older property with newer, more expensive models.

For instance, if a 15-year-old refrigerator is damaged beyond repair, its ACV payout might be significantly less than the cost of a new, comparable refrigerator. This is because the older refrigerator has experienced a substantial amount of depreciation.

Understanding ACV Insurance Policy Terms

Navigating the complexities of an ACV insurance policy can be challenging, especially if you’re unfamiliar with the specific terminology used. It’s crucial to understand the key terms and conditions before purchasing an ACV insurance policy. This ensures you’re aware of the coverage limitations, potential deductibles, and any exclusions that may apply.

Common Terms in ACV Insurance Policies

The following table Artikels some common terms found in ACV insurance policies, along with their definitions and explanations:

| Term | Definition | Explanation |

|---|---|---|

| Actual Cash Value (ACV) | The fair market value of an insured item at the time of loss, taking into account depreciation. | ACV represents the cost of replacing the damaged item with a similar item, minus depreciation. This means you receive compensation based on the item’s current value, not its original purchase price. |

| Depreciation | The decrease in value of an item over time due to wear and tear, obsolescence, or other factors. | Depreciation is calculated based on the item’s age, condition, and market value. It reflects the reduced value of the item due to its use and passage of time. |

| Deductible | The amount you pay out-of-pocket before your insurance coverage kicks in. | A deductible is a fixed amount you must pay for each claim, regardless of the total cost of the damage. The higher your deductible, the lower your premium, but you’ll pay more out-of-pocket in case of a claim. |

| Coinsurance | A percentage of the insured value that you agree to cover in the event of a loss. | Coinsurance requires you to pay a portion of the claim cost, usually a percentage of the total value of the insured property. It’s designed to encourage policyholders to insure their property for its full value. |

| Exclusions | Specific events or circumstances that are not covered by the insurance policy. | Exclusions Artikel situations where the insurance policy won’t provide coverage. These can include events like natural disasters, acts of war, or intentional damage. |

| Policy Period | The time frame during which the insurance policy is in effect. | The policy period specifies the duration of your coverage. It’s essential to renew your policy before the end of the policy period to ensure continuous coverage. |

| Cancellation Clause | Specifies the conditions under which the policy can be canceled by either the insurer or the policyholder. | This clause Artikels the circumstances under which either party can terminate the insurance contract. It may include provisions for non-payment of premiums, material misrepresentation, or other breaches of the policy terms. |

| Renewal Clause | Specifies the conditions under which the policy can be renewed at the end of the policy period. | This clause defines the terms for renewing the policy, including the renewal premium, any changes in coverage, and any conditions that must be met for renewal. |

It’s crucial to read your policy carefully and understand all of the terms and conditions before purchasing an ACV insurance policy.

Ultimate Conclusion

Understanding the nuances of actual cash value insurance is crucial for making informed decisions about your coverage. By carefully evaluating your needs, property type, and budget, you can determine whether ACV insurance is the right fit for you. Whether you’re seeking cost-effective protection for older belongings or simply seeking to understand the complexities of insurance coverage, this comprehensive guide provides the necessary insights to navigate the world of ACV insurance.