The cost of life insurance is a crucial factor for many individuals seeking financial protection for their loved ones. While the price of a 30-year term life insurance policy can vary depending on several factors, age is a key determinant. Understanding how age impacts premiums can help you make informed decisions about your life insurance needs and budget.

This guide explores the relationship between age and 30-year term life insurance rates, providing insights into how premiums change with age and why. We’ll also delve into the factors that influence these rates, including health, lifestyle, and coverage amount. By the end, you’ll have a clearer understanding of how to obtain quotes, compare rates, and choose the right policy for your individual circumstances.

Understanding 30-Year Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the term. In this case, the term is 30 years. If the insured person dies within the 30-year term, the beneficiary receives a death benefit. If the insured person survives the term, the policy expires, and no death benefit is paid.

Key Features and Benefits of a 30-Year Term Policy

A 30-year term life insurance policy offers several key features and benefits, making it a popular choice for many individuals and families.

- Affordable Premiums: Term life insurance premiums are generally lower than other types of life insurance, such as whole life or universal life. This is because term life insurance only provides coverage for a limited period, making it less expensive to provide.

- Coverage for Specific Needs: 30-year term life insurance is ideal for covering specific needs, such as a mortgage, child’s education, or income replacement for a certain period. The policy’s duration aligns with these financial obligations, providing peace of mind that these needs will be met in the event of the insured person’s death.

- Flexibility: Some 30-year term life insurance policies offer the option to convert to a permanent life insurance policy at the end of the term, without having to undergo a medical exam. This allows policyholders to continue their life insurance coverage beyond the initial 30-year term, if desired.

Comparison with Other Types of Life Insurance

It is essential to understand the differences between 30-year term life insurance and other types of life insurance to make an informed decision.

- Whole Life Insurance: Whole life insurance provides permanent coverage for the insured person’s entire life. It combines a death benefit with a cash value component that grows over time. While whole life insurance offers lifetime coverage, it is generally more expensive than term life insurance.

- Universal Life Insurance: Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefit amounts. It also has a cash value component, but the growth rate is not guaranteed. Universal life insurance premiums are generally higher than term life insurance premiums.

Factors Influencing 30-Year Term Life Insurance Rates

Several factors influence 30-year term life insurance rates. These factors determine the risk associated with insuring an individual and thus influence the premium they pay. Understanding these factors can help individuals make informed decisions about their life insurance needs and find the best rates available.

Age

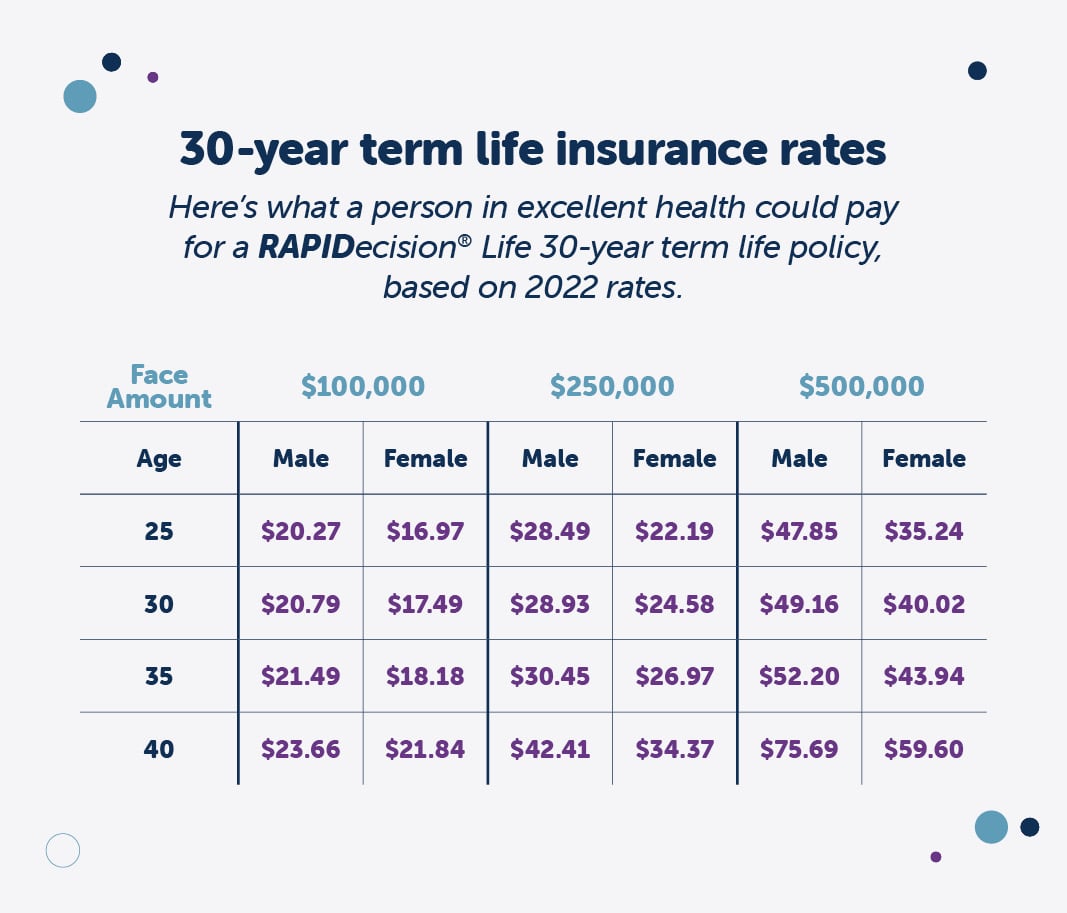

Age is a significant factor in determining life insurance rates. As individuals age, their mortality risk increases. This means that the likelihood of them dying within the policy term becomes higher. Therefore, insurance companies charge higher premiums to older individuals to account for this increased risk. For example, a 30-year-old individual will typically pay a lower premium than a 40-year-old individual for the same coverage amount.

Health

An individual’s health is another critical factor that impacts life insurance rates. Individuals with pre-existing health conditions or unhealthy lifestyles are considered higher risks. Insurance companies may require medical examinations, blood tests, or other medical evaluations to assess an individual’s health. Those with conditions such as diabetes, heart disease, or cancer may face higher premiums. For instance, a person with a history of heart disease will likely pay a higher premium than a person with no known health issues.

Lifestyle

An individual’s lifestyle can also influence life insurance rates. Factors like smoking, excessive alcohol consumption, and participation in dangerous hobbies can increase mortality risk. Insurance companies may charge higher premiums to individuals with these risk factors. For example, a smoker may pay a significantly higher premium than a non-smoker for the same coverage amount.

Coverage Amount

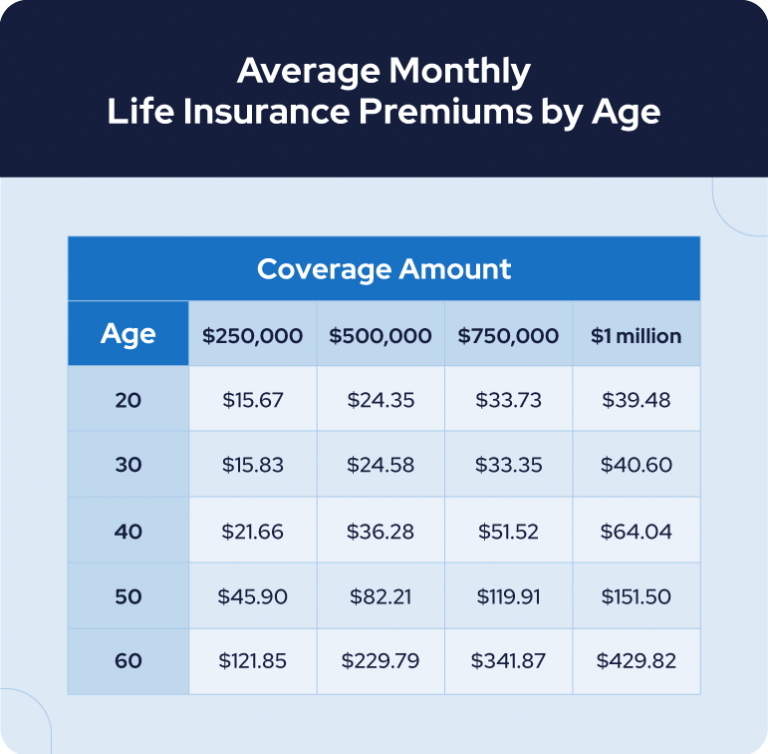

The coverage amount, or the death benefit, is directly proportional to the premium. Higher coverage amounts require higher premiums because the insurance company assumes a greater financial risk. If an individual needs a higher death benefit, they will typically pay a higher premium than someone with a lower coverage amount. For example, a person seeking $500,000 in coverage will pay a higher premium than someone seeking $250,000 in coverage.

Age and 30-Year Term Life Insurance Rates

Age is a significant factor influencing 30-year term life insurance rates. Younger individuals typically enjoy lower premiums compared to older individuals. This is because younger individuals generally have a lower risk of mortality, meaning they are statistically less likely to pass away during the policy term. As individuals age, their risk of mortality increases, leading to higher premiums.

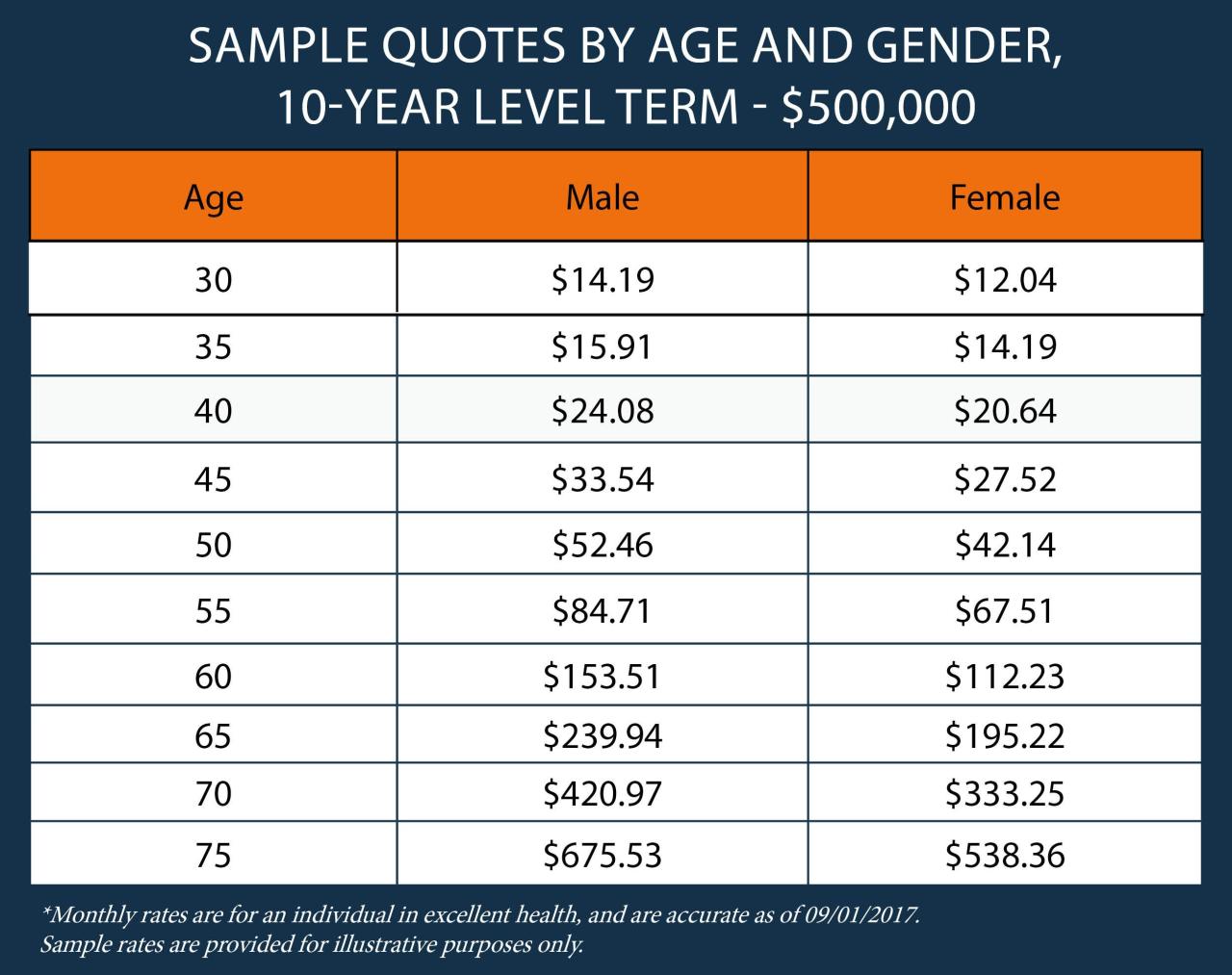

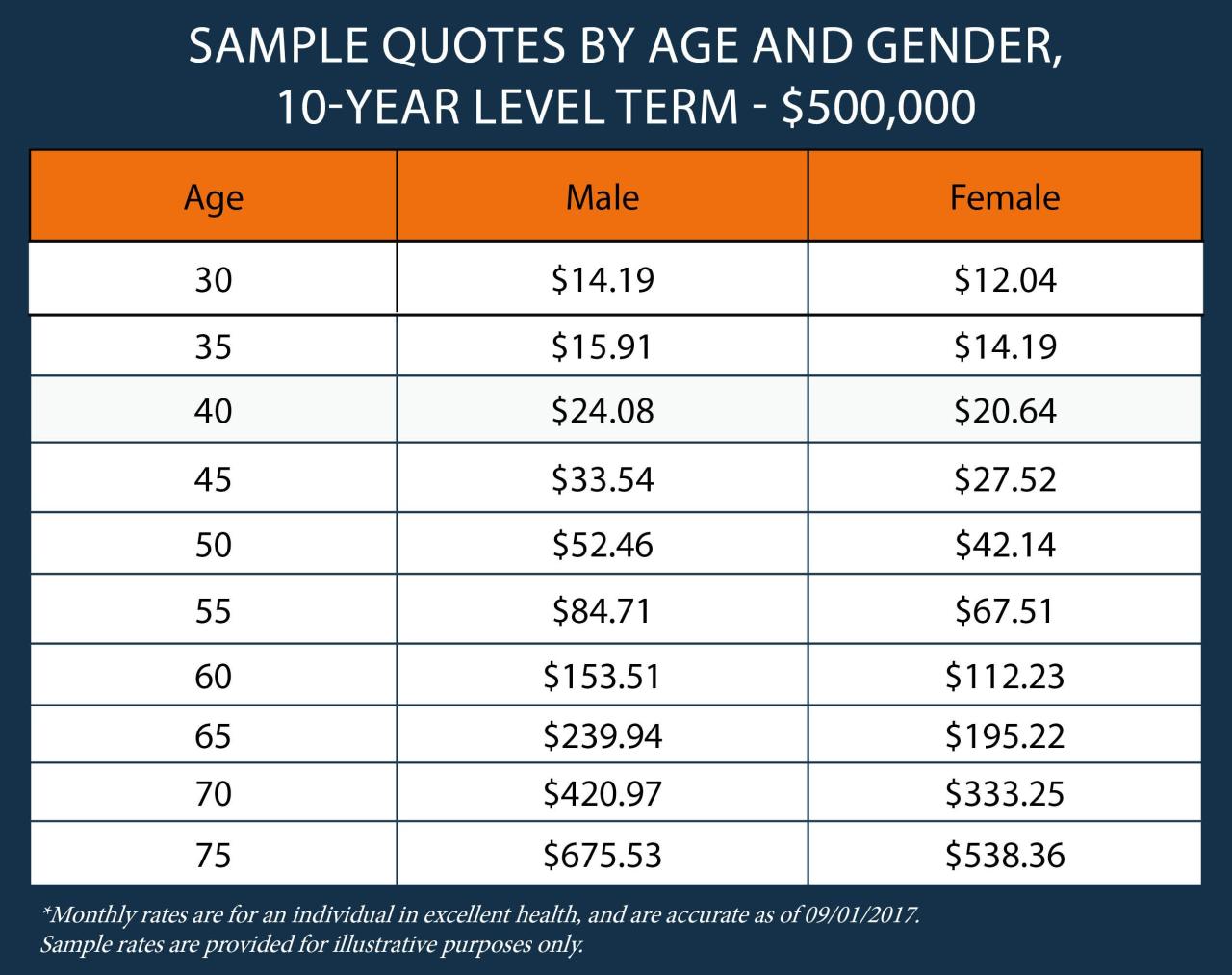

Average 30-Year Term Life Insurance Rates by Age Group

The table below presents average monthly and annual rates for 30-year term life insurance policies across different age groups, assuming a healthy individual with a $500,000 death benefit.

| Age Group | Average Rate (Monthly) | Average Rate (Annual) | Notes |

|---|---|---|---|

| 20-29 | $15 | $180 | Rates for this age group are generally the lowest due to their low risk of mortality. |

| 30-39 | $25 | $300 | Premiums increase as individuals enter their 30s and 40s, reflecting a higher risk of mortality. |

| 40-49 | $40 | $480 | Rates continue to rise with age, as individuals are more likely to experience health issues and have a higher risk of mortality. |

| 50-59 | $75 | $900 | Premiums significantly increase in this age group, as individuals approach retirement age and are more likely to face health challenges. |

| 60-69 | $150 | $1,800 | Rates are significantly higher for individuals in their 60s and 70s due to their increased risk of mortality. |

Age-Related Health Risks and Premium Adjustments

As individuals age, their risk of developing various health conditions increases. These health risks can influence life insurance premiums, as they increase the likelihood of a claim being filed.

For instance, individuals with pre-existing conditions, such as diabetes, heart disease, or cancer, may face higher premiums. This is because they are considered to have a higher risk of mortality compared to individuals without these conditions. Life insurance companies use sophisticated actuarial models to assess the risk of mortality for individuals based on their age and health history. These models factor in various health risks and adjust premiums accordingly.

“Life insurance premiums are calculated based on actuarial tables that reflect the likelihood of death at different ages and health conditions.”

Obtaining Quotes and Comparing Rates

Securing the most favorable rates for 30-year term life insurance necessitates a comprehensive approach to obtaining quotes and comparing offers from multiple insurance providers. This process involves a series of steps designed to ensure you receive the most competitive pricing and policy terms.

Comparing Quotes from Multiple Providers

Obtaining quotes from multiple insurance providers is essential for finding the most competitive rates. Each insurer uses different underwriting criteria and pricing models, resulting in varying premiums for the same coverage.

- Utilize online comparison tools: Online comparison websites simplify the process by allowing you to enter your details and receive quotes from various insurers simultaneously. These tools can save time and effort, enabling you to compare offers side-by-side.

- Contact insurers directly: Reaching out to insurance companies directly provides an opportunity to discuss your specific needs and receive personalized quotes. This approach allows you to ask questions and gather more detailed information about the policy terms.

- Consider independent insurance agents: Independent agents represent multiple insurance companies and can provide unbiased advice. They can help you compare quotes and find the best policy for your individual circumstances.

Understanding Policy Features and Riders

Beyond the core death benefit, 30-year term life insurance policies often come with additional features and riders that can enhance coverage and tailor the policy to individual needs. These features can provide extra protection, flexibility, and financial support in specific circumstances.

Common Features and Riders

Understanding the different features and riders available with 30-year term life insurance policies is crucial for making informed decisions about coverage. Here are some common features and riders:

- Accidental Death Benefit: This rider pays an additional lump sum benefit if the insured dies due to an accident. It can provide extra financial support to cover unexpected expenses related to the accident, such as funeral costs or outstanding debts.

- Critical Illness Coverage: This rider provides a lump sum benefit if the insured is diagnosed with a critical illness, such as cancer, heart attack, or stroke. It can help cover medical expenses, lost income, and other financial burdens associated with critical illnesses.

- Waiver of Premium: This rider waives future premium payments if the insured becomes disabled and unable to work. It ensures that the policy remains active even during a period of financial hardship.

- Living Benefits: Some policies offer living benefits, which allow the insured to access a portion of the death benefit while still alive to cover expenses related to a terminal illness or long-term care.

- Term Conversion Option: This feature allows the policyholder to convert the term life insurance policy to a permanent life insurance policy, such as whole life or universal life, without undergoing a medical exam. This can be beneficial if the insured’s needs change and they require lifelong coverage.

Benefits and Drawbacks of Riders

While riders can enhance policy coverage, it’s essential to consider their benefits and drawbacks carefully:

- Benefits: Riders can provide valuable financial protection in specific circumstances, such as accidents, critical illnesses, or disability. They can also offer peace of mind and financial security for the insured and their beneficiaries.

- Drawbacks: Riders typically come with an additional cost, increasing the overall premium. It’s important to weigh the potential benefits against the extra cost and ensure the rider aligns with the insured’s specific needs and budget.

Examples of How Features Enhance Coverage

Here are some examples of how features and riders can enhance policy value and coverage:

- Accidental Death Benefit: A young parent with a mortgage and dependents may choose an accidental death benefit rider to provide extra financial support in case of an accidental death. This can help cover outstanding debts and ensure the family’s financial security.

- Critical Illness Coverage: A middle-aged individual with a family history of heart disease may opt for critical illness coverage to help cover medical expenses and lost income if they are diagnosed with a heart attack or stroke.

- Waiver of Premium: A self-employed individual may choose a waiver of premium rider to ensure their policy remains active if they become disabled and unable to work. This can provide financial security and peace of mind during a challenging period.

Choosing the Right 30-Year Term Life Insurance Policy

Selecting the right 30-year term life insurance policy is crucial for ensuring adequate financial protection for your loved ones in case of your untimely demise. With various options available, it’s essential to carefully consider your individual needs, budget, and the specific features offered by different policies.

Assessing Coverage Needs

Determining the appropriate amount of coverage is a critical step in the policy selection process. Consider your dependents’ financial needs, outstanding debts, and the cost of living expenses they may face in your absence. A common rule of thumb is to aim for coverage that’s 10 to 15 times your annual income, but this may vary based on your specific circumstances.

Budget Constraints

While adequate coverage is essential, it’s also important to factor in your budget. 30-year term life insurance premiums are generally affordable, but the cost can vary depending on factors such as age, health, and the amount of coverage. Compare quotes from multiple insurers to find the best value for your money.

Policy Features

Different insurers offer various policy features, such as riders, which provide additional coverage for specific situations. Carefully evaluate the features offered by each policy to ensure they align with your needs. For example, a disability rider can provide income protection if you become unable to work, while a terminal illness rider can offer financial assistance in case of a terminal diagnosis.

Making Informed Decisions

Once you’ve considered your coverage needs, budget, and desired features, it’s time to make an informed decision.

- Compare quotes: Obtain quotes from multiple insurers to compare premiums and coverage options.

- Read policy documents: Carefully review the policy documents before making a decision to understand the terms and conditions.

- Seek professional advice: If you’re unsure about your coverage needs or policy features, consult with a financial advisor or insurance broker for personalized guidance.

The Importance of Financial Planning

Life insurance plays a crucial role in comprehensive financial planning, providing a safety net for loved ones in the event of an unexpected death. It helps mitigate the financial hardship that can arise from the loss of a primary income earner, ensuring the continuation of essential financial obligations and allowing survivors to maintain their lifestyle.

The Role of Life Insurance in Financial Planning

Life insurance is an essential component of a well-rounded financial plan. It provides a financial safety net for your family in the event of your untimely death, helping them manage the financial burden of your absence.

Protecting Loved Ones from Financial Hardship

A 30-year term life insurance policy provides a death benefit that can be used to cover a variety of expenses, including:

- Outstanding debts: Mortgages, car loans, credit card debt, and other outstanding loans can be repaid with the death benefit, freeing your loved ones from the burden of these financial obligations.

- Living expenses: The death benefit can help cover essential living expenses, such as rent or mortgage payments, utilities, groceries, and healthcare costs, allowing your family to maintain their standard of living.

- Education expenses: The death benefit can be used to fund your children’s education, ensuring they can pursue their educational goals without financial strain.

- Final expenses: The death benefit can cover funeral and burial costs, as well as other final expenses, such as legal fees and estate taxes.

Aligning Life Insurance Coverage with Financial Goals

It is crucial to align your life insurance coverage with your financial goals and responsibilities. Consider factors such as:

- Outstanding debt: The amount of outstanding debt you have, including mortgages, loans, and credit card balances, should be factored into your life insurance coverage.

- Income replacement: Determine how much income your family relies on and how long they will need that income to be replaced. This will help you determine the appropriate death benefit amount.

- Financial goals: Consider your long-term financial goals, such as your children’s education, retirement savings, or any other financial aspirations that your family might have.

- Family size and dependents: The number of dependents you have and their ages will also influence the amount of life insurance coverage you need.

Common Misconceptions about 30-Year Term Life Insurance

Many people hold misconceptions about 30-year term life insurance, which can lead to confusion and potentially poor financial decisions. It’s crucial to understand the true nature of this type of insurance to make informed choices about your coverage.

Term Life Insurance is Not an Investment

Term life insurance is designed to provide a death benefit to your beneficiaries if you pass away during the policy’s term. It is not an investment vehicle, meaning it does not grow in value over time. You pay premiums for coverage, and if you outlive the policy term, you receive nothing back.

Term Life Insurance Doesn’t Build Cash Value

Unlike permanent life insurance, such as whole life or universal life, term life insurance does not accumulate cash value. This means you cannot borrow against the policy or withdraw funds for other purposes.

Term Life Insurance Isn’t for Everyone

While term life insurance can be a cost-effective way to protect your loved ones financially during a specific period, it may not be the best option for everyone. Your individual needs and circumstances will determine whether term life insurance is suitable.

Term Life Insurance Can Be Expensive

The cost of term life insurance can vary significantly depending on factors like age, health, and the amount of coverage you need. However, it is generally considered a more affordable option compared to permanent life insurance.

Term Life Insurance Premiums Can Increase

While most term life insurance policies have fixed premiums for the initial term, some policies may have premiums that increase over time. This is often the case with renewable term policies, where you can extend the coverage period beyond the initial term.

Resources for Further Research

For a deeper understanding of 30-year term life insurance, explore these reputable resources that offer comprehensive information and insights.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and providing consumer protection. These agencies offer valuable resources and guidance for individuals seeking life insurance.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that works to promote uniformity in insurance regulation across the United States. Their website provides information on consumer protection, insurance regulations, and resources for finding licensed insurance agents. [https://www.naic.org/](https://www.naic.org/)

- Federal Trade Commission (FTC): The FTC is a federal agency responsible for protecting consumers from unfair and deceptive business practices. Their website provides information on consumer rights, fraud prevention, and resources for filing complaints. [https://www.ftc.gov/](https://www.ftc.gov/)

Consumer Advocacy Organizations

Consumer advocacy organizations are dedicated to protecting consumer rights and providing information and support to consumers. These organizations often offer resources on life insurance and other financial products.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent product reviews and consumer advice. They offer in-depth articles and ratings on life insurance companies and policies. [https://www.consumerreports.org/](https://www.consumerreports.org/)

- National Endowment for Financial Education (NEFE): NEFE is a non-profit organization that provides financial education and resources to individuals and families. Their website offers information on life insurance, retirement planning, and other financial topics. [https://www.nefe.org/](https://www.nefe.org/)

Financial Websites and Publications

Financial websites and publications provide valuable information and analysis on life insurance and other financial products. These resources can help you compare rates, understand policy features, and make informed decisions.

- Investopedia: Investopedia is a comprehensive financial website that offers articles, guides, and tools on a wide range of financial topics, including life insurance. [https://www.investopedia.com/](https://www.investopedia.com/)

- Bankrate: Bankrate is a financial website that provides information on a variety of financial products, including life insurance. They offer tools for comparing rates and finding the best deals. [https://www.bankrate.com/](https://www.bankrate.com/)

Additional Considerations for 30-Year Term Life Insurance

While a 30-year term life insurance policy provides a solid foundation for financial security, it’s crucial to acknowledge that life circumstances can change over time. Recognizing these potential shifts and proactively adjusting your coverage as needed is vital to ensuring your policy remains relevant and effective.

Impact of Health Changes and Lifestyle Choices on Premiums

Changes in health status or lifestyle choices can influence your life insurance premiums. For example, if you develop a health condition that increases your risk profile, your insurer may adjust your premium accordingly. Similarly, engaging in risky activities, such as smoking or participating in extreme sports, can lead to higher premiums. It’s essential to maintain a healthy lifestyle and inform your insurer of any significant health changes to avoid potential premium increases.

Reviewing and Adjusting Coverage Needs Over Time

Life insurance needs can evolve over time, necessitating periodic reviews and adjustments. For example, if you get married, have children, or take on significant debt, your coverage requirements might increase. Conversely, if your children become financially independent or your debt is paid off, you may consider reducing your coverage. Regular reviews ensure your policy remains aligned with your current financial obligations and family needs.

Long-Term Implications of Choosing a 30-Year Term Policy

A 30-year term life insurance policy offers a fixed term of coverage, typically lasting until you reach a specific age. Once the term expires, the policy will terminate, and you’ll no longer have coverage. This is a crucial consideration for individuals who want to ensure their loved ones are protected beyond the 30-year period. If you anticipate needing coverage beyond this timeframe, you may need to explore alternative options, such as permanent life insurance, which offers lifetime coverage.

Ending Remarks

Navigating the world of life insurance can feel overwhelming, but understanding how age impacts your premiums is essential for making informed choices. Remember to factor in your individual needs, budget, and long-term goals when selecting a 30-year term life insurance policy. With careful consideration and research, you can find the right coverage to provide financial security for your loved ones.