In the realm of car insurance, collision and comprehensive coverage stand as essential pillars, offering financial protection against a spectrum of potential mishaps. While seemingly straightforward, understanding the nuances of these insurance types can be a complex endeavor, particularly when considering the factors that influence premiums and the intricacies of the claims process.

This guide delves into the intricacies of collision and comprehensive insurance, unraveling their core purposes, coverage specifics, and the critical decisions surrounding their purchase. We’ll explore the factors that affect premiums, navigate the claims process, and examine the benefits and risks associated with these vital insurance components.

What is Collision and Comprehensive Insurance?

Collision and comprehensive insurance are two types of coverage that are commonly included in car insurance policies. They protect you against financial losses due to damage to your vehicle caused by various events.

Purpose of Collision and Comprehensive Insurance

Collision and comprehensive insurance serve as financial safeguards for car owners in case of accidents or unexpected events. They help cover the costs of repairs or replacement of the vehicle, minimizing the financial burden on the policyholder.

Collision Coverage

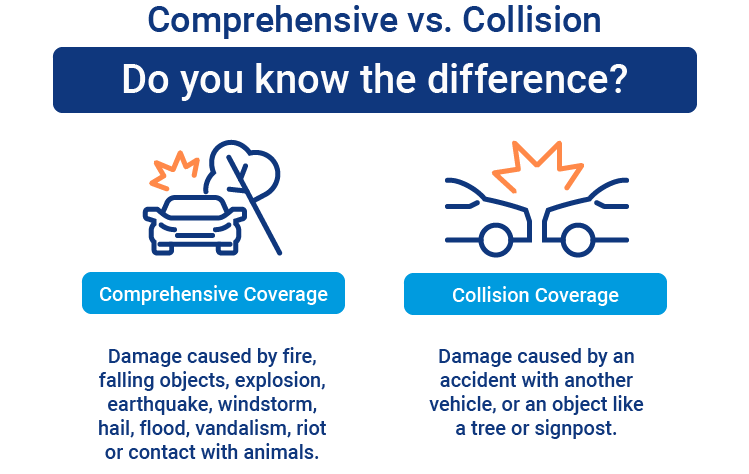

Collision coverage protects you against financial losses resulting from damage to your vehicle caused by a collision with another vehicle or an object. It covers repairs or replacement of your car, regardless of who is at fault. For example, if you collide with another vehicle while driving, your collision coverage will help pay for repairs to your car, even if you are not at fault.

Comprehensive Coverage

Comprehensive coverage provides financial protection against damage to your vehicle caused by events other than collisions. This includes incidents like theft, vandalism, fire, hailstorms, and other natural disasters. For instance, if your car is stolen or damaged by a hailstorm, comprehensive coverage will help pay for repairs or replacement.

Key Differences Between Collision and Comprehensive Coverage

- Cause of Damage: Collision coverage covers damage caused by collisions with other vehicles or objects, while comprehensive coverage covers damage from events other than collisions.

- Coverage Limits: Both collision and comprehensive coverage have limits on the amount they will pay for repairs or replacement. These limits are typically based on the actual cash value (ACV) of your vehicle, which is the amount it is worth at the time of the loss.

- Deductible: You will have to pay a deductible, which is a fixed amount, before your insurance coverage kicks in for both collision and comprehensive claims. The deductible amount is usually lower for collision coverage than for comprehensive coverage.

When is Collision Insurance Necessary?

Collision insurance is essential for drivers who want financial protection against the costs associated with accidents they cause. While it may seem like an optional expense, collision insurance can save you from significant financial burdens in the event of a collision.

Situations Where Collision Insurance is Crucial

It’s essential to understand the situations where collision insurance becomes a necessity. Here are some instances where it proves invaluable:

- New Car Purchase: Collision insurance is highly recommended for new cars. Since newer vehicles tend to have a higher market value, repairs or replacements can be expensive. Collision insurance can provide the financial cushion needed to cover these costs.

- Outstanding Loan on a Vehicle: If you have an outstanding loan on your vehicle, your lender will typically require you to have collision insurance. This ensures that the lender is protected in case of an accident, as they have a financial interest in the vehicle.

- Living in an Area with High Accident Rates: If you live in a region known for its high accident rates, having collision insurance is crucial. This helps mitigate the financial risk associated with increased chances of accidents.

Examples of Incidents Covered by Collision Insurance

Collision insurance covers various incidents related to accidents caused by the insured driver. Some common examples include:

- Rear-End Collisions: If you are rear-ended by another vehicle, collision insurance can help cover the costs of repairing your car.

- Side-Impact Collisions: Collision insurance also covers damage incurred in side-impact collisions, which can be particularly damaging.

- Single-Vehicle Accidents: Even if you are the only vehicle involved in an accident, such as hitting a stationary object, collision insurance can cover the repair costs.

Factors Influencing the Decision to Purchase Collision Insurance

Several factors play a role in determining whether collision insurance is necessary. These factors include:

- Vehicle Age and Value: Collision insurance is generally more beneficial for newer vehicles with a higher market value. As vehicles age and depreciate, the cost of repairs may become less significant, making collision insurance less critical.

- Driving Experience: Drivers with a history of accidents or traffic violations may find it more challenging to obtain collision insurance at affordable rates. However, maintaining a clean driving record can lead to lower premiums.

- Financial Situation: If you have a substantial emergency fund or the financial capacity to cover repair costs out of pocket, you might consider forgoing collision insurance. However, this decision should be made after careful consideration of the potential financial risks involved.

When is Comprehensive Insurance Necessary?

Comprehensive insurance provides financial protection against various perils that could damage your vehicle, including incidents beyond your control. It’s a valuable addition to your auto insurance policy, particularly in situations where your car might be vulnerable to unexpected events.

Examples of Incidents Covered by Comprehensive Insurance

Comprehensive insurance covers a broad range of events that can cause damage to your vehicle. This includes:

- Natural Disasters: Comprehensive insurance protects your car against damage caused by natural disasters like floods, earthquakes, tornadoes, hailstorms, and wildfires. This coverage is essential in areas prone to such events, ensuring you have financial assistance to repair or replace your vehicle.

- Vandalism and Theft: If your vehicle is vandalized or stolen, comprehensive insurance will cover the costs of repairs or replacement, depending on the policy’s terms. This coverage is particularly important in high-crime areas or when your vehicle is parked in vulnerable locations.

- Animal Collisions: Unexpected encounters with animals can lead to significant damage. Comprehensive insurance covers damage caused by collisions with animals, including deer, elk, and other wildlife.

- Falling Objects: Comprehensive insurance also covers damage from falling objects, such as tree branches or debris from construction sites. This coverage is crucial in areas where trees are abundant or construction is frequent.

- Other Non-Collision Events: Comprehensive insurance extends beyond these specific events, covering damage from various other non-collision incidents, such as fire, explosion, and riots.

Factors Influencing the Decision to Purchase Comprehensive Insurance

Several factors influence the decision to purchase comprehensive insurance, including:

- Vehicle Value: If your vehicle has a high value, comprehensive insurance is more important. This coverage helps protect your investment in case of unexpected damage.

- Location: Your location plays a significant role. If you live in an area prone to natural disasters, vandalism, or theft, comprehensive insurance is crucial.

- Driving Habits: If you frequently drive in areas with high wildlife populations or construction, comprehensive insurance can provide valuable protection.

- Financial Situation: Consider your financial situation. If you can afford to self-insure for minor damage, comprehensive insurance might not be necessary. However, for major damage or events like theft, comprehensive insurance can provide peace of mind.

- Deductible: The deductible amount you choose will impact your premium. A higher deductible generally leads to lower premiums, but you’ll pay more out of pocket in case of a claim.

Factors Affecting Collision and Comprehensive Insurance Premiums

Your collision and comprehensive insurance premiums are influenced by various factors. These factors help insurers assess your risk and determine how much you’ll pay for coverage.

Vehicle Make and Model

The make and model of your vehicle significantly impact your premiums. Insurers use historical claims data to determine the cost of repairing or replacing specific vehicles. Cars with a higher frequency of accidents or expensive parts will generally have higher premiums.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and electronic stability control are often considered safer and may result in lower premiums.

- Repair Costs: Vehicles with expensive parts or complex repair procedures can drive up insurance premiums. Luxury cars and sports cars often fall into this category.

- Theft Risk: Some vehicle models are more prone to theft than others. Insurers may charge higher premiums for vehicles with a higher theft risk.

Driving History and Credit Score

Your driving history and credit score play a significant role in determining your insurance premiums.

- Driving Record: A clean driving record with no accidents or violations will likely result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will increase your premiums. Insurers see these incidents as indicators of higher risk.

- Credit Score: While this may seem counterintuitive, your credit score can influence your insurance premiums. Insurers use credit scores as a proxy for financial responsibility. Individuals with lower credit scores may be seen as higher risk and could face higher premiums.

Location and Deductibles

Your location and the deductibles you choose can also impact your premiums.

- Location: Insurance premiums vary depending on the location where you live. Areas with higher rates of accidents or theft tend to have higher premiums. This is due to the increased likelihood of claims in those areas.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums. This is because you are assuming more financial responsibility in the event of a claim.

The Claims Process for Collision and Comprehensive Insurance

Filing a claim for collision or comprehensive insurance can be a straightforward process if you understand the steps involved. By following the Artikeld procedures and providing the necessary documentation, you can navigate the claims process efficiently.

Submitting a Claim

To initiate a claim, you need to contact your insurance company as soon as possible after the incident. This is crucial to ensure timely processing and avoid any potential delays.

- You can typically submit a claim through your insurance company’s website, mobile app, or by calling their customer service line.

- Be prepared to provide details about the incident, including the date, time, location, and a description of what happened.

- You’ll also need to provide your policy information, including your policy number and contact information.

Providing Documentation

After submitting your claim, your insurance company will request documentation to support your claim.

- This documentation may include a police report, if applicable, photographs of the damage, and any witness statements.

- You may also need to provide repair estimates from a qualified mechanic.

- It’s important to keep all relevant documentation organized and readily available for the insurance company’s review.

Damage Assessment

Once you have submitted the required documentation, an insurance adjuster will be assigned to assess the damage to your vehicle.

- The adjuster will inspect the vehicle and determine the extent of the damage.

- They will then prepare an estimate of the repair costs.

- You have the right to choose a repair shop, but your insurance company may have preferred shops that offer discounts or faster service.

Claim Settlement

After the damage assessment is complete, your insurance company will determine the amount of your claim.

- If the repair costs exceed your deductible, your insurance company will cover the remaining costs.

- However, you will be responsible for paying your deductible.

- The insurance company will typically send you a check or direct payment to the repair shop for the covered amount.

Common Exclusions and Limitations of Collision and Comprehensive Insurance

Collision and comprehensive insurance, while valuable for protecting against certain risks, have inherent limitations and exclusions that may restrict coverage in specific circumstances. Understanding these limitations is crucial for policyholders to make informed decisions and avoid potential financial burdens in the event of a claim.

Exclusions Related to the Insured Vehicle

Policyholders should be aware that collision and comprehensive insurance typically do not cover damage caused by:

- Wear and tear, normal maintenance, or mechanical breakdowns

- Damage caused by intentional acts of the insured or their authorized drivers

- Damage resulting from driving under the influence of alcohol or drugs

- Damage caused by racing or other competitive events

- Damage caused by driving in a prohibited area, such as a racetrack or off-road terrain

Exclusions Related to the Cause of Loss

Collision and comprehensive insurance policies typically exclude coverage for:

- Damage caused by acts of war or terrorism

- Damage resulting from nuclear, chemical, or biological events

- Damage caused by natural disasters, such as earthquakes, volcanic eruptions, or tsunamis (unless specifically covered by a separate endorsement)

- Damage resulting from civil unrest or riots

Exclusions Related to the Covered Property

Collision and comprehensive insurance policies may not cover damage to:

- Personal belongings, such as clothing, electronics, or jewelry, even if they are inside the vehicle

- Modifications or aftermarket parts that are not factory-installed

- Custom paint jobs or other cosmetic enhancements

Limitations on Coverage

In addition to specific exclusions, collision and comprehensive insurance policies often include limitations on coverage, such as:

- Deductibles: Policyholders are typically required to pay a deductible before the insurance company will cover the remaining costs of a claim.

- Maximum coverage limits: The policy may specify a maximum amount that will be paid for a particular claim, such as the actual cash value of the vehicle or a specific dollar amount.

- Coverage limitations based on vehicle age: Policies may have age limitations on vehicles, meaning that coverage may be reduced or eliminated for older vehicles.

Examples of Denied Claims

It is important to understand that claims may be denied if they fall under an exclusion or limitation of the policy. Here are some examples of scenarios where claims might be denied:

- A policyholder drives their car into a ditch due to negligence and the damage exceeds the coverage limit.

- A policyholder’s car is stolen and the police later recover it with significant damage, but the policyholder has a comprehensive deductible that is higher than the value of the car.

- A policyholder’s car is damaged by a falling tree during a severe storm, but the policy does not include coverage for natural disasters.

Benefits of Having Collision and Comprehensive Insurance

Collision and comprehensive insurance, while often considered optional, offer substantial benefits that go beyond simply covering repairs. These insurance types provide financial protection, peace of mind, and potential cost savings in the event of an accident or damage to your vehicle.

Financial Protection

Collision and comprehensive insurance provide a financial safety net in the event of an accident or damage to your vehicle. Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Protection from Out-of-Pocket Expenses: Without collision and comprehensive insurance, you would be responsible for paying for repairs or replacement costs out of your own pocket, which can be substantial, especially for major accidents or significant damage. These insurance policies act as a buffer, protecting your finances from unexpected expenses.

- Coverage for Non-Collision Damages: Comprehensive insurance covers a wide range of non-collision damages, such as those caused by hailstorms, floods, or acts of vandalism. This coverage is crucial as these events can cause significant damage to your vehicle and leave you financially vulnerable.

- Financial Stability in the Event of an Accident: Collision and comprehensive insurance can help you maintain financial stability even after a major accident. This is particularly important if you rely on your vehicle for work or other essential activities. The insurance coverage allows you to focus on recovering from the accident without worrying about the financial burden of repairs or replacement.

Peace of Mind and Security

Beyond financial protection, collision and comprehensive insurance offer peace of mind and security, knowing that you have a safety net in place in the event of an accident or damage.

- Reduced Stress and Anxiety: The uncertainty and potential financial burden associated with an accident can be stressful. Having collision and comprehensive insurance can alleviate this stress by providing a sense of security knowing that your insurance will cover the costs of repairs or replacement.

- Focus on Recovery: In the aftermath of an accident, the last thing you want to worry about is the financial implications. Collision and comprehensive insurance allow you to focus on your recovery and well-being, knowing that your insurance will handle the financial aspects of the situation.

- Protection from Unexpected Expenses: Accidents and damage to your vehicle can happen unexpectedly. Collision and comprehensive insurance provide protection from these unexpected expenses, ensuring that you’re not caught off guard and facing a significant financial burden.

Potential Cost Savings

Collision and comprehensive insurance can potentially save you money in the long run by mitigating the costs associated with accidents and damage.

- Avoiding Out-of-Pocket Expenses: As mentioned earlier, collision and comprehensive insurance cover the costs of repairs or replacement, preventing you from having to pay out of pocket. This can save you significant amounts of money, especially for major accidents or extensive damage.

- Lower Deductible Payments: By choosing a higher deductible, you can lower your insurance premiums. While you’ll pay more out of pocket in the event of a claim, you’ll save money on your monthly premiums. This can be a cost-effective strategy if you’re confident in your driving abilities and have a good driving record.

- Maintaining Your Vehicle’s Value: Collision and comprehensive insurance can help you maintain the value of your vehicle. By covering repairs or replacement, these insurance policies ensure that your vehicle remains in good condition, which can increase its resale value.

Risks of Not Having Collision and Comprehensive Insurance

Forgoing collision and comprehensive insurance might seem like a way to save money on your premiums, but it can leave you vulnerable to significant financial hardship in the event of an accident or damage to your vehicle.

Financial Burden of Repair or Replacement

Without collision and comprehensive coverage, you are solely responsible for covering the costs of repairs or replacement following an accident or damage. This can lead to substantial out-of-pocket expenses, especially if the damage is extensive. For example, a major accident could require thousands of dollars to repair or even total the vehicle, leaving you with a large financial burden.

Potential for Legal Issues and Financial Hardship

In the event of an accident, even if you are not at fault, you could be held liable for damages if you lack collision coverage. This could result in legal disputes and potentially significant financial losses, including legal fees, court costs, and compensation for the other party’s damages.

Impact on Credit Score and Overall Financial Well-being

Facing significant out-of-pocket expenses for repairs or replacement can negatively impact your credit score. If you are forced to take out loans or use credit cards to cover these costs, it can lead to increased debt and lower credit scores. This can further impact your ability to secure loans or financing in the future, hindering your overall financial well-being.

Alternatives to Traditional Collision and Comprehensive Insurance

While collision and comprehensive insurance are standard options for many car owners, alternative coverage options might better suit certain situations. These alternatives can offer different levels of protection and cost-effectiveness compared to traditional insurance.

Gap Insurance

Gap insurance bridges the gap between the actual cash value (ACV) of your vehicle and the outstanding loan balance if your car is totaled or stolen. The ACV represents the market value of your vehicle, which typically depreciates over time. If you owe more on your car loan than the ACV, gap insurance pays the difference, protecting you from significant financial losses.

- Advantages: Gap insurance offers peace of mind by covering the difference between the loan balance and the ACV of your vehicle, minimizing out-of-pocket expenses if your car is declared a total loss.

- Disadvantages: Gap insurance is an additional expense, and its cost varies depending on factors such as your vehicle’s make, model, and loan amount. Additionally, some lenders might automatically include gap insurance in your car loan, which could increase your overall financing costs.

Other Specialized Coverage

Besides gap insurance, other specialized coverage options can provide protection for specific scenarios. These options can include:

- Rental Car Reimbursement: This coverage helps cover rental car costs if your vehicle is damaged or stolen and you need transportation.

- Roadside Assistance: This coverage offers assistance for unexpected events like flat tires, jump starts, and towing services.

- Loan/Lease Protection: This coverage provides financial protection if you’re unable to make loan or lease payments due to unexpected events like job loss or disability.

Epilogue

Ultimately, collision and comprehensive insurance serve as vital safeguards in the unpredictable world of driving. By understanding their complexities, drivers can make informed decisions about their coverage, ensuring financial security and peace of mind on the road. From carefully considering the factors influencing premiums to navigating the claims process with ease, this guide empowers drivers to confidently navigate the landscape of collision and comprehensive insurance.